🚗 April 2025 Auto Retail Data Report – Sector-Wise Performance & Investment Insights

📅 Published on: 20th May 2025

✍️ By Profit From IT – Research & Investment Desk

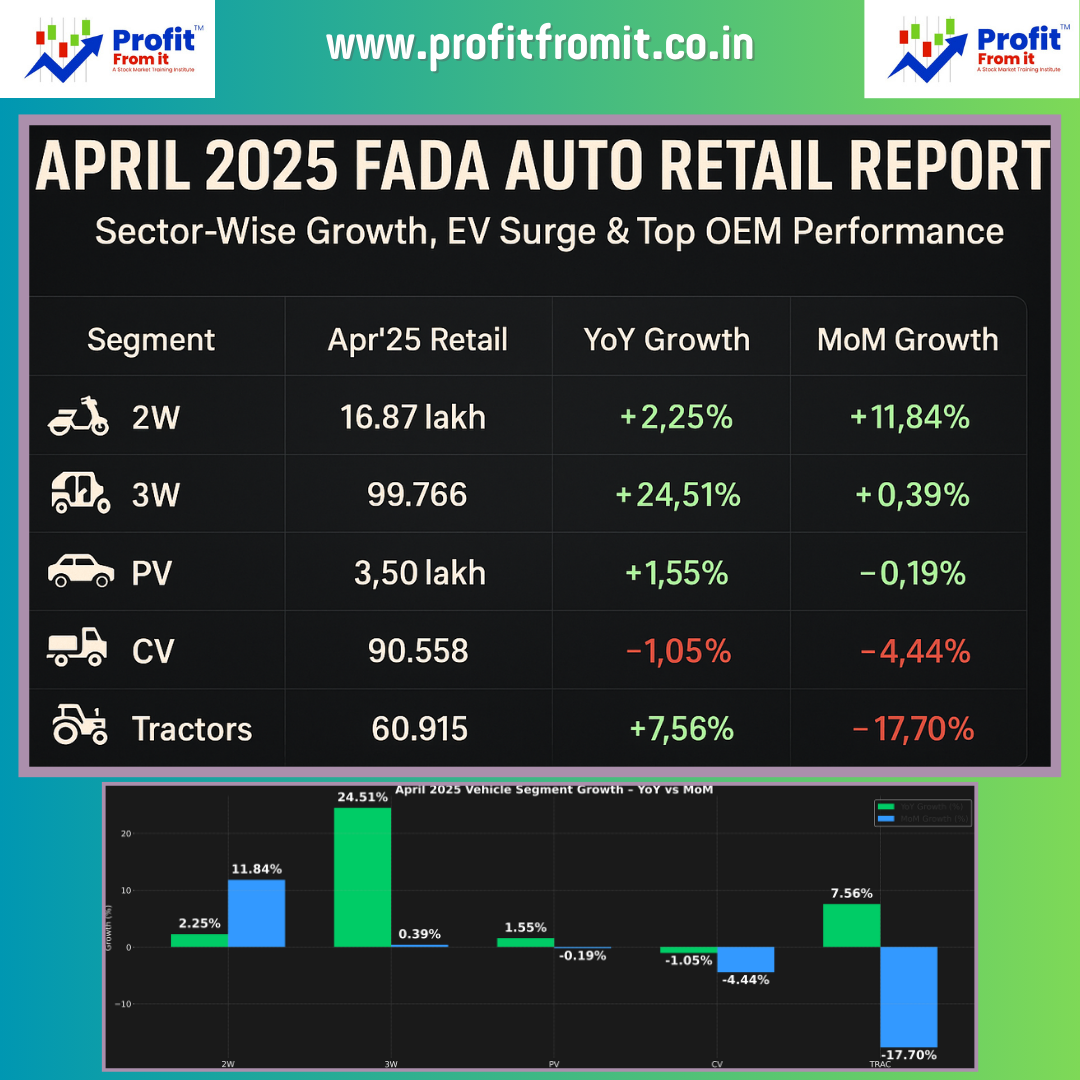

🔍 Sector-Wise Retail Performance (YoY Growth)

| Segment | Apr'25 Retail | YoY Growth | MoM Growth |

|---|---|---|---|

| 🛵 Two-Wheelers (2W) | 16.87 lakh | 🟢 2.25% | 🟢 11.84% |

| 🚖 Three-Wheelers (3W) | 99,766 | 🟢 24.51% | 🟢 0.39% |

| 🚗 Passenger Vehicles (PV) | 3.50 lakh | 🟢 1.55% | 🔴 –0.19% |

| 🚛 Commercial Vehicles (CV) | 90,558 | 🔴 –1.05% | 🔴 –4.44% |

| 🚜 Tractors (TRAC) | 60,915 | 🟢 7.56% | 🔴 –17.70% |

🔋 Fuel Mix Evolution – Investment Trend for EVs

EV Share Growth:

2W EVs: 5.44% (up from 3.97% YoY) 🔼

3W EVs: 62.68% (up from 52.49% YoY) 🚀

PV EVs: 3.5% (up from 2.26% YoY) 🔼

➡️ Investor Insight: Companies focused on 3W and 2W EV segments such as Ola Electric, Ather Energy, and TVS are poised for future scalability.

🌾 Sector Outlook & Economic Cues

🌦️ Above-normal monsoon forecast expected to boost rural demand.

💰 RBI's liquidity support to ease auto loan rates.

🧾 Inventory pressure in PV segment (50 days) might lead to deeper discounts, impacting margins.

🏆 OEM Performance: Best Performing Companies (YoY Growth & Market Share Gains)

🛵 Two-Wheelers

| Company | Apr'25 Units | YoY Change |

|---|---|---|

| TVS Motor | 3.09 lakh | 🟢 +10.0% |

| Suzuki | 91.7k | 🟢 +17.0% |

| Ather Energy | 13.2k | 🚀 +218% |

🚖 Three-Wheelers

| Company | Apr'25 Units | YoY Change |

|---|---|---|

| Mahindra (Combined) | 12.5k | 🟢 +64% |

| TVS Motor | 3.15k | 🟢 +98% |

🚗 Passenger Vehicles

| Company | Apr'25 Units | YoY Change |

|---|---|---|

| Mahindra | 48.4k | 🟢 +25% |

| Toyota | 23.3k | 🟢 +15.7% |

| Kia | 21.6k | 🟢 +9.1% |

| Skoda VW Group | 9.46k | 🚀 +39.5% |

🚜 Tractors

| Company | Apr'25 Units | YoY Change |

|---|---|---|

| TAFE | 6.83k | 🟢 +21.5% |

| Escorts Kubota | 6.36k | 🟢 +8.2% |

🚛 Commercial Vehicles

| Company | Apr'25 Units | YoY Change |

|---|---|---|

| Force Motors | 3.31k | 🚀 +78% |

| VE Commercial | 7.57k | 🟢 +9.1% |

📊 Retail Sentiment Survey – Key Metrics

🪙 Liquidity Sentiment:

Neutral: 52.3%

Good: 23.8%

💭 Market Sentiment:

Neutral: 55.1%

Positive: 23.8%

📅 May 2025 Outlook:

Growth Expected: 37.5%

Flat: 48.4%

De-growth: 14.1%

💡 Investment Watchlist – Key Takeaways

✅ Top Gainers (YoY Growth):

Ather Energy ⚡ (EV)

Mahindra & Mahindra (PV + Trac + 3W) 🔼

Skoda VW Group (PV) 🚗

Force Motors (CV) 🚛

⚠️ Caution in:

Entry-level PVs – weak retail trends

CVs – ongoing price pressures, freight stagnation

Urban 2W – financing bottlenecks

📌 Conclusion: Sector Positioning for Investors

🔋 EV Transition is most visible in the 3W segment—favorable for EV component suppliers and manufacturers like BAJAJ AUTO, Olectra, Greaves, and Mahindra Electric.

🌾 Tractor sector remains strong—watch Mahindra Tractors, Escorts Kubota, and TAFE for rural play.

🧾 Inventory glut in PV signals cautious approach; but SUV-focused players like Mahindra and Toyota still show resilience.

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)