🚜 Balkrishna Industries Ltd – Q4 & FY25 Results Update: Strong Long-Term Strategy Despite Soft Q4

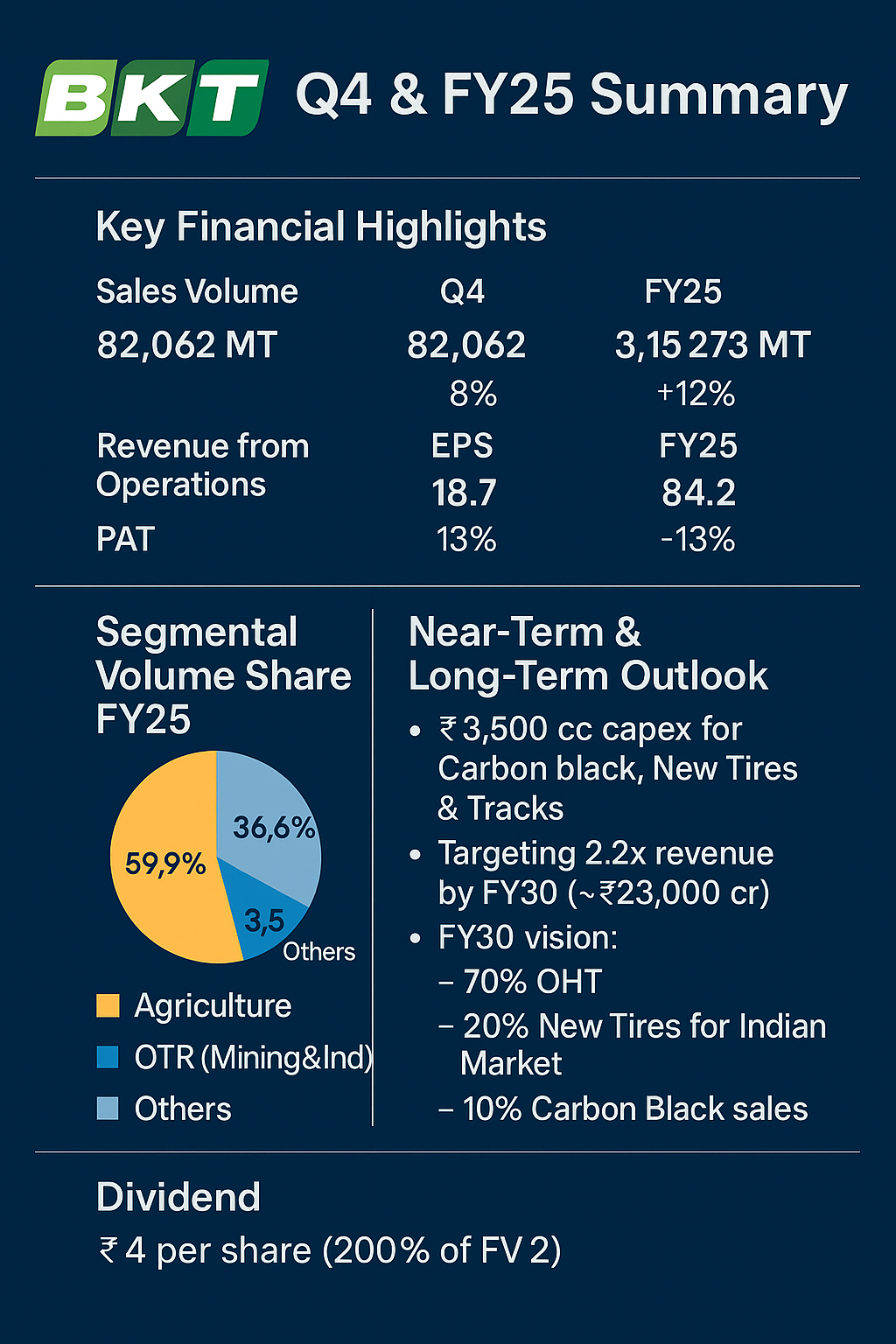

📊 Key Financial Highlights

📉 Q4 PAT dropped due to higher depreciation, interest, and unrealized forex losses.

📦 Segmental, Channel & Regional Volume Share (FY25)

📈 Key Ratios & Metrics (Consolidated)

📘 Consolidated Balance Sheet Summary (₹ Cr)

💰 Consolidated Cash Flow Statement (₹ Cr)

🔭 Near-Term & Long-Term Outlook

🛠️ Expansion Projects

₹3,500 Cr capex over 3 years for:

Carbon black expansion to 360,000 MTPA

New categories: Commercial Vehicle & Passenger Radial Tires

Track systems & De-bottlenecking

Targeting 2.2x revenue by FY30 (~₹23,000 Cr)

FY30 vision:

70% OHT

20% New Tires for Indian Market

10% Carbon Black sales

📌 Outlook

Near-term profitability may stay muted due to capex, higher depreciation, and forex volatility.

Strong long-term visibility with product diversification and global OEM expansion.

Resilient business model with surplus cash and strategic cost control.

📢 Final Dividend

₹4 per share (200% of FV ₹2)

Total FY25 dividend: ₹16 per share

📌 Disclosure

This analysis is for educational and informational purposes only and does not constitute a buy/sell recommendation.

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)