EMS Limited Q4 & FY25 Financial Analysis

Introduction

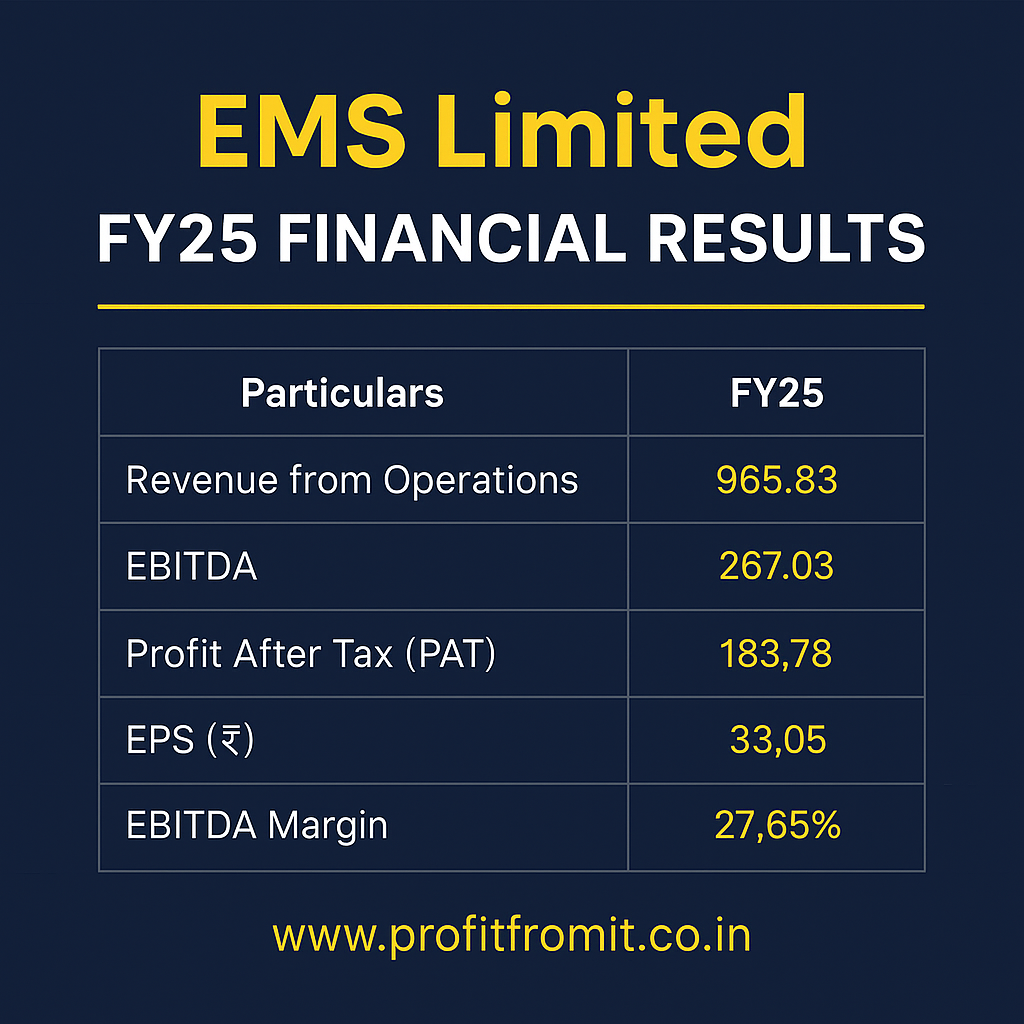

EMS Limited announced its Q4 and FY25 financial results on May 28, 2025. This analysis provides a detailed overview of the company's performance, key highlights, and future outlook.

Recent Insights and Highlights

- The Board of Directors approved the audited Standalone and Consolidated Financial Results of the Company for the quarter and financial year ended March 31, 2025,

- A final dividend of ₹1.50 per equity share (15% on ₹10 par value) has been recommended for FY25, subject to shareholder approval at the AGM.

- M/s. Garg Sanjay Kumar & Associates has been re-appointed as the Internal Auditor for the financial year 2025-26.

- The IPO Committee, formed on March 14, 2023, has been dissolved with effect from May 28, 2025.

Order Book and Growth

- As of March 31, 2025, the total unexecuted consolidated Order Book stands at ₹2236.43 Crore.

- The order book includes 27 active EPC projects, including 12 bundled projects with O&M scope.

Segmental & Regional Share and Growth

- EMS Limited is primarily engaged in the business of providing EPC and Operation & Maintenance ("O&M") services in the water and waste-water segment.

- The company also provides EPC services in electrical transmission and distribution and building and public infrastructure facilities.

- In FY24, the water and wastewater treatment segment contributed 70%, and sewerage and drinking water piping contributed 30% to the market.

- In FY24, 80% of the market was municipal, and 20% was industrial.

- In FY24, 82% of the market was Capex, and 18% was O&M.

Analysis of Consolidated Income Statement

Profit Margins Expansion

- Gross Profit Margin (FY25): 34.98%

- Gross Profit Margin (FY24): 33.77%

- Net Profit Margin (FY25): 19.38%

- Net Profit Margin (FY24): 20.85%

- Observations: There is a slight expansion in the gross profit margin, but a small contraction in the net profit margin.

Ratios

- P/E Ratio: 20.11 (at CMP of ₹660)

Analysis of Balance Sheet

Key Ratios:

- Debt to Equity Ratio (FY25): 0.08

- Debt to Equity Ratio (FY24): 0.09

- Current Ratio (FY25): 5.75

- Current Ratio (FY24): 5.21

- Price to Book Value (P/BV): 3.75

EMS Limited Q4 & FY25 Financial Analysis

Introduction

EMS Limited announced its Q4 and FY25 financial results on May 28, 2025. This analysis provides a detailed overview of the company's performance, key highlights, and future outlook.

Recent Insights and Highlights

- The Board of Directors approved the audited Standalone and Consolidated Financial Results of the Company for the quarter and financial year ended March 31, 2025,

on May 28, 2025. - A final dividend of ₹1.50 per equity share (15% on ₹10 par value) has been recommended for FY25, subject to shareholder approval at the AGM.

- M/s. Garg Sanjay Kumar & Associates has been re-appointed as the Internal Auditor for the financial year 2025-26.

- The IPO Committee, formed on March 14, 2023, has been dissolved with effect from May 28, 2025.

Order Book and Growth

- As of March 31, 2025, the total unexecuted consolidated Order Book stands at ₹2236.43 Crore.

- The order book includes 27 active EPC projects, including 12 bundled projects with O&M scope.

Segmental & Regional Share and Growth

- EMS Limited is primarily engaged in the business of providing EPC and Operation & Maintenance ("O&M") services in the water and waste-water segment.

- The company also provides EPC services in electrical transmission and distribution and building and public infrastructure facilities.

- In FY24, the water and wastewater treatment segment contributed 70%, and sewerage and drinking water piping contributed 30% to the market.

- In FY24, 80% of the market was municipal, and 20% was industrial.

- In FY24, 82% of the market was Capex, and 18% was O&M.

Analysis of Consolidated Income Statement

Profit Margins Expansion

- Gross Profit Margin (FY25): 34.98%

- Gross Profit Margin (FY24): 33.77%

- Net Profit Margin (FY25): 19.38%

- Net Profit Margin (FY24): 20.85%

- Observations: There is a slight expansion in the gross profit margin, but a small contraction in the net profit margin.

Ratios

- P/E Ratio: 20.11 (at CMP of ₹660)

Analysis of Balance Sheet

Key Ratios:

- Debt to Equity Ratio (FY25): 0.08

- Debt to Equity Ratio (FY24): 0.09

- Current Ratio (FY25): 5.75

- Current Ratio (FY24): 5.21

- Price to Book Value (P/BV): 3.75

Analysis of Consolidated Cash Flow Statement

Near Term & Short Term Outlook

- The Indian water and wastewater market has significant growth potential, driven by increasing demand and government initiatives.

- Government initiatives such as the Namami Gange Programme, Atal Mission for Rejuvenation and Urban Transformation (AMRUT), and Jal Jeevan Mission are expected to drive growth in the sector.

- EMS Limited is well-positioned to benefit from this growth with its experience, full-stack capabilities, and established track record.

Disclosure

All figures are in ₹ Crore unless otherwise stated.

This analysis is based on the information provided in the EMS Limited financial results for the year ended March 31, 2025, and the investor presentation dated May 28, 2025.

Disclaimer:

This is an analysis for informational and educational purposes only and should not be considered investment advice.

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)