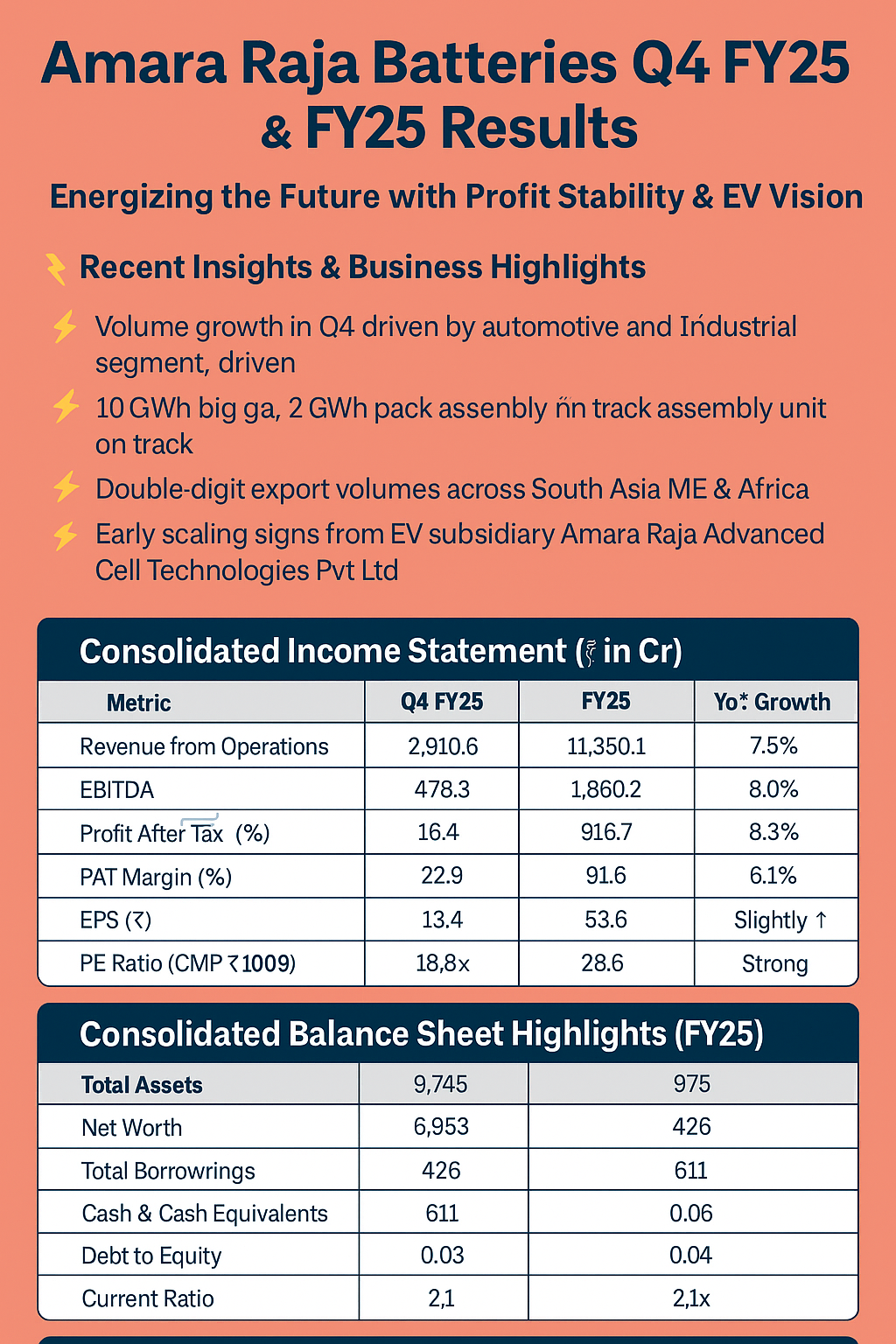

🔋 Amara Raja Batteries Q4 FY25 & FY25 Results: Energizing the Future with EV Vision But Profits in fall

🔍 Recent Insights & Business Highlights

Volume Growth: Q4 witnessed strong traction in both automotive and industrial segments, driven by export demand and OEM recovery.

New Energy Push: Lithium-ion giga factory (10 GWh) and pack assembly unit (2 GWh) remain on track—marking Amara Raja’s EV transition.

Export Expansion: Double-digit growth in export volumes; widening distribution network across emerging markets in South Asia, Middle East & Africa.

EV Subsidiary: Amara Raja Advanced Cell Technologies Pvt Ltd shows early signs of scaling.

📊 Consolidated Income Statement (₹ in Cr)

🧾 Consolidated Balance Sheet Highlights (FY25)

💰 Consolidated Cash Flow Snapshot (FY25)

🌐 Segmental & Regional Performance

Automotive Batteries: Volume growth led by strong replacement market and OEM revival.

Industrial Batteries: Sustained telecom & UPS segment demand.

Geographic Mix: ~22% of revenue from exports; Middle East & Africa growing rapidly.

🔮 Outlook – Short Term & Long Term

Near-Term:

Margins may face input cost pressure; however, export volumes and OEM recovery to support top line.

Channel expansion and product mix to help maintain profitability.

Long-Term:

Growth aligned with India’s EV and energy storage story.

Giga-factory progress and cell manufacturing capabilities to create value beyond FY26.

📢 Disclosure

This blog is intended purely for educational and informational purposes and does not constitute financial advice or a recommendation. Investors are encouraged to perform their own research before making investment decisions.

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)