📝 Executive Summary

Launched in 2020, the SVAMITVA Scheme is a groundbreaking initiative that has revolutionized rural India’s land ownership landscape through drone-based surveys and the issuance of 2.42 crore property cards across 1.61 lakh villages.

It serves as a critical building block in India's journey towards self-reliance, financial inclusion, rural economic growth, and governance reforms.

🎯 How Investors Can Benefit

Financial Deepening: Rise in formal property ownership will catalyze rural credit growth through banks, NBFCs, and microfinance institutions.

Expansion of Rural Fintech: Growing demand for property-backed loans, digital KYC, land verification, and insurance solutions.

Real Estate Development: Clear land titles will fuel affordable rural housing projects and plotted developments.

Consumption Upsurge: Increased financial empowerment of rural households will boost demand for FMCG, two-wheelers, tractors, consumer durables, and rural banking services.

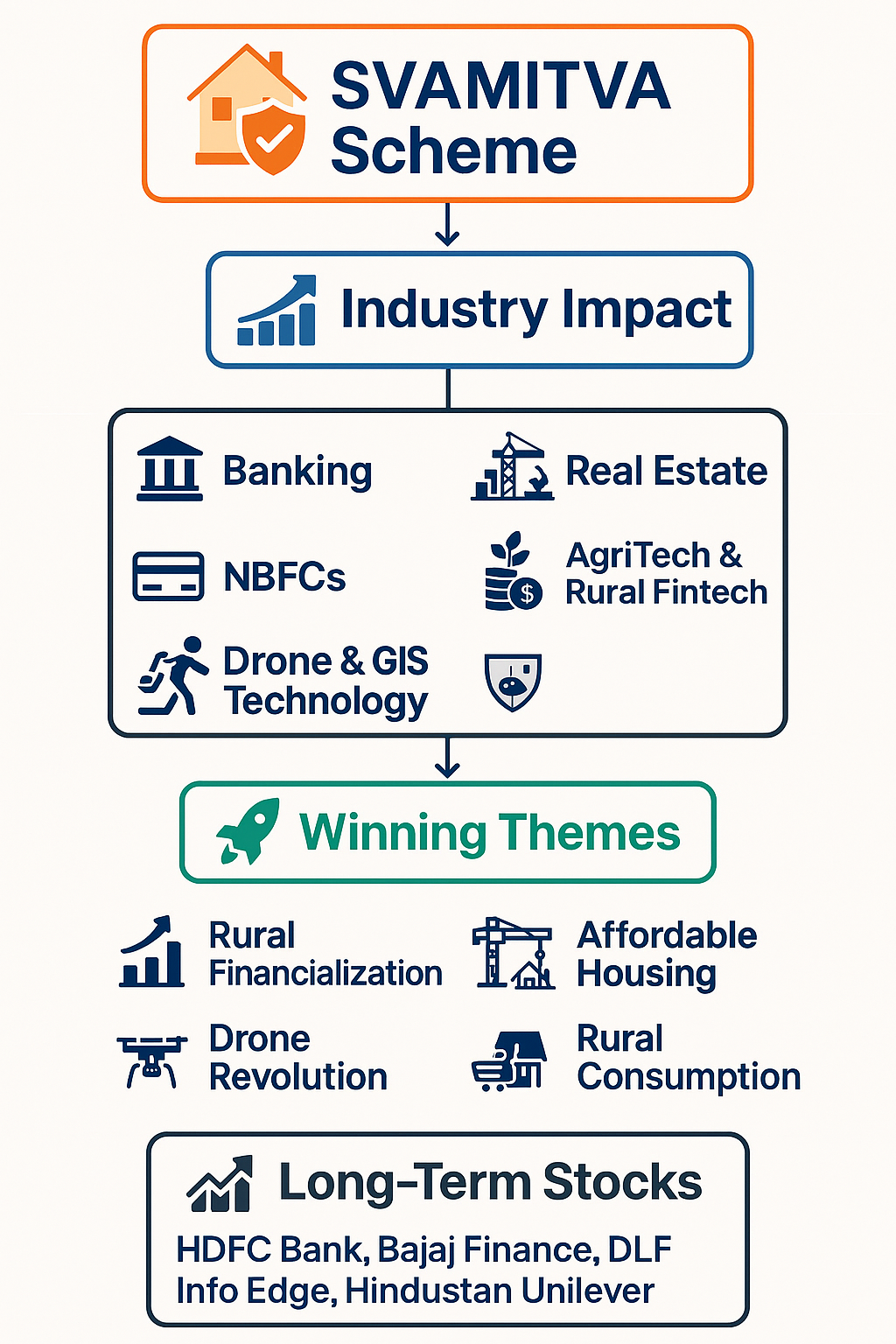

🌍 Sectoral/Industry Impact

| Industry / Sector | Impact |

|---|---|

| Banking, Financial Services & Insurance (BFSI) | Higher rural lending, insurance, and credit penetration. |

| NBFCs & Microfinance | Property collateralization boosting micro and SME lending. |

| Real Estate and Infrastructure | Entry-level housing and plotted developments will rise. |

| AgriTech and Rural Fintech | New services in rural land analytics, agri-loans, and financial inclusion tech. |

| Drone and GIS Technology | Escalated demand for drone manufacturing, mapping, and land digitization services. |

🏦 Long-Term Listed Companies Poised to Benefit

| Sector | Companies | Strategic Benefit |

|---|---|---|

| Banking | HDFC Bank, ICICI Bank, SBI, Bandhan Bank, AU Small Finance Bank | Rural loan expansion, property-linked finance, mortgage growth. |

| NBFCs | Bajaj Finance, Mahindra Finance, Muthoot Finance, Manappuram Finance | Explosion in property-secured rural lending, gold loans. |

| Insurance | HDFC Life, SBI Life, ICICI Lombard, New India Assurance | Growing rural life and property insurance coverage. |

| Real Estate | DLF, Godrej Properties, Mahindra Lifespace, Ashiana Housing | Expansion into semi-urban/rural affordable housing. |

| AgriTech and Rural Fintech | Info Edge, Nazara Tech (indirectly), Samunnati (unlisted) | Land record digitization and rural fintech services growth. |

| Drone & GIS Tech | Zen Technologies, Paras Defence, IdeaForge Technology, RattanIndia Enterprises | Drone deployment in land surveying and rural mapping. |

| Rural Consumption | HUL, Dabur, Marico, Hero MotoCorp, Mahindra & Mahindra | Higher rural disposable income driving consumption. |

🔭 Long-Term Investment Themes

Rural Financialization Play 🚀: Banking and NBFC companies.

Drone Revolution Play 🚀: Drone and GIS mapping tech companies.

Affordable Housing Play 🚀: Real estate developers with rural/semi-urban focus.

Rural Consumption Play 🚀: FMCG, two-wheeler, and AgriTech beneficiaries.

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)