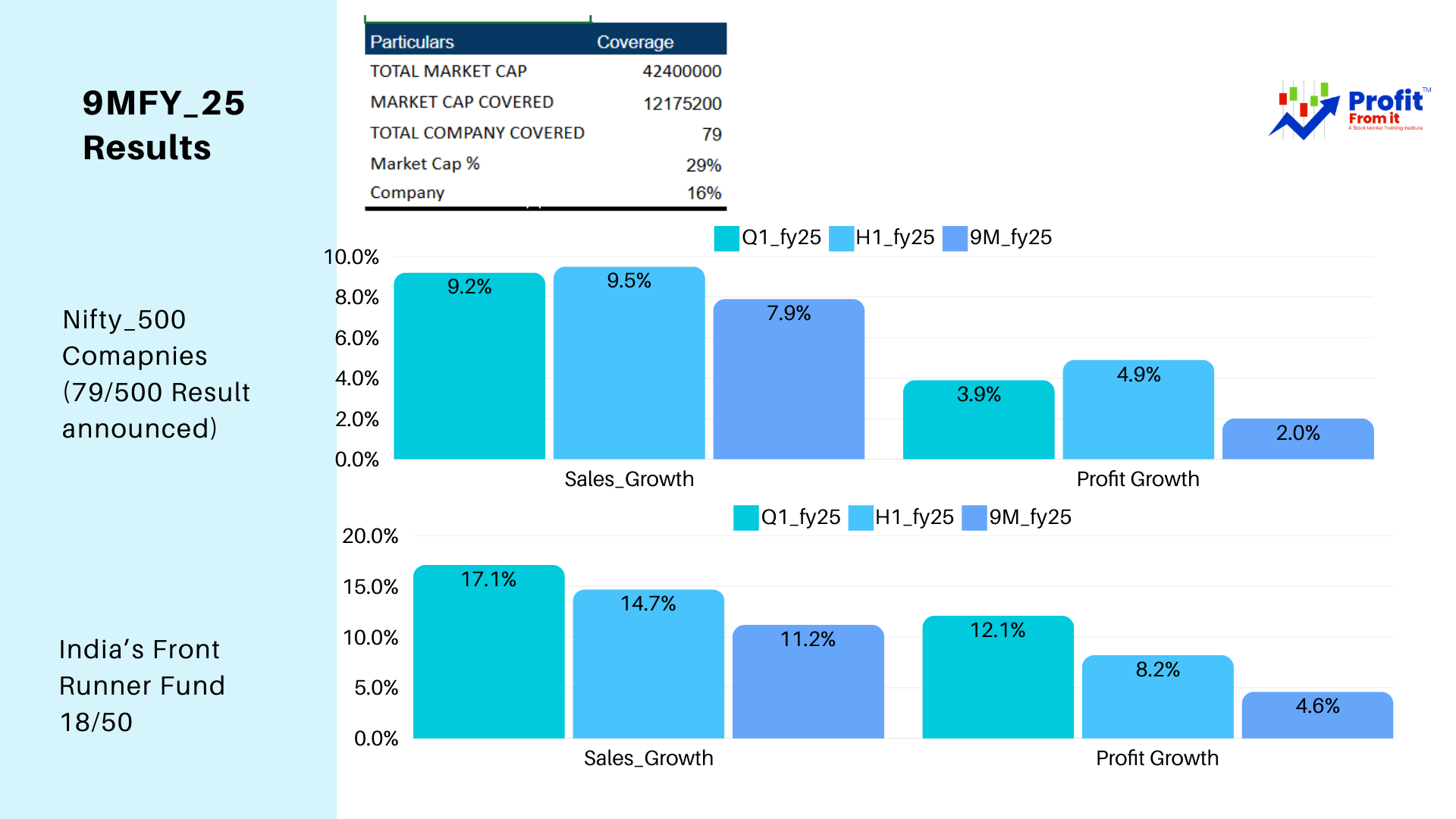

9M_Fy25 Results Update for 79 Companies out of Nifty_500

Market Coverage Analysis:

Total Market Cap: ₹42,40,000 crores

Market Cap Covered: ₹12,17,520 crores

This represents about 29% of the total market capitalization, suggesting the data covers a significant portion of the market by value.

Total Companies Covered: 79

The companies covered represent 16% of a larger set, indicating a focus on a selective group of companies, potentially those with higher market capitalization or strategic importance.

Performance Overview for Nifty 500 vs. IFRF Fund:

Sales Growth:

Nifty 500:

FY22: 26%

FY23: 21%

FY24: 8.3%

Q1 FY25: 9.2%

H1 FY25: 9.5%

9M FY25: 7.9%

The sales growth shows a general decline from FY22 to FY24, but there's a slight rebound in FY25, indicating a recovery or improvement in market conditions.

IFRF Fund: (India’s Front Runner Fund)

Q1 FY25: 17.1%

H1 FY25: 14.7%

9M FY25: 11.2%

The IFRF Fund shows strong sales growth compared to the Nifty 500 in FY25, suggesting it may be focusing on sectors or companies that are outperforming the broader market.

Profit Growth:

Nifty 500:

FY22: 50%

FY23: 6%

FY24: 29.0%

Q1 FY25: 3.9%

H1 FY25: 4.9%

9M FY25: 2.0%

The profit growth trend depicts a high variability, with a peak in FY22, significant drop in FY23, and a partial recovery in FY24. FY25 shows a slowing growth rate, potentially due to increased expenses. Decreasing Profits has attracted the Market correction we saw during the last 4 Months.

IFRF Fund:

Q1 FY25: 12.1%

H1 FY25: 8.2%

9M FY25: 4.6%

Similar to sales growth, the IFRF Fund's profit growth is also performing better than the Nifty 500 average in FY25. This could indicate effective fund management or a strategic allocation towards high-profit-generating companies.

Interpretation:

The data indicates that the IFRF Fund is relatively more resilient or strategically positioned compared to the broader Nifty 500 index in terms of sales and profit growth.

The coverage of 29% of the market cap by the IFRF Fund, combined with better performance metrics, suggests it might be focusing on either high-growth sectors or is managing risks and opportunities better than the market average.

However, should be prepared that Profits decline has made the valuations of market also done, we have already seen the correction of near to 13% in the market. Market patiently waiting for the Rate Cut which could help Profits rise again.

This analysis should help investors understand the relative performance and strategic positioning of the IFRF Fund compared to the broader market, supporting more informed decision-making regarding potential investments in this fund or related sectors.

CSPradhan

Comments (0)

Categories

Recent posts

ITC Hotels and its strategic plans ...

30 Dec 2024

Reliance Leads Energy Revolution: 100% ...

22 Jan 2025 for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)

📊 Analysis of Nifty 500 Companies: ...

14 Feb 2025