Bajaj Housing Finance Ltd. – FY25 Financial Performance Highlights and Analysis

Bajaj Housing Finance Limited (BHFL) delivered robust financial results for the fiscal year ending March 31, 2025 (FY25), underpinned by substantial growth in Assets Under Management (AUM), advances, income, and profit metrics, alongside sustained healthy asset quality.

Financial Performance Highlights 📊:

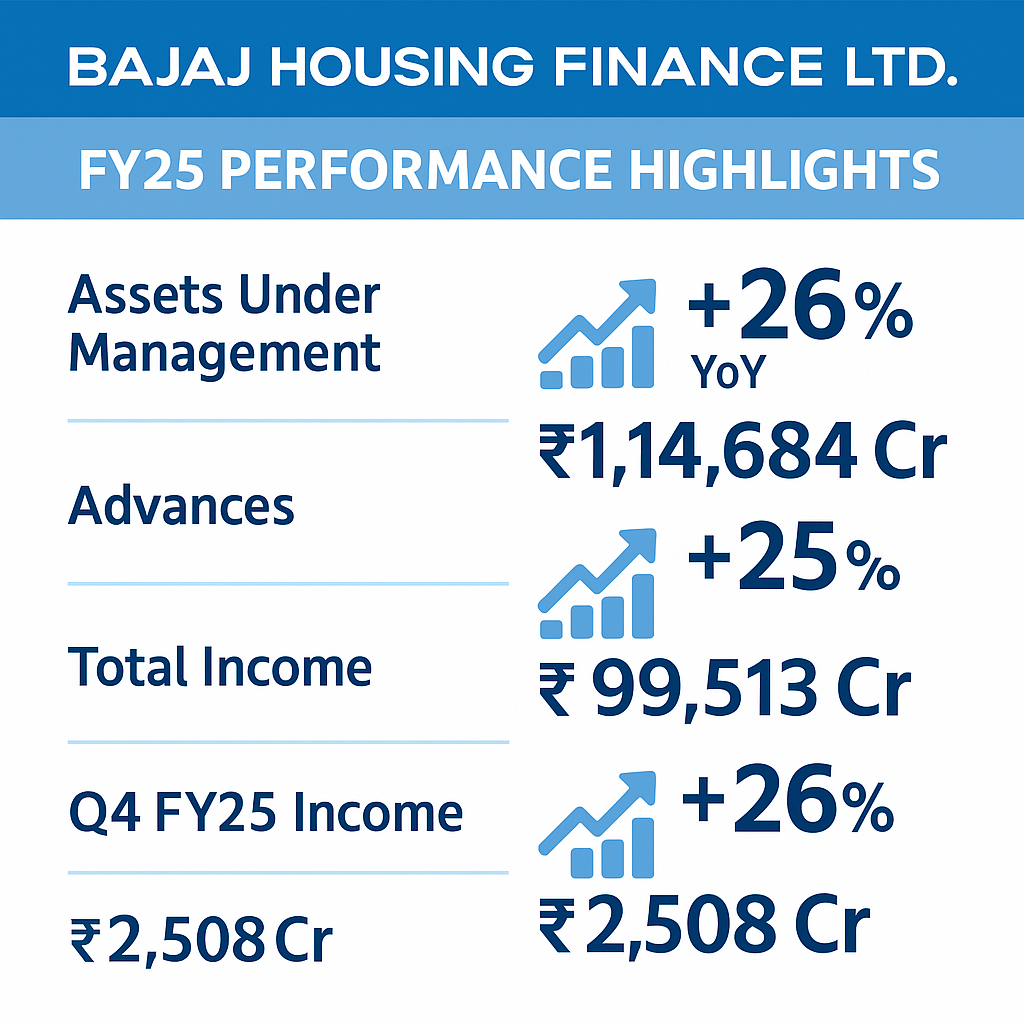

Assets Under Management (AUM) 📈 grew impressively by 26% year-on-year (YoY) to ₹1,14,684 crore from ₹91,370 crore in FY24.

Advances 🚀 recorded substantial growth of 25%, reaching ₹99,513 crore, compared to ₹79,301 crore in FY24.

Total Income 💰 increased by 26% YoY to ₹9,576 crore, significantly up from ₹7,618 crore in FY24. Specifically, the Q4 FY25 income rose to ₹2,508 crore, marking a 26% increase from Q4 FY24.

Profitability Metrics 📈:

Net Profit 💹 exhibited strong growth, increasing by 25% YoY to ₹2,163 crore in FY25 from ₹1,731 crore in FY24. Specifically, Q4 FY25 net profit surged by 54% to ₹587 crore compared to ₹381 crore in Q4 FY24.

Profit Margins 💼 improved notably, with Profit Before Tax (PBT) rising by 28% to ₹2,770 crore from ₹2,161 crore in FY24. Q4 FY25 saw a 48% increase in PBT to ₹720 crore compared to Q4 FY24.

Net Interest Margin (NIM) stood firm at 4.0%, showcasing stable margin management.

Asset Quality and Risk Management 🛡️:

Gross Non-Performing Assets (GNPA) 📉 remained controlled at 0.29% in Q4 FY25, consistent with the previous quarter, indicating stable asset quality.

Net Non-Performing Assets (NNPA) 🔄 slightly decreased to 0.11% from 0.13% in Q3 FY25, demonstrating efficient risk management.

Provision Coverage Ratio (PCR) stood healthy at 60.3% in FY25, maintaining a strong coverage against potential loan losses.

Key Industry KPIs and Ratios 📌:

Capital Adequacy Ratio (CRAR) was robust at 28.24%, significantly above the regulatory requirement of 15%, highlighting a strong capital position.

Return on Assets (RoA) for Q4 FY25 was steady at 2.4%, reflecting consistent profitability.

Return on Equity (RoE) stood at 12.1% for Q4 FY25, impacted by recent capital raises including a rights issue and an IPO.

Opex to Net Total Income (NTI) ratio improved to 20.8% for FY25 from 24.0% in FY24, indicating enhanced operational efficiency.

Debt-to-Equity Ratio improved significantly to 4.11 in Q4 FY25 from 5.65 in Q4 FY24, demonstrating a prudent leverage strategy.

Solvency, Liquidity, and Valuations 💲:

Liquidity Coverage Ratio (LCR) 💧 was exceptionally strong at 191%, substantially higher than the regulatory minimum of 100%.

Net Worth expanded significantly to ₹19,932 crore, reflecting a solid financial base to support growth strategies.

At a current market price (CMP) of ₹132, Bajaj Housing Finance maintains a favorable valuation supported by its robust growth trajectory and solid financial health.

Near-term & Long-term Outlook 🔭:

Near-term Outlook: The company continues to see robust demand across home loans and affordable housing segments. Operating efficiencies and technology-driven initiatives are expected to further enhance profitability and customer experience.

Long-term Outlook: Bajaj Housing Finance is strategically positioned for sustained growth, driven by product diversification, geographic expansion, and a strong digital framework. The company's medium-term guidance projects sustained high growth rates (24-26% AUM growth), healthy asset quality (GNPA between 40-60 bps), and improving operational efficiency (Opex to NTI at 14-15%).

In summary, Bajaj Housing Finance Limited demonstrates strong fundamentals, prudent risk management, and strategic expansion efforts, laying a solid foundation for continued success and delivering consistent value to its stakeholders.

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)