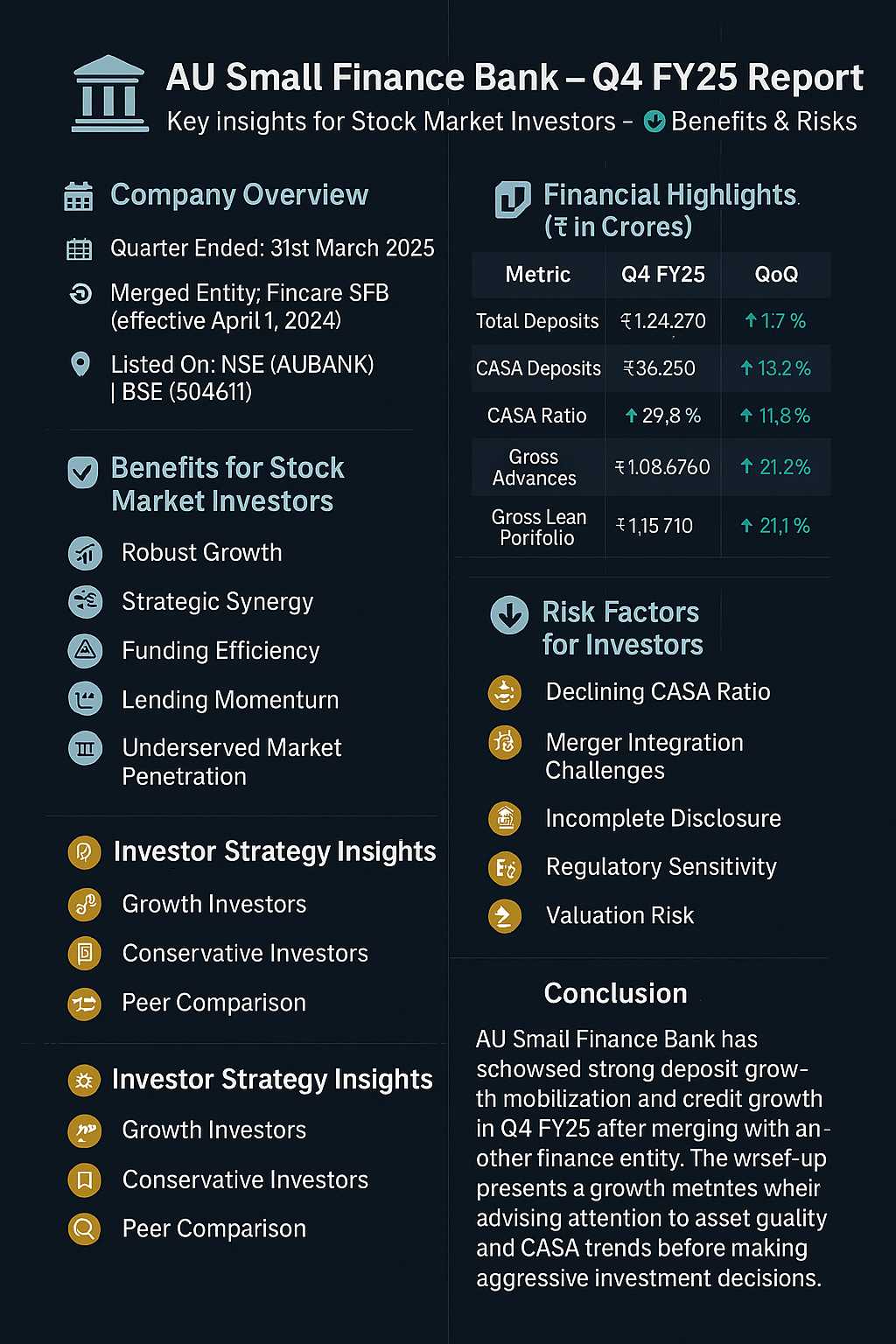

🏦 Company Overview

📅 Quarter Ended: 31st March 2025

🔄 Merged Entity: Fincare SFB (effective April 1, 2024)

📍 Listed On: NSE (AUBANK) | BSE (540611)

📈 Financial Highlights (₹ in Crores)

📊 Metric 🔹 Q4 FY25 🔺 QoQ 📅 YoY

💰 Total Deposits ₹1,24,270 ▲ 10.7% ▲ 27.2%

🏦 CASA Deposits ₹36,250 ▲ 5.4% ▲ 15.2%

🧾 CASA Ratio 29.2% ⬇ 30.6% ⬇ 32.2%

📋 Gross Advances ₹1,08,780 ▲ 7.7% ▲ 25.8%

🧮 Gross Loan Portfolio ₹1,15,710 ▲ 6.2% ▲ 19.9%

✅ Benefits for Stock Market Investors

🔷 💹 Robust Growth

Consistent expansion in deposits and advances demonstrates strength in customer acquisition and credit demand.

🔷 🔗 Strategic Synergy

Post-merger with Fincare SFB provides scale and access to newer geographies.

🔷 📉 Funding Efficiency

CASA deposits offer low-cost capital, vital for maintaining net interest margins.

🔷 📊 Lending Momentum

Loan portfolio nearing ₹1.16 lakh crore reflects healthy credit offtake across sectors.

🔷 🏦 Underserved Market Penetration

The bank’s model targets financially excluded regions—supporting financial inclusion and long-term scalability.

⚠ Risk Factors for Investors

🔺 📉 Declining CASA Ratio

From 32.2% to 29.2% over the year—possible impact on cost of funds.

🔺 🔄 Merger Integration Challenges

Technology, culture, and process alignment risks may affect operational efficiency in the near term.

🔺 ⚖ Incomplete Disclosure

Provisional data lacks GNPA/NNPA metrics—crucial for assessing credit quality.

🔺 📏 Regulatory Sensitivity

Being an SFB, it operates under strict RBI norms related to priority sector lending and capital requirements.

🔺 📉 Valuation Risk

Strong performance might be priced in; susceptible to downside if growth tapers or market sentiment shifts.

🧠 Investor Strategy Insights

🎯 Growth Investors

Ideal for long-term investors seeking exposure to the rising small finance bank segment.

📊 Conservative Investors

Wait for audited results and complete disclosures before taking positions.

🔍 Peer Comparison

Compare performance with other small finance banks to identify relative value and growth potential.

📌 Conclusion

AU Small Finance Bank has showcased commendable performance in Q4 FY25 with strong deposit mobilization and credit growth. While the merger presents an exciting growth runway, near-term clarity on asset quality and CASA trends will be essential before making aggressive investment decisions.

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)