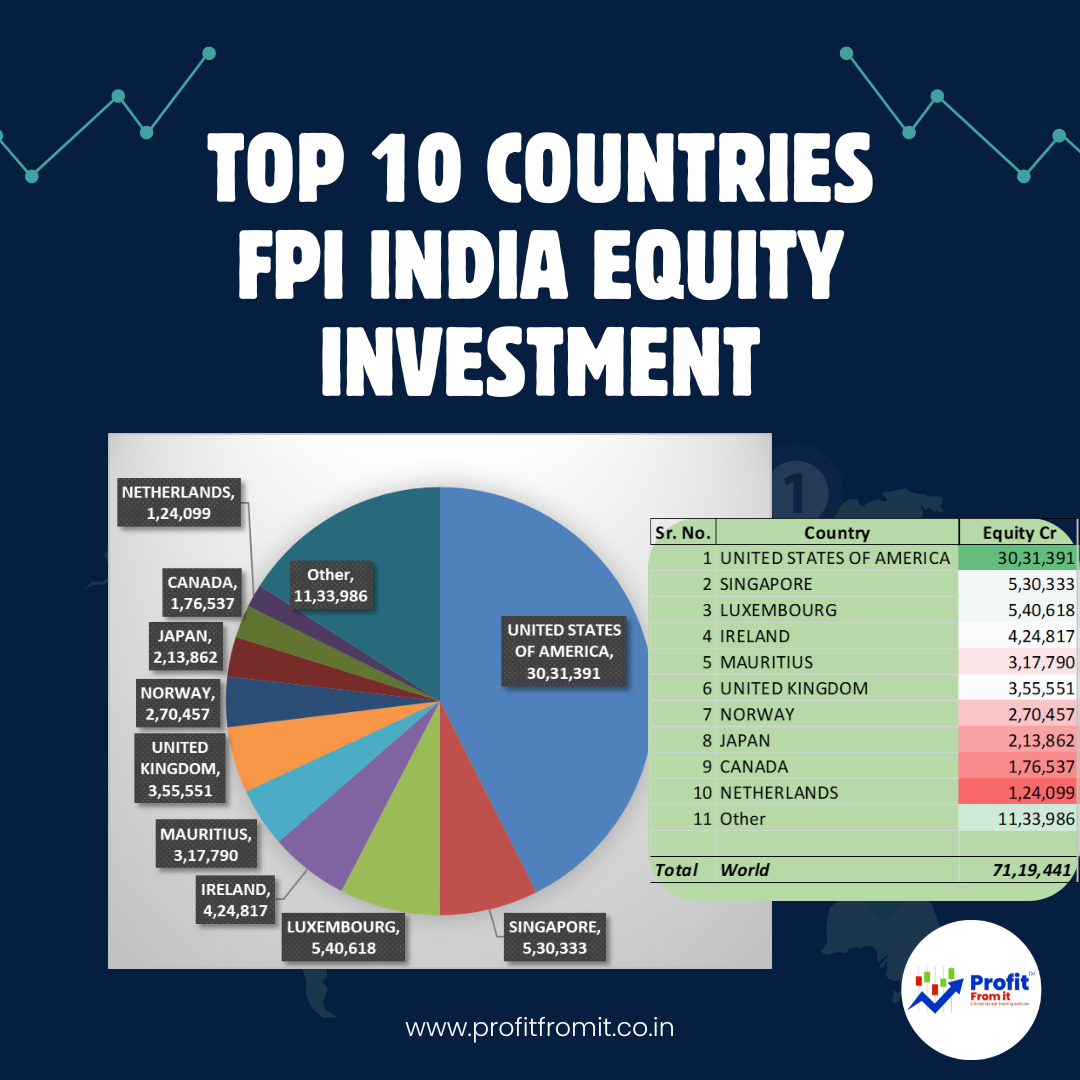

Foreign Portfolio Investment (FPI) in Indian equity by the top 10 countries, here are some key insights:

After Promoters, FPI are today the largest Investors in Indian equity. Indian AMC’s which were far few years back have today decreased the large gap but still they will have to rise near to 2X to close the gap.

🇺🇸 Dominance of the USA: The United States of America leads significantly in terms of investment with 30,31,391 Crore INR, which is more than 42% of the total equity investment from the listed countries. This indicates a strong confidence and interest from American investors in the Indian market.

🌏 High Investment from Developed Nations: Following the USA, countries like Singapore 🇸🇬 and Luxembourg 🇱🇺 also show substantial investment figures, highlighting the appeal of Indian equity markets to investors from economically advanced and financially stable countries.

🌍 Diverse Geographic Investment: The list of countries includes a mix of European, Asian, and North American nations, suggesting that Indian equity is attractive across diverse geographic locations and economic profiles.

📊 Smaller but Significant Contributions: Countries like Norway 🇳🇴, Japan 🇯🇵, and the Netherlands 🇳🇱, though contributing smaller amounts compared to the top three, still show significant investment, emphasizing a broader confidence in the Indian economic environment.

🔍 Minor Contributions from Other Countries: The 'Other' category, totaling 11,33,986 Crore INR, suggests that there are numerous other countries contributing to FPI in India, indicating widespread global interest.

🚀 Emerging Markets Attraction: Mauritius 🇲🇺 and Ireland 🇮🇪, though smaller in economic size compared to others like the USA and UK, make substantial investments. This could be due to their strategic financial policies & tax benefits that align well with investing in emerging markets like India.

💹 Total FPI Influence: The total investment from these countries amounts to 71,19,441 Crore INR, signifying the substantial role of FPI in the Indian stock market and its influence on the Indian economy.

The heavy investments by these countries underscore the attractiveness and potential growth prospects of the Indian equity market. This data can help understand market trends, investor confidence, and potential sectors or companies that might be garnering international interest.

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)