🚀 Dixon Technologies & Inventec JV Announcement: A Strategic Leap into IT Hardware Manufacturing

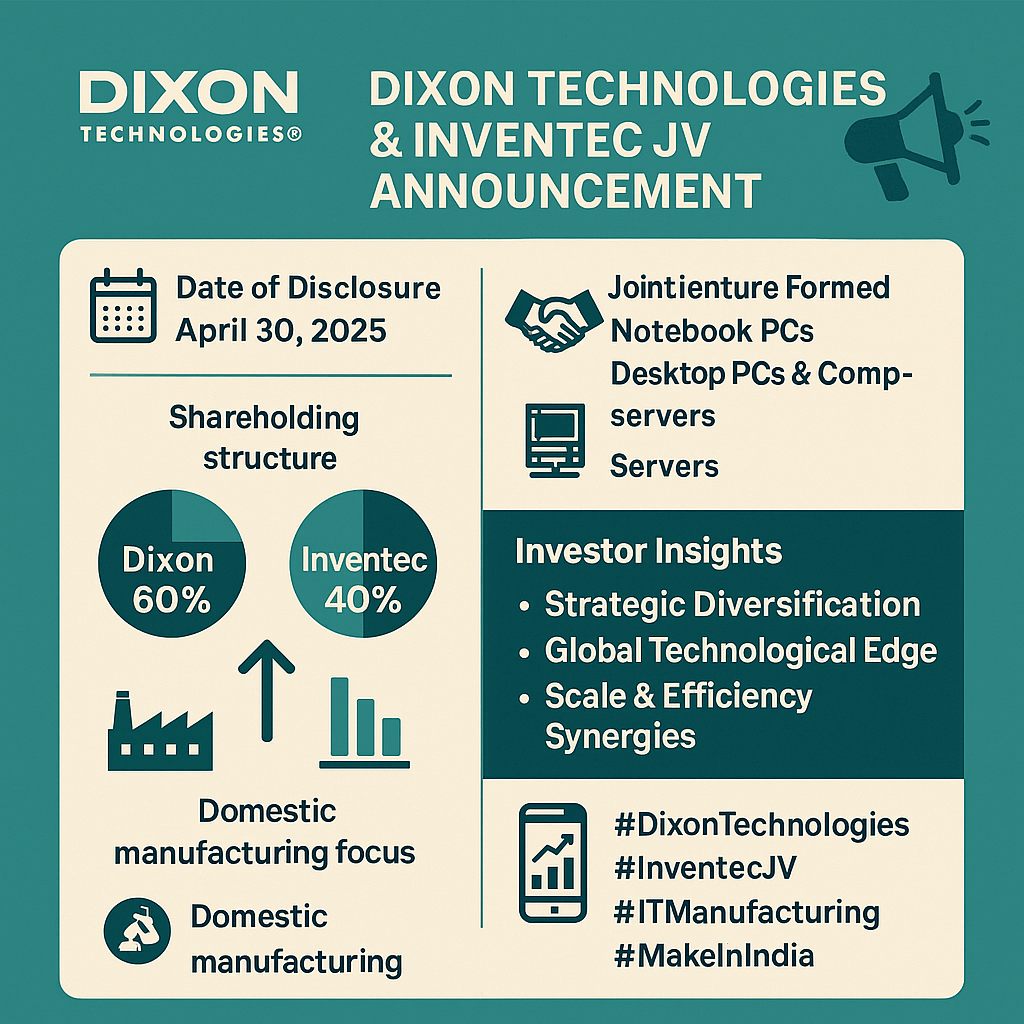

📅 Date of Disclosure: April 30, 2025

🏢 Companies Involved: Dixon Technologies (India) Ltd. & Inventec Corporation

📘 SEBI Regulation Reference: Regulation 30 – SEBI (LODR) Regulations, 2015

🔍 Key Highlights of the Announcement

🤝 Joint Venture Formed between Dixon Technologies (India) Ltd. and Inventec Corporation, a global leader in IT hardware manufacturing.

🏭 The JV will manufacture:

Notebook PCs

Desktop PCs & Components

Servers

📊 Shareholding Structure:

Dixon: 60%

Inventec: 40%

🛠 Operated via: Dixon IT Devices Pvt. Ltd. (Dixon’s wholly-owned subsidiary)

🗺 Domestic manufacturing focus under the Make in India initiative

💡 Investor Insights

1. Strategic Diversification

🔄 Dixon’s entry into notebook and server manufacturing positions it within high-growth IT hardware segments, expanding beyond its traditional strongholds like LED TVs and mobile phones.

2. Global Technological Edge

🌐 Inventec is among the top 5 global PC ODM players, bringing high-end R&D, engineering, and global supply chain capabilities into the JV.

3. Scale & Efficiency Synergies

🧩 Dixon’s operational scale and domestic manufacturing excellence, paired with Inventec’s product innovation, can create a cost-effective, high-quality product pipeline for Indian and global markets.

📈 Potential Long-Term Impact on Dixon’s Share Price

🔵 Positive Tailwinds:

📦 Higher margin product addition may improve EBITDA margins

🌟 Enhanced perception as a multi-segment electronics contract manufacturer

📊 Likely to drive EPS growth in the next 3–5 years post commercial operations commencement

⚠ Key Watchpoints:

🔧 Execution and ramp-up risks in new categories

🧾 JV implementation timeline and regulatory clearances

📦 Order book visibility and capacity utilization post-launch

🌏 Alignment with Macroeconomic & Government Policies

✅ Support from PLI schemes in IT Hardware & Electronics Manufacturing

🔁 Boosts domestic component ecosystem and import substitution

📣 Strong alignment with India's ambition to be a global electronics hub

🔍 Disclosure Statement

This blog post is for educational and informational purposes only. It does not constitute investment advice or a recommendation. Investors are advised to perform their own due diligence

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)