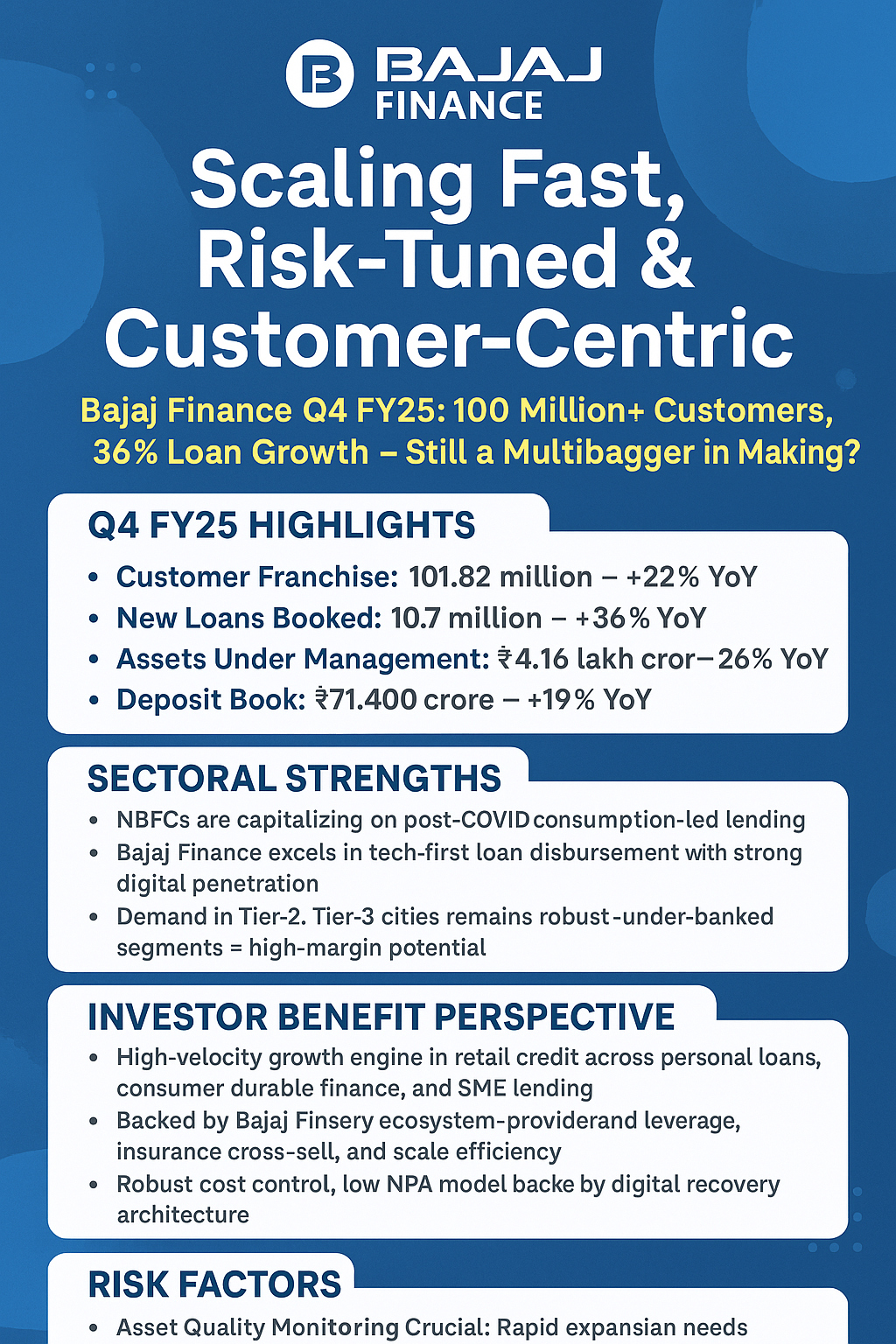

Bajaj Finance Q4 FY25: 100 Million+ Customers, 36% Loan Growth – Still a Multibagger in Making?

🔎 Q4 FY25 Highlights:

Customer Franchise: 101.82 million — +22% YoY

New Loans Booked: 10.7 million — +36% YoY

Assets Under Management (AUM): ₹4.16 lakh crore — +26% YoY

Deposit Book: ₹71,400 crore — +19% YoY

💼 Sectoral Strengths:

NBFCs are capitalizing on post-COVID consumption-led lending.

Bajaj Finance excels in tech-first loan disbursement with strong digital penetration.

Demand in Tier-2, Tier-3 cities remains robust—under-banked segments = high-margin potential.

🎯 Investor Benefit Perspective:

High-velocity growth engine in retail credit across personal loans, consumer durable finance, and SME lending

Backed by Bajaj Finserv ecosystem—provides brand leverage, insurance cross-sell, and scale efficiency

Robust cost control, low NPA model backed by digital recovery architecture

⚠ Risk Factors:

Asset Quality Monitoring Crucial: Rapid expansion needs stringent underwriting

Interest Rate Risk: Higher borrowing cost could impact spreads

Market Expectation Risk: Sky-high growth expectations mean shortfalls can cause stock volatility

🧠 Long-Term Eagle-Eye View:

Bajaj Finance continues to be a high-conviction pick for investors chasing secular compounding stories. With deep roots in Indian middle-class finance and scalable infrastructure, it is a potential multibagger if managed prudently.

🛡 Disclaimer:

This blog post is strictly for educational and informational purposes. It does not constitute investment advice, stock recommendation, or solicitation to buy/sell securities. Investors are advised to perform their own due diligence or consult a certified investment advisor. Stock markets are subject to market risk.

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)