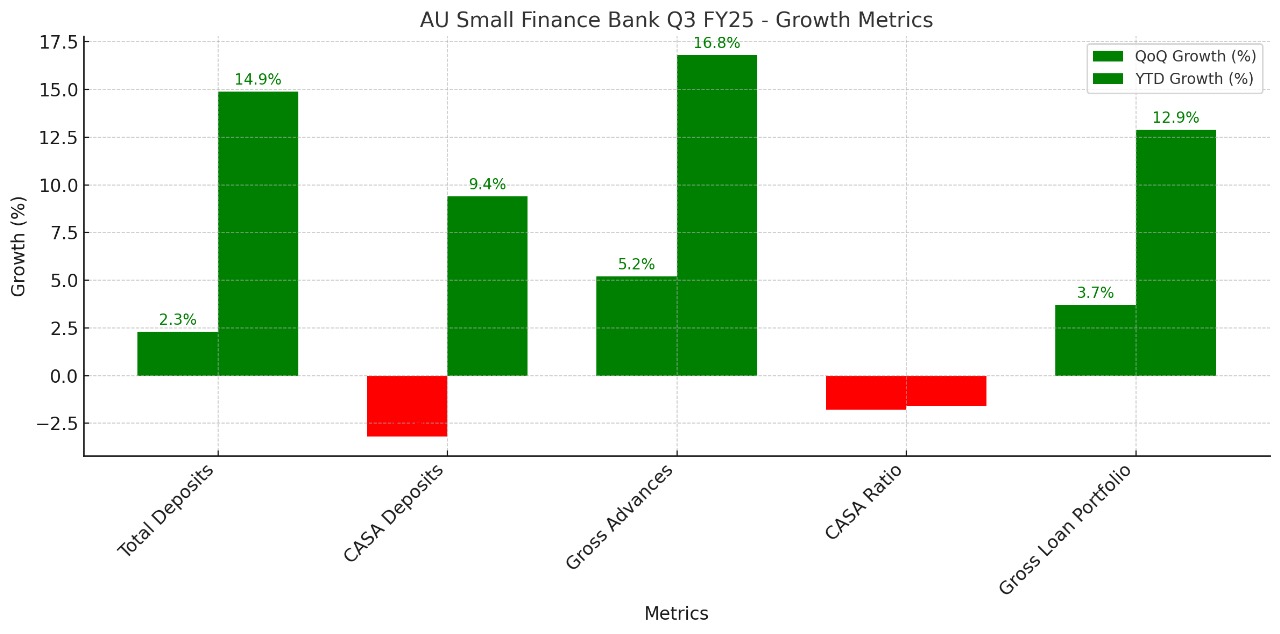

✅ Total Deposits: ₹1,12,260 Cr

🔼 Growth: +2.3% QoQ

🔼 YTD Growth: +14.9%

💡 Positive growth driven by the merger with Fincare SFB and strong retail deposits.

❌ CASA Deposits: ₹34,400 Cr

🔽 Decline: -3.2% QoQ

🔼 YTD Growth: +9.4%

💡 The slight QoQ dip is concerning, but the bank has seen a steady increase in CASA deposits over the year.

✅ Gross Advances: ₹1,00,990 Cr

🔼 Growth: +5.2% QoQ

🔼 YTD Growth: +16.8%

💡 Strong credit demand across retail and MSME segments continues to drive loan book growth.

❌ CASA Ratio: 30.6%

🔽 Decline from 32.4% in Q2 FY25

💡 The CASA ratio needs improvement to reduce the bank’s cost of funds.

✅ Gross Loan Portfolio: ₹1,08,920 Cr

🔼 Growth: +3.7% QoQ

🔼 YTD Growth: +12.9%

💡 The bank's loan portfolio shows consistent growth, indicating robust lending operations.

🚩 Key Takeaways for Investors:

📌 Total Deposits & Gross Advances show steady growth, indicating a strong and growing customer base.

📌 CASA Ratio decline needs to be monitored closely for its impact on profitability.

📌 Merger synergies with Fincare SFB are expected to boost long-term growth and geographic expansion.

🔔 Disclaimer: This update is for informational purposes only. Investors are advised to conduct their own research and consult with financial advisors before making any investment decisions.

#AUFinance #BankingUpdate #QuarterlyResults #InvestorInsights #ProvisionalResults

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)