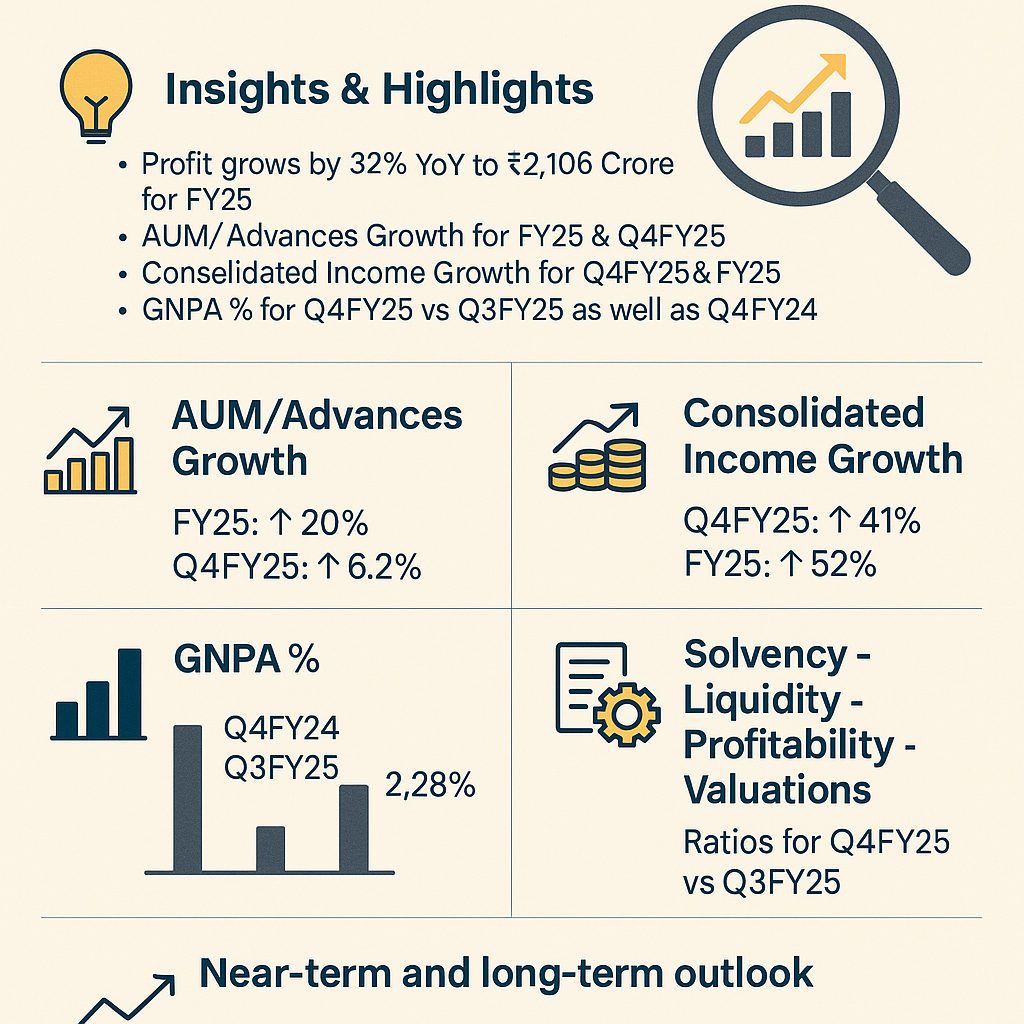

📊 AU Small Finance Bank Q4 & FY25 Results – Growth Anchored by Profitability & Prudent Risk Management

Date: 22nd April 2025

CMP: ₹613 | Market Cap Leader in Small Finance Banking

🏦 Key Financial Highlights

🔹 AUM/Advances Growth

Gross Loan Portfolio grew to ₹1,15,704 Cr (20% YoY | 6.2% QoQ).

Secured Portfolio (Retail + Commercial) expanded 25.3% YoY and 8.1% QoQ.

Unsecured Portfolio contracted by 17.6% YoY, reflecting conservative asset quality focus amidst sector-wide deleveraging.

🔹 Consolidated Income Growth

Net Interest Income (NII) surged by 55% YoY to ₹8,012 Cr in FY25 and by 57% YoY in Q4 to ₹2,094 Cr.

Other Income rose by 49% YoY in FY25 to ₹2,526 Cr and by 41% YoY in Q4 to ₹761 Cr.

Total Income for FY25 reached ₹18,590 Cr, up 52% YoY.

🔹 Profit Performance

FY25 PAT: ₹2,106 Cr (32% YoY growth)

Q4FY25 PAT: ₹504 Cr (18% YoY growth)

EPS: ₹28 for FY25 (up 19% YoY)

Book Value Per Share: ₹231 (up 23% YoY)

📉 Asset Quality Snapshot

The bank demonstrated prudent provisioning with an additional ₹150 Cr set aside in Q4FY25 to further strengthen buffers, primarily for unsecured exposures.

📌 Key Operating Metrics

NIM: 5.94% for FY25 vs. 5.45% in FY24 | Q4 NIM at 5.8%

RoA: 1.5% for FY25 | Q4 RoA at 1.4%

RoE: 13.1% for FY25 | Q4 RoE at 11.9%

Cost to Income Ratio: Improved to 57% in FY25 (vs. 64% in FY24) | Q4 at 55%

Liquidity Coverage Ratio (LCR): Healthy at 116%

🧮 Solvency, Liquidity, Profitability & Valuations (CMP ₹613)

🌐 Industry KPIs vs. AU Bank Performance

AU Bank’s high RoA model and leaner operations are positioning it above the peer average in profitability, despite macro headwinds.

🔭 Outlook: Near Term & Long Term

Near-Term View (FY26):

Margins may moderate slightly due to rising cost of funds.

Risk-controlled growth likely in secured books.

Further integration of Fincare business to add scale with cost synergies.

Long-Term View (Vision 2027):

Strategic portfolio shift towards high-RoA segments to continue (~73% already achieved).

Digital innovation (AU Ivy, AU Eternity, AU Udyogini) to enhance cross-sell and fee income.

AU Bank is building resilience with a strong capital base, diversified product suite, and robust liquidity management.

📝 Disclosure

This blog post is for informational purposes only. It does not constitute investment advice or a recommendation. Investors must exercise their own judgment before investing. AU Bank's performance data are derived from publicly available documents including investor presentations, press releases, and financial results.

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)