🌏 Asia’s Economic Resilience Amid Trade Tensions: Strategic Outlook for Investors

📅 Published: April 2025

✅ Executive Summary

Asia, the driver of nearly 60% of global growth in 2024, now faces a recalibration moment. The traditional export-led model is under strain due to unprecedented US tariffs, slowing global demand, and rising trade policy uncertainty. To sustain its momentum, Asia must pivot toward domestic demand, regional trade integration, and digital transformation.

📉 Macroeconomic Outlook: Growth Slows Across the Board

🔹 2025 Forecast Highlights

Asia-Pacific: Growth revised down to 3.9% (from 4.6% in 2024).

2026: Estimated at 4.0%, still lower than pre-conflict projections.

🔹 Country-Wise Insights

Japan: Uptick to 0.6% as wage growth supports consumption.

China: Downgraded to ~4% in 2025 and 2026 due to tariff impact, despite fiscal push.

India: Still resilient at 6.2–6.3%, supported by strong domestic base.

ASEAN: Growth reduced to 4.1%, hit by weaker exports and sluggish domestic recovery.

🚨 Risks: Trade Tensions & Debt Overhang

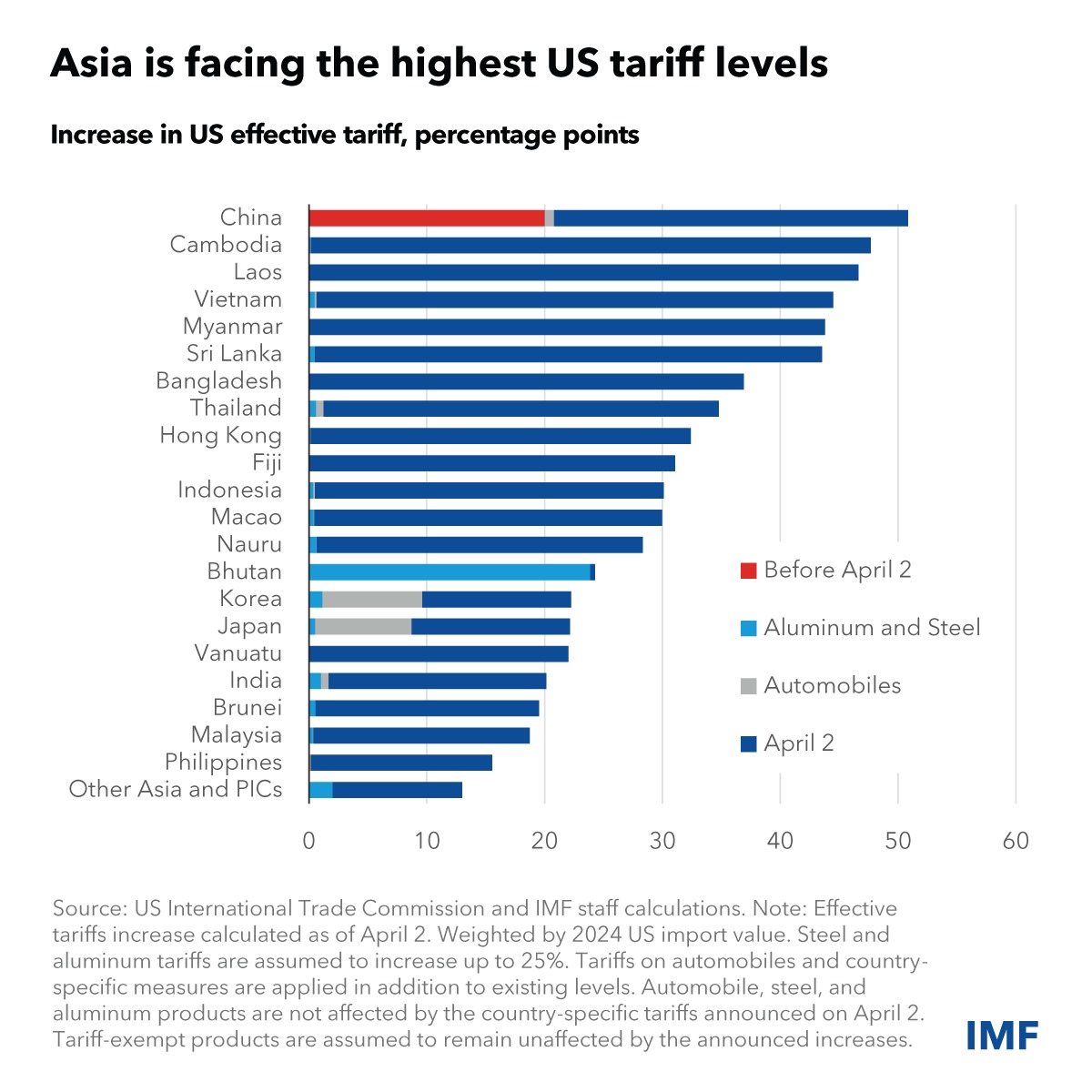

US Tariffs: Highest in 100 years, primarily targeting Asia.

Borrowing Surge: High household and corporate debt constraining spending.

Export Dependence: Vulnerability to AI-driven but volatile US tech demand.

💡 Strategic Solutions Proposed for Asia

🔄 1. Rebalance Growth

Pivot from exports to domestic consumption.

Build effective social safety nets and debt restructuring programs.

🌐 2. Diversify & Integrate

Strengthen regional trade ties—e.g., ASEAN, RCEP.

Invest in digital trade, services, and regulatory harmonization.

📊 3. Policy Realignment

Fiscal Policy: Targeted stimulus + medium-term deficit reduction.

Monetary Policy: Support demand where inflation is under control.

FX Flexibility: Use exchange rate to absorb shocks.

🛠️ 4. Structural Reforms

Improve business environment, labor markets, and human capital.

Promote financial inclusion and deep capital markets.

📈 Investor Insight: Market Impact & Opportunities

🔍 How This Impacts Stock Markets

Exporters under pressure from tariffs, margin compression.

Domestic-focused businesses (retail, consumption, infra) set to benefit.

Tech & Digital Economy remains a secular growth theme.

🏢 Sectors & Companies to Watch

Sector Impact Notable Companies (Indicative)

Technology & AI 🚀 Positive Tata Elxsi, Infosys, LTIMindtree, TCS

Consumer & Retail ✅ Positive DMart, ITC, Nestle India, HUL

Export Manufacturing ⚠️ At Risk Bajaj Auto, Motherson Sumi, Welspun India

Digital Platforms & SaaS 🚀 Positive Zomato, Nykaa, Paytm, Affle India

Capital Goods & Infra ✅ Beneficial L&T, Adani Ports, Siemens India

Financial Services 📊 Mixed HDFC Bank, SBI, ICICI Lombard, Bajaj Fin.

📌 Long-Term Strategy for Investors

Overweight domestic-demand-driven sectors.

Stay selective in export-oriented manufacturing.

Focus on digital transformation plays with scalable models.

Monitor fiscal reform and trade strategy in Asia’s top economies.

🛡️ Disclosure

This article is intended for educational and informational purposes only and should not be construed as financial advice or stock recommendations. All investors must perform their own due diligence based on risk appetite and investment goals. The data presented reflects macroeconomic trends and is not an endorsement of any security or investment strategy

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)