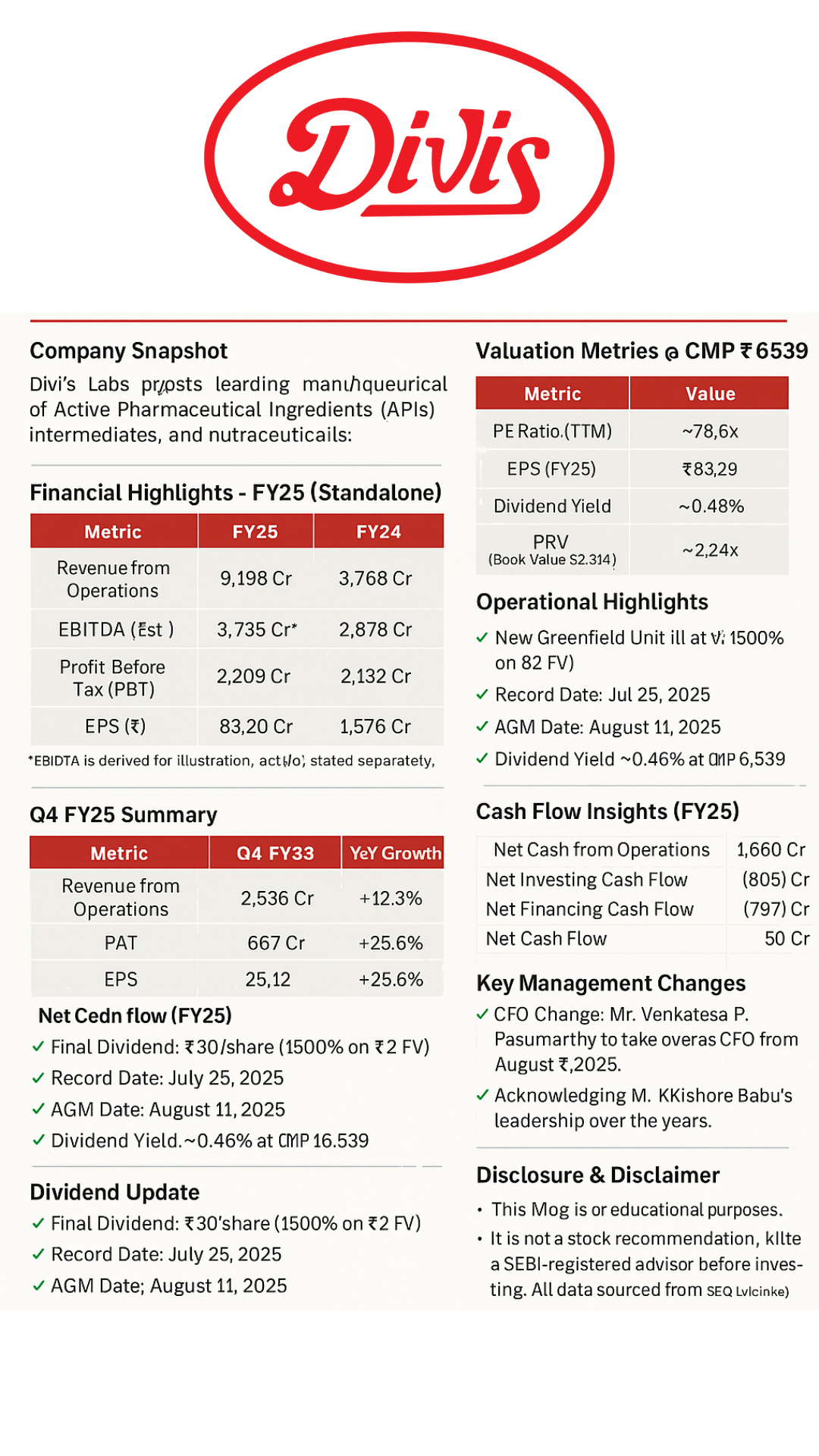

🧪 Divi's Laboratories Q4 & FY25 Results: ₹2,209 Cr PAT | ₹30 Dividend | CMP ₹6,539 | Strong Capex-Led Growth

📌 Company Snapshot

Divi’s Laboratories is a leading manufacturer of Active Pharmaceutical Ingredients (APIs), intermediates, and nutraceuticals, known for its strong R&D, zero-debt status, and consistent dividend payouts. The company continues to strengthen its global leadership with expansion projects and technology adoption.

📊 Financial Highlights – FY25 (Standalone)

| Metric | FY25 | FY24 | YoY Growth |

|---|---|---|---|

| Revenue from Operations | ₹9,198 Cr | ₹7,665 Cr | 🟢 +20.0% |

| EBITDA (Est.) | ₹3,736 Cr* | ₹2,878 Cr* | 🟢 +29.8% |

| Profit Before Tax (PBT) | ₹2,929 Cr | ₹2,132 Cr | 🟢 +37.4% |

| Profit After Tax (PAT) | ₹2,209 Cr | ₹1,576 Cr | 🟢 +40.2% |

| EPS (₹) | ₹83.20 | ₹59.37 | 🟢 +40.2% |

*EBITDA is derived for illustration; actual not separately stated.

💸 Valuation Metrics @ CMP ₹6,539

| Metric | Value |

|---|---|

| PE Ratio (TTM) | ~78.6x |

| EPS (FY25) | ₹83.20 |

| Dividend Yield | ~0.46% |

| PBV (Book Value ₹2,914) | ~2.24x |

🧾 Q4 FY25 Summary

| Metric | Q4 FY25 | Q4 FY24 | YoY Growth |

|---|---|---|---|

| Revenue from Operations | ₹2,536 Cr | ₹2,259 Cr | 🟢 +12.3% |

| PAT | ₹667 Cr | ₹531 Cr | 🟢 +25.6% |

| EPS | ₹25.12 | ₹19.99 | 🟢 +25.6% |

🏭 Operational Highlights

✅ New Greenfield Unit III at Kakinada commenced operations in Q4 FY25.

✅ Forex Gains: ₹48 Cr in FY25 (🟢 up from ₹28 Cr in FY24).

✅ Capex in FY25: ₹1,437 Cr towards expansion and infrastructure.

✅ Zero Debt: High liquidity with cash and bank of ₹3,696 Cr.

💰 Dividend Update

📌 Final Dividend: ₹30/share (🟢 1500% on ₹2 FV)

🗓️ Record Date: July 25, 2025

🏛️ AGM Date: August 11, 2025

💵 Dividend Yield: ~0.46% at CMP ₹6,539

💹 Cash Flow Insights (FY25)

| Cash Flow Component | FY25 | FY24 |

|---|---|---|

| Net Cash from Operations | ₹1,650 Cr | ₹1,266 Cr |

| Net Investing Cash Flow | ₹(803) Cr | ₹(268) Cr |

| Net Financing Cash Flow | ₹(797) Cr | ₹(798) Cr |

| Net Cash Flow | ₹50 Cr | ₹200 Cr |

💼 Key Management Changes

🔁 CFO Change: Mr. Venkatesa P. Pasumarthy to take over as CFO from August 1, 2025.

👏 Acknowledgment of Mr. L. Kishore Babu’s leadership over the years.

📈 Long-Term Outlook

Divi’s strategic expansions, robust cash flow generation, and zero-debt model make it a compelling pick for long-term wealth creation. The steady increase in exports, capacity building, and R&D strength positions the company well for future earnings growth.

📋 Disclosure & Disclaimer

This blog is for educational purposes only.

It is not a stock recommendation.

All data is sourced from the company’s official investor filings dated May 17, 2025.

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)