📊 Bajaj Auto Q4 FY25 & FY25 Financial Highlights: Growth, Resilience, & Green Momentum

🔍 Recent Business Insights & Strategic Growth

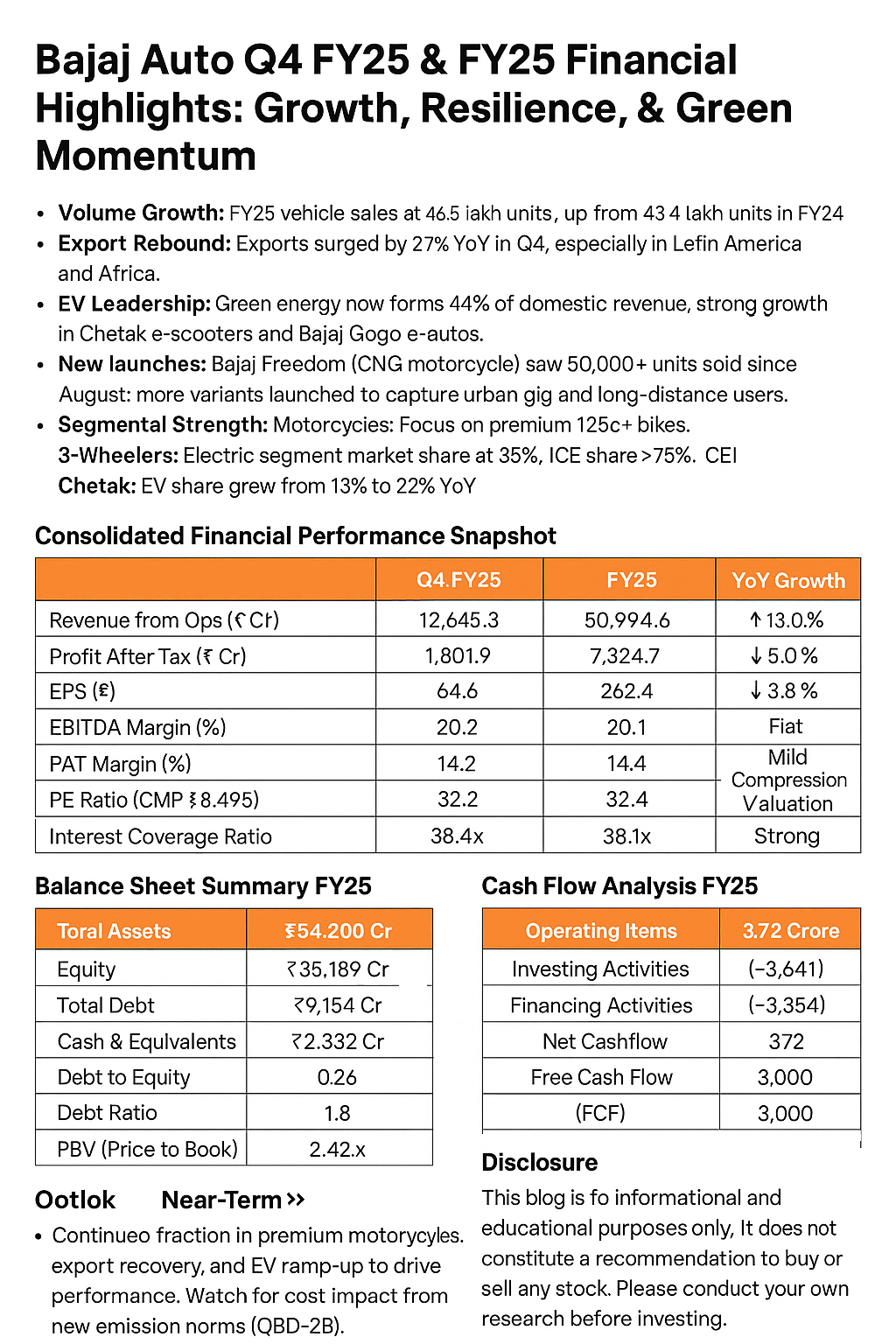

Volume Growth: FY25 vehicle sales at 46.5 lakh units, up from 43.4 lakh units in FY24.

Export Rebound: Exports surged by 27% YoY in Q4, especially in Latin America and Africa.

EV Leadership: Green energy now forms 44% of domestic revenue; strong growth in Chetak e-scooters and Bajaj Gogo e-autos.

New launches: Bajaj Freedom (CNG motorcycle) saw 50,000+ units sold since August; more variants launched to capture urban gig and long-distance users.

Segmental Strength:

Motorcycles: Focus on premium 125cc+ bikes.

3-Wheelers: Electric segment market share at 35%, ICE share >75%.

Chetak: EV share grew from 13% to 22% YoY.

📈 Consolidated Financial Performance Snapshot

📊 Balance Sheet Summary FY25

💵 Cash Flow Analysis FY25

🔮 Outlook

Near-Term: Continued traction in premium motorcycles, export recovery, and EV ramp-up to drive performance. Watch for cost impact from new emission norms (OBD-2B).

Long-Term: Strong product pipeline (e-rickshaw, premium EVs), expanding financial services (BACL), and tech focus (BATL) to support sustainable growth.

📢 Disclosure

This blog is for informational and educational purposes only. It does not constitute a recommendation to buy or sell any stock. Please conduct your own research before investing.

Comments (0)

Categories

Recent posts

ITC Hotels and its strategic plans ...

30 Dec 2024

Reliance Leads Energy Revolution: 100% ...

22 Jan 2025 for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)

📊 Analysis of Nifty 500 Companies: ...

14 Feb 2025