📊 Dixon Technologies (India) Ltd – Q4 FY25 & FY25 Financial Results Analysis

CMP: ₹15,608 | Sector: Electronics Manufacturing Services (EMS)

📌 Executive Summary

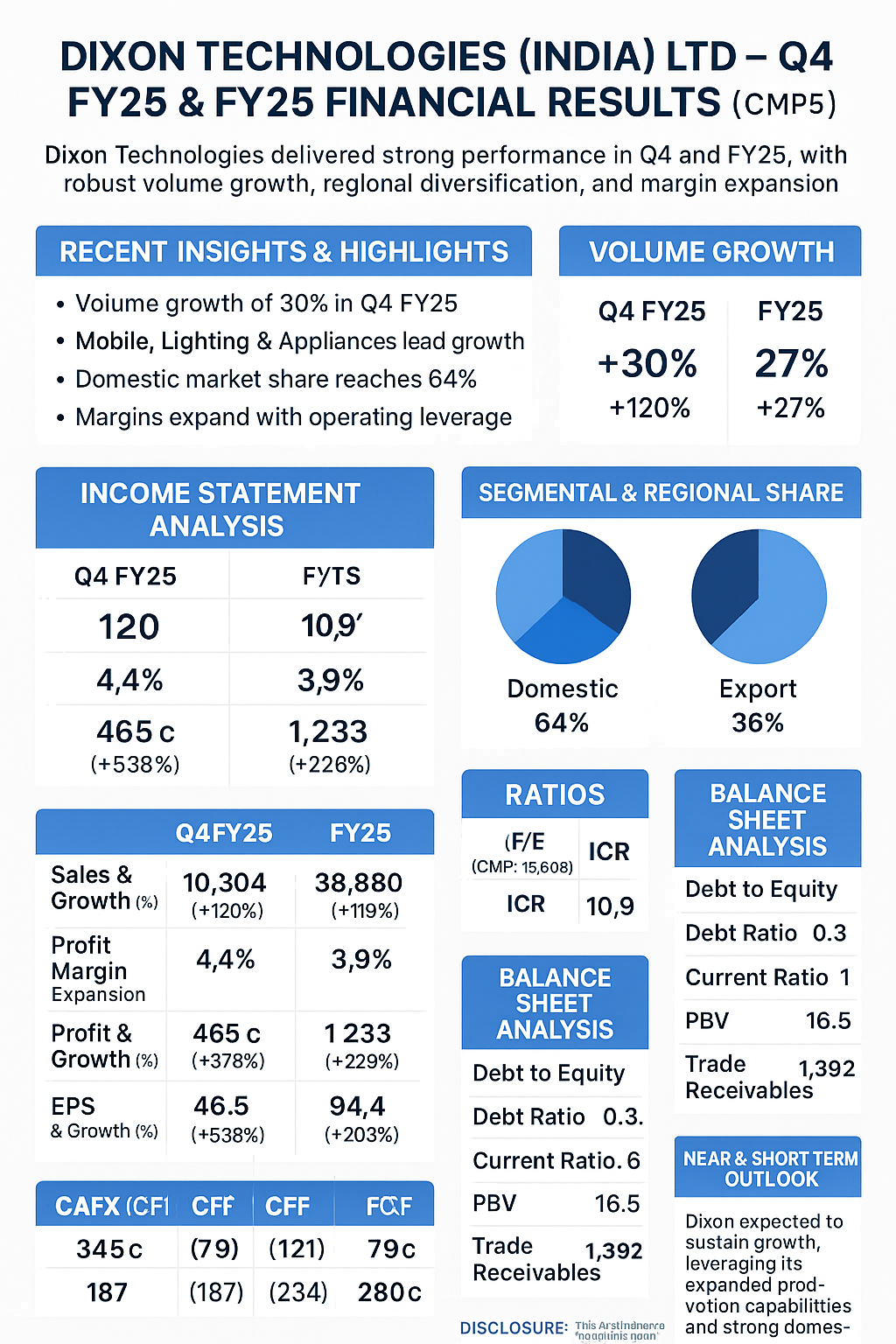

Dixon Technologies delivered an outstanding performance in Q4 FY25 and the full FY25, reporting over 120% YoY growth in revenue and profit metrics. Strategic business growth, enhanced operating leverage, and the fair value gain from its investment in Aditya Infotech significantly boosted profitability.

🧾 Consolidated Income Statement – Performance Snapshot

📈 Key Financial Ratios (FY25)

🧮 Balance Sheet Analysis (FY25)

💸 Consolidated Cash Flow Analysis (FY25)

🌐 Business & Strategic Highlights

Acquisition of 50.1% stake in Ismartu India Pvt Ltd

Divestment of 50% stake in AIL Dixon with gain of ₹25,037 Lakhs (booked as exceptional)

Incorporated 3 new subsidiaries in FY25 to expand verticals

ROCE improved sharply by 1,050 bps YoY

🔍 Near-Term & Strategic Outlook

Dixon is likely to maintain its growth momentum on the back of:

Government's PLI support for EMS sector

Increasing outsourcing from global brands

Expansion in mobiles, IT hardware, and consumer electronics

Strong cash position and improving working capital cycle

📌 Investor Takeaway

📈 Dixon Technologies continues to strengthen its market leadership in EMS, backed by scale, integration, and technology partnerships.

✅ Strong revenue visibility, robust balance sheet, and sector tailwinds make it a key long-term watch for investors despite premium valuation.

⚠️ Disclosure

This blog is intended for educational and informational purposes only. It does not constitute investment advice. Please consult your financial advisor before making any investment decisions.

Comments (0)

Categories

Recent posts

ITC Hotels and its strategic plans ...

30 Dec 2024

Reliance Leads Energy Revolution: 100% ...

22 Jan 2025 for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)

📊 Analysis of Nifty 500 Companies: ...

14 Feb 2025