Empowering India's Economy: Ministry of Statistics and Programme Implementation offers valuable insights into the Annual Survey of Unincorporated Sector Enterprises (ASUSE) for 2023-24:

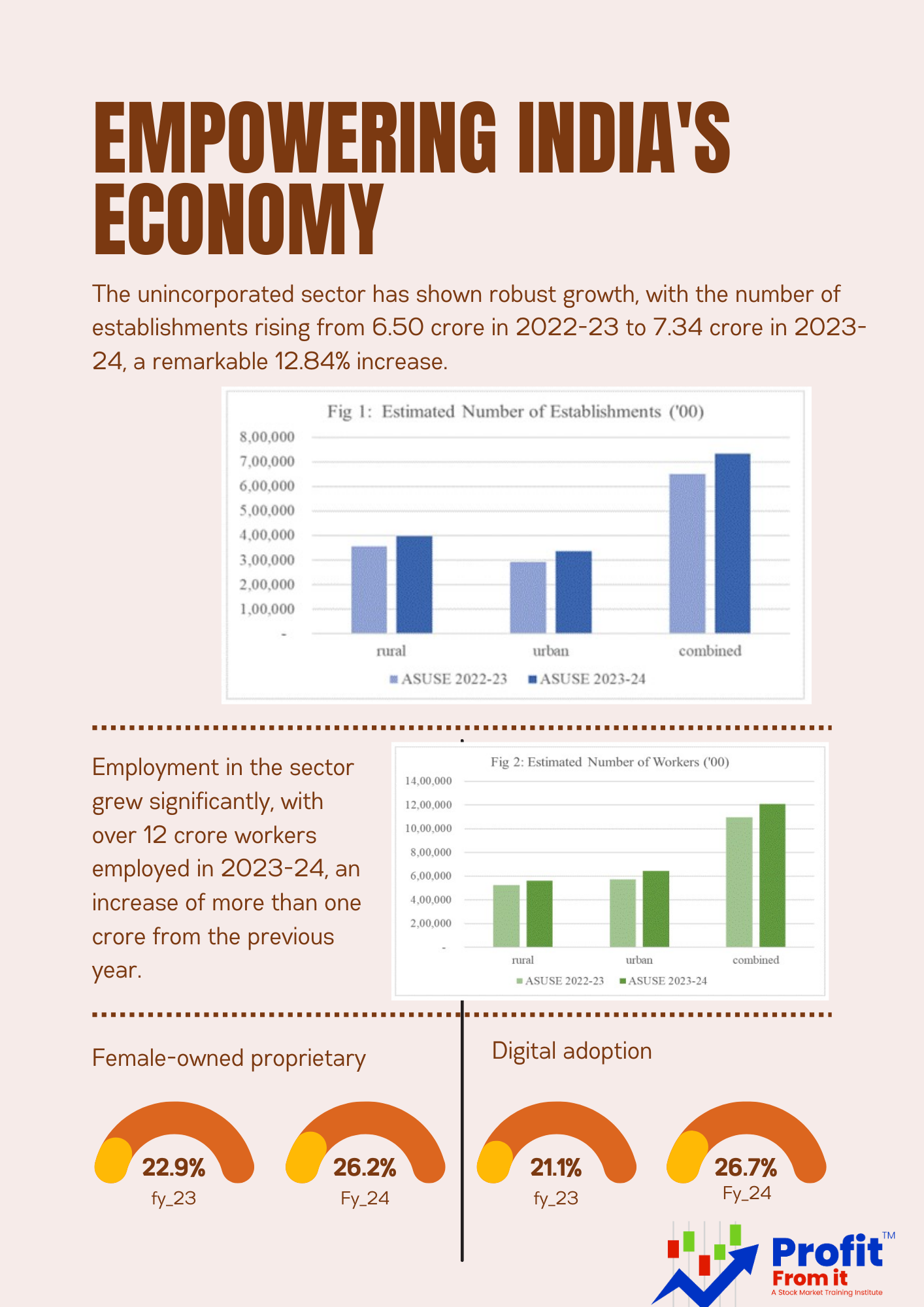

Sectoral Growth: The unincorporated sector showed a robust growth of 12.84% in the number of establishments, particularly strong in the "Other Services" and manufacturing sectors. This indicates a thriving economic environment in these sectors, suggesting potential investment opportunities in companies supplying or operating within these domains.

Gross Value Added (GVA): A significant rise in GVA by 16.52%, driven by a 26.17% growth in the "other services" sector, highlights the increasing economic productivity and profitability of these sectors. For investors, this suggests sectors where companies might be generating higher revenue and profits.

Employment Growth: With employment increasing by over one crore workers, particularly in "Other Services" and manufacturing, there is clear evidence of economic expansion which can lead to higher consumer spending and a buoyant market for consumer-related stocks.

Wage Levels and Labour Productivity: Increased average emoluments by 13% reflect strengthening economic demand, which can lead to higher consumer spending. Improvements in labour productivity (GVA per worker) indicate efficient operations, which could translate into better profit margins for businesses in these sectors.

Digital Adoption: The growth in internet usage from 21.1% to 26.7% among establishments indicates a shift towards digital operations, which could be a positive sign for tech and digital services companies. Investors might look at companies facilitating or benefiting from this digital transition.

Gender Inclusivity: The increase in female-owned proprietary establishments suggests a diversification in entrepreneurship, which could open up new consumer demographics and market opportunities, potentially benefiting sectors that cater to a more diverse audience.

These insights offer a clearer picture of where the growth and potential lie within the Indian economy, particularly in the unincorporated sectors. It can guide investment strategies, highlighting promising sectors and revealing economic trends that might influence market dynamics. This data should be coupled with individual company analysis and broader economic indicators for a comprehensive investment approach.

Terminology: 1 “Other Services”

The term "Other Services" in economic reports typically refers to a category that encompasses a variety of service-oriented activities not specifically classified under other major sectors like manufacturing, agriculture, or construction. This can include a wide range of services such as:

Education services

Health care services

Financial services

Real estate services

Professional services (like legal, consulting, engineering)

Hospitality and entertainment services

Personal services (such as beauty, maintenance)

Information technology services

These services generally contribute to the tertiary sector of the economy, which deals with the provision of services rather than the production of goods. The growth in this sector, as indicated by the document, suggests that there is substantial economic activity and potential investment opportunities in these varied service industries, which are crucial for the overall economic health and consumer market expansion.

Terminology: 2 “Unincorporated Sector Enterprises”

Unincorporated Sector Enterprises refer to those businesses that have not been registered as separate legal entities distinct from their owners. This means the business and the owner are legally the same, and they do not possess a separate corporate or legal identity. These enterprises are typically owned and operated by individuals or family members, and they can include:

Sole proprietorships: Single-owner businesses where the individual is responsible for all assets and liabilities.

Partnerships: Businesses owned by two or more people who share profits and responsibilities but haven't formed a corporation.

In many cases, these enterprises are small in scale and might not be subject to the same regulatory and tax frameworks as incorporated businesses (like private limited companies or public limited companies). They are common in sectors where personal skills and individual effort are the primary business drivers, such as small-scale retail, handicrafts, personal services, and other service-oriented sectors.

The characteristics of these enterprises usually include:

Simple management and organizational structures.

Limited access to capital markets.

Personal liability for business debts and obligations.

Fewer formalities in terms of accounting and legal compliance compared to incorporated businesses.

Understanding the dynamics of the unincorporated sector can be crucial for policy-making, economic planning, and for investors considering the broader economic environment and opportunities in emerging markets like India.

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)