🇮🇳 Bharat Electronics Ltd – Q4 & FY25 Financial Results & Investor Insights 🔍

📅 As of 31st March 2025 | 📈 CMP: ₹362 | 🏢 PSU | Defense Electronics Leader

✍️ Prepared by: Profit From IT – Investment Research Desk

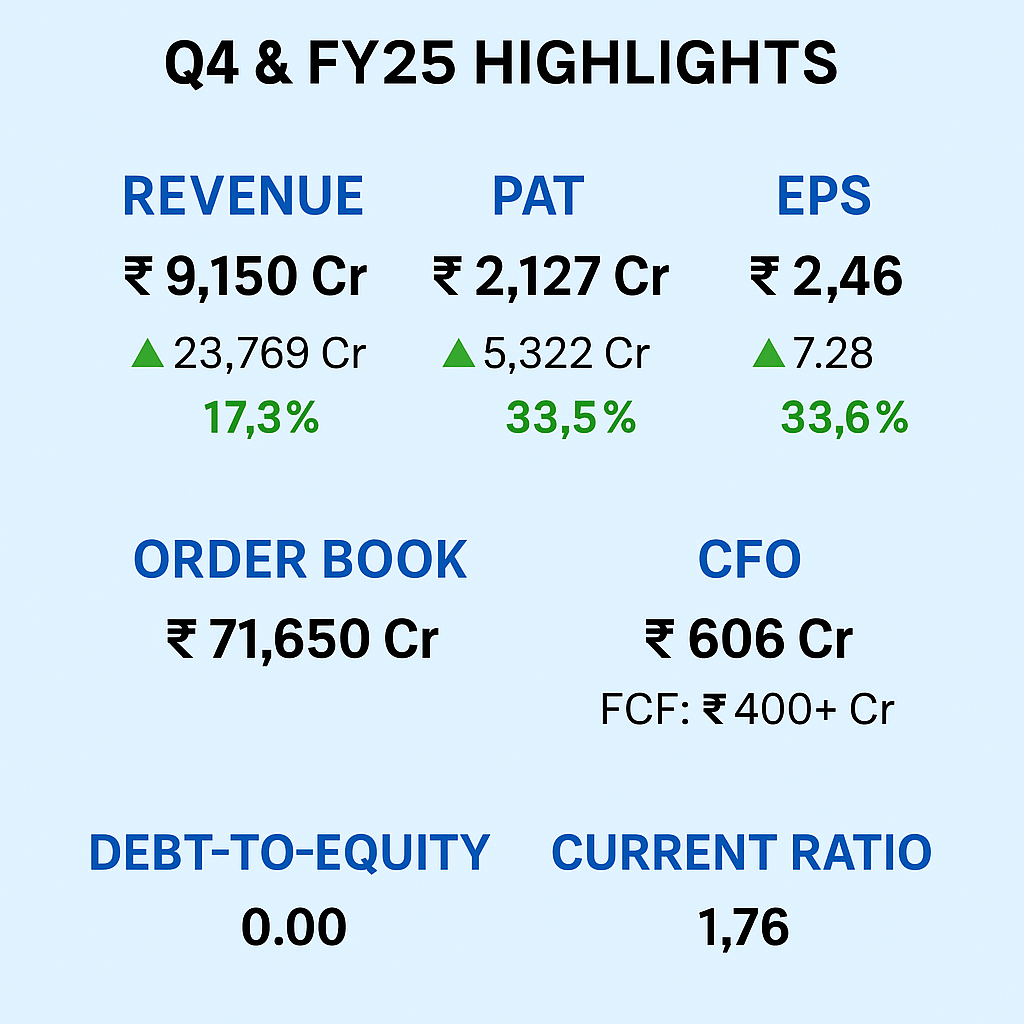

🔷 Key Highlights – FY25 & Q4 FY25 Performance

Revenue (FY25): ₹23,024 Cr ⬆️ 16.2% YoY

PAT (FY25): ₹5,288 Cr ⬆️ 31.6% YoY

Order Book (as of 1st Apr 2025): ₹71,650 Cr 🟢

Order Inflow: Significant with strategic wins across radar systems, defence electronics, and communication projects.

🧾 Consolidated Financial Analysis (₹ in Cr)

🧮 Valuation Ratios (Based on CMP ₹362)

📊 Balance Sheet Highlights (Standalone)

💰 Cash Flow Summary (Standalone)

🔎 Investor Insights & Outlook

📌 Near-Term Outlook:

Strong execution capability and zero-debt position provide resilience in a rising interest rate environment.

Strategic orders from the Ministry of Defence ensure predictable revenue visibility.

📌 Long-Term Outlook:

₹71,650 Cr order book offers 3-year revenue visibility.

Focus on exports, R&D, and indigenization aligns with Make-in-India & Atmanirbhar Bharat themes.

Growth drivers: radar systems, naval systems, missile systems, and cyber-security solutions.

⚠️ Risk Factors

Delay in defence budget allocation or procurement clearances.

Execution risk in high-tech, large-scale orders.

📌 Disclosure

This analysis is prepared for educational purposes only. It does not constitute investment advice or a recommendation.

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)