🧾 DMart Q4 FY25 & FY25 Result Highlights – Resilient Growth Amid Operational Pressures

📌 Key Performance Highlights

✅ Like-to-Like (LTL) Growth – Q4 FY25

Estimated LTL revenue growth stands moderately positive as store additions continue to weigh, indicating robust demand in mature clusters while new stores stabilize.

Growth compared to Q4 FY24 (₹12,726.55 Cr) to Q4 FY25 (₹14,871.86 Cr): ~16.9% YoY growth in consolidated revenue suggests moderate LTL expansion.

✅ Consolidated Sales Growth

🏬 Store Network Growth

Continued capex and higher inventories (₹5,044 Cr vs ₹3,927 Cr) signal expansion in physical retail footprint.

Online channels via Avenue E-commerce also contributed modestly to topline.

📊 Profitability Overview

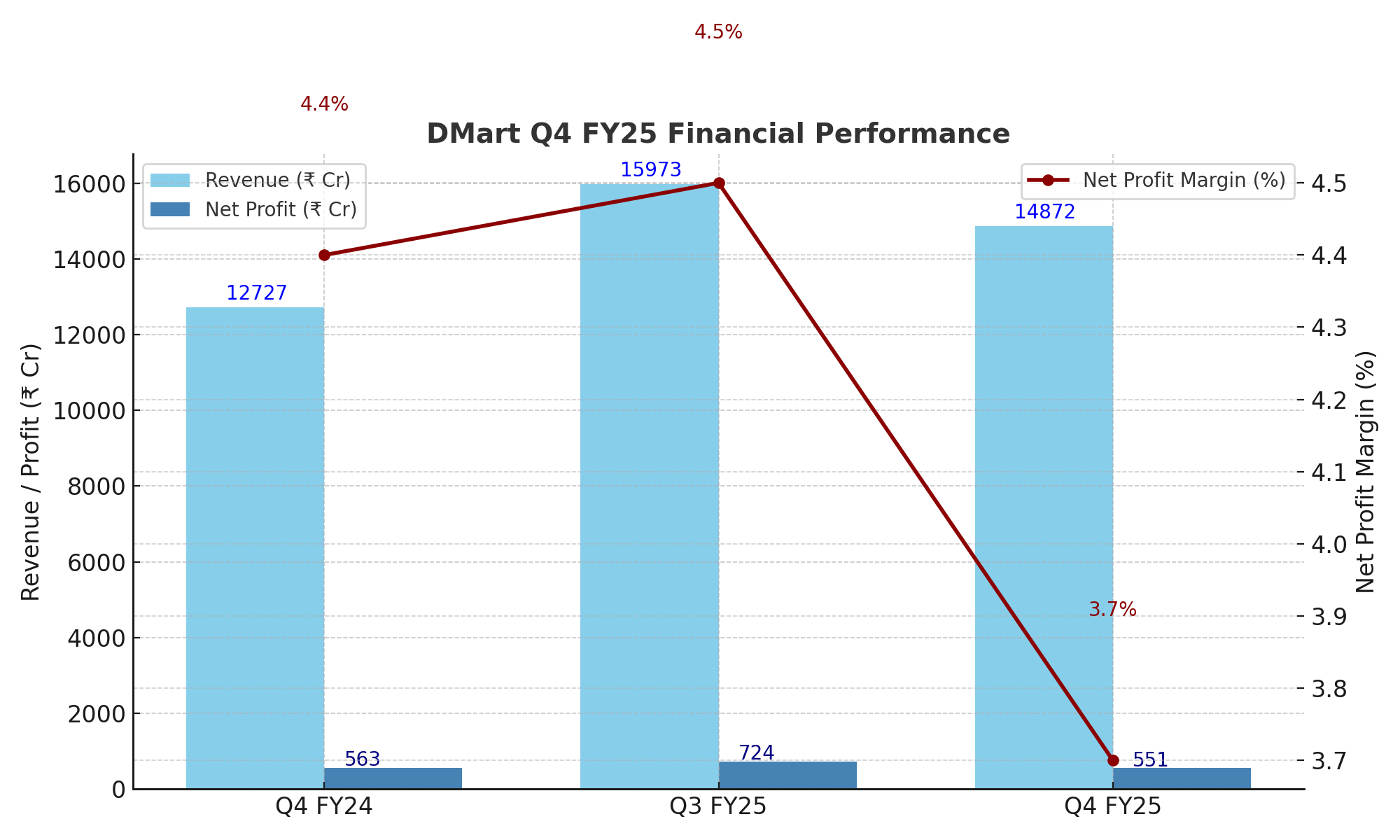

✅ Net Profit Growth

Q4 saw margin compression owing to inventory adjustments and muted festive spillover vs Q3.

✅ Profit Margins

*Margins impacted by higher Opex and backend logistics costs.

💼 Financial Ratios @ CMP ₹4,060

📈 Cashflow and Capex Trends

Cash Flow from Operations (FY25): ₹2,462.97 Cr (↓ from ₹2,745.84 Cr)

Capex: ₹3,423.04 Cr – major store and backend infra expansion

Despite cash outflows, the company maintained healthy cash & equivalents of ₹355.48 Cr

🧭 Industry KPIs & Macro Trends

🔮 Outlook – Strategic Perspective

⏳ Near-Term Outlook (FY26)

Cautious optimism expected as operational leverage stabilizes.

Focus on enhancing productivity per store & e-commerce efficiency.

🌐 Long-Term Outlook (FY25–FY30)

Structural story intact: value retail model, deep supply chain, cost focus.

Earnings CAGR expected at 14–16% with margin normalization and network expansion.

Potential PE re-rating unlikely due to high base; growth-led returns more probable.

⚠️ Disclosure

This analysis is intended for educational purposes only. Investors are advised to perform their own due diligence before making investment decisions.

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)