🧬 Dr. Lal PathLabs Q4 & FY25 Results: Strategic Growth Beyond Metro Markets

📅 Period Covered: Q4 FY25 & FY25

🏢 Company: Dr. Lal PathLabs Ltd.

📈 CMP: ₹2,831 | PE Ratio: ~48.4x (based on normalized FY25 EPS)

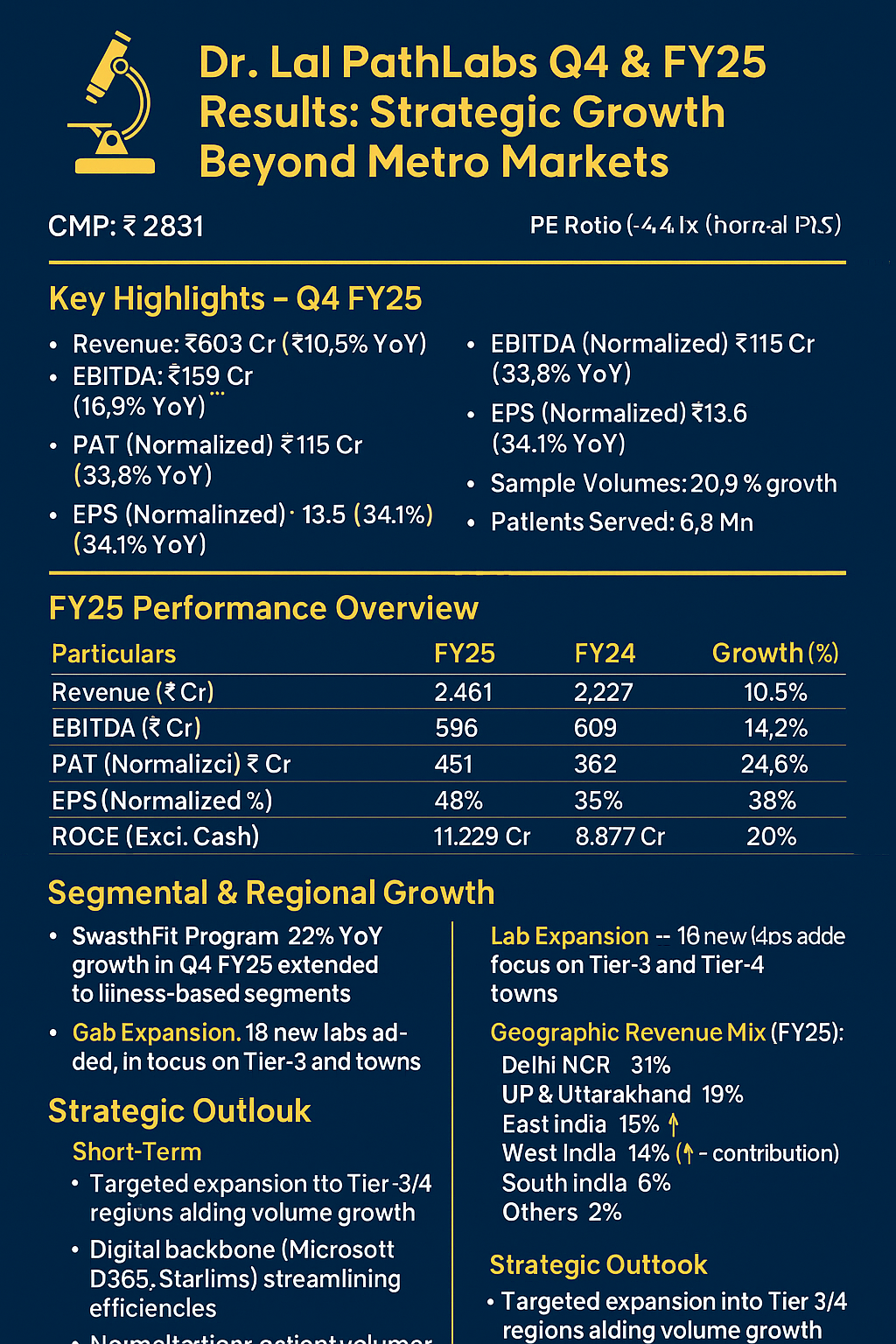

🔍 Key Highlights – Q4 FY25

Revenue: ₹603 Cr (↑10.5% YoY)

EBITDA: ₹169 Cr (↑16.9% YoY), Margin 28.1%

PAT (Reported): ₹156 Cr (↑81.4% YoY, includes one-time tax benefit)

PAT (Normalized): ₹115 Cr (↑33.8% YoY), Margin 25.8%

EPS (Normalized): ₹13.6 (↑34.1% YoY)

SwasthFit Bundled Test Contribution: 26% of revenue

Sample Volumes: 20.9 Mn (↑9.5% YoY)

Patients Served: 6.8 Mn (↑3.8% YoY)

📊 FY25 Performance Overview

🧪 Segmental & Regional Growth

SwasthFit Program: 22% YoY growth in Q4 FY25. Extended to illness-based segments.

Lab Expansion: 18 new labs added in FY25, with focus on Tier-3 and Tier-4 towns.

Geographic Revenue Mix (FY25):

Delhi NCR: 31%

UP & Uttarakhand: 19%

East India: 15%

West India: 14% (↑ contribution)

South India: 6%

Others: 2%

🧾 Balance Sheet Ratios (FY25)

💸 Cash Flow Summary (₹ Cr)

📈 Strategic Outlook

Short-Term:

Targeted expansion into Tier-3/4 regions will aid volume growth.

Digital backbone (Microsoft D365, Starlims) to streamline efficiencies.

Normalization of patient volumes to pre-COVID baselines continuing.

Medium to Long-Term:

Rising chronic & geriatric diseases offer diagnostic demand tailwinds.

Specialized testing (genomics, amyloid typing) to increase wallet share.

Integrated national presence enhances brand recall and access.

📌 Analyst Takeaway

Dr. Lal PathLabs has delivered a robust FY25 performance, outpacing industry averages with double-digit revenue growth and strong margin expansion. With a zero-debt balance sheet, aggressive Tier-3 expansion, and bundled test adoption, the company is structurally positioned for sustainable long-term growth. Continued investment in digital platforms and specialization augments future scalability.

⚠️ Disclaimer:

This report is intended for educational purposes only and does not constitute financial advice or a recommendation to buy/sell any securities.

Comments (0)

Categories

Recent posts

ITC Hotels and its strategic plans ...

30 Dec 2024

Reliance Leads Energy Revolution: 100% ...

22 Jan 2025 for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)

📊 Analysis of Nifty 500 Companies: ...

14 Feb 2025