📊 CDSL Q4 & FY25 Result Analysis

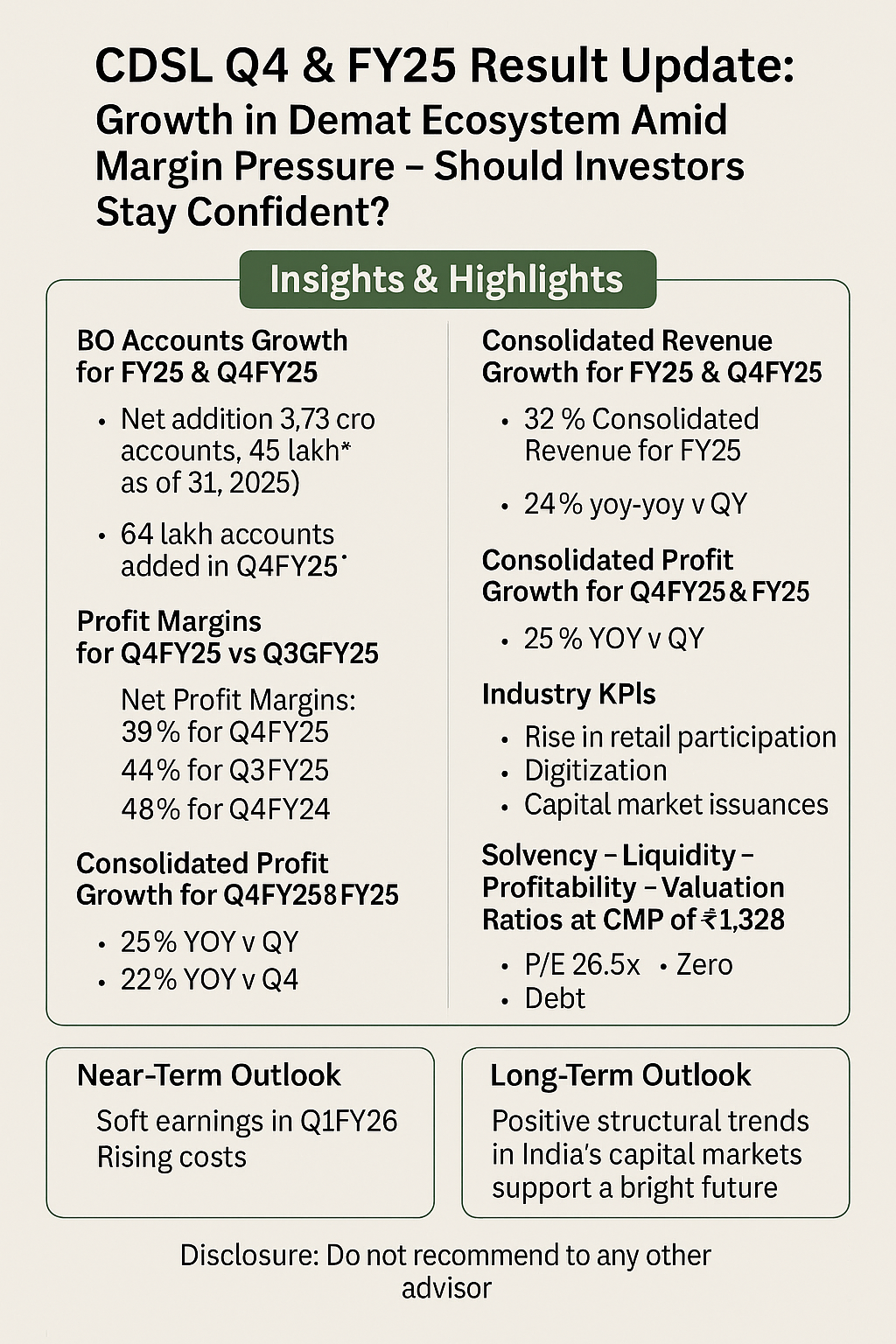

CDSL Q4 & FY25 Results: Growth in Demat Ecosystem Amid Margin Pressure – Should Investors Stay Confident?

Explore CDSL’s Q4 & FY25 results: BO account growth, revenue trends, profitability analysis, industry KPIs, and investor outlook. Fair valuation insights at CMP ₹1328.

🔍 Key Business Highlights

BO Account Growth:

FY25 Net Additions: 3.73 crore new demat accounts (15.29+ Cr total BO accounts as of March 31, 2025)

Quarterly Trend (Q4FY25): Net addition of 64 lakh accounts, slight drop QoQ.

Demat Custody Value:

Rose to ₹35.92 lakh crore in Q4FY25, up from ₹31.56 lakh crore in Q3FY25 and ₹23.06 lakh crore in Q4FY24 – a 56% YoY growth.

Number of Issuers & ISINs:

Issuers: 98,436 (+36% YoY)

ISINs: Continuous upward trend, reflecting deepening of the capital markets.

📈 Financial Performance Summary

✅ Consolidated Figures (₹ in Cr)

✅ Full-Year FY25 vs FY24

✅ Standalone Revenue Mix (Q4FY25)

Annual Issuer Income: ₹87 Cr

Transaction Charges: ₹49 Cr

IPO/CA Income: ₹25 Cr

Online Data Charges: ₹37 Cr

Other Income: ₹58 Cr

Dividend from Subsidiary (CVL): ₹48 Cr (in Q2FY25)

📉 Profitability & Margins

Despite a strong topline for FY25, Q4 margins declined YoY and QoQ due to rising employee & tech infra costs.

💡 Industry KPIs & Business Drivers

Structural Tailwinds:

Rise in retail participation

Digitization of financial services

Growth in capital market issuances

Subsidiary Strength:

CVL: 8.93 Cr+ KYC records (largest KRA), offers RTA, GSP, e-KYC, and e-Sign

CIRL: 17.5L e-insurance accounts

CCRL: Digital commodity receipts for FPOs and traders

🧮 Solvency, Liquidity, Profitability, Valuation

→ Verdict: Debt-Free, Cash-Rich, Profitable – but premium valuations.

🔎 Near-Term Outlook

Challenges:

Q4fy25 Revenue is down, suggesting cool off, -ve for fy26.

Margins under pressure due to rising operational costs

Market-linked income components (like IPO activity) remain cyclical

Opportunities:

Continued BO account growth

Cross-leveraging from subsidiaries (e-KYC, Insurance Repository, etc.)

Growing capital market inclusion through digital innovations

🌐 Long-Term Outlook

Bullish Structural Drivers:

Financial inclusion

Regulatory focus on transparency

India’s shift to digital investing platforms

Sustainable Moat:

Duopoly status

High switching costs for BO accounts

Platform stickiness

→ CDSL remains a long-term structural play on India’s capital market deepening.

📢 Disclosure

This blog is created for educational purposes only and does not constitute investment advice. Readers are advised to do their own research before making any investment decisions.

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)