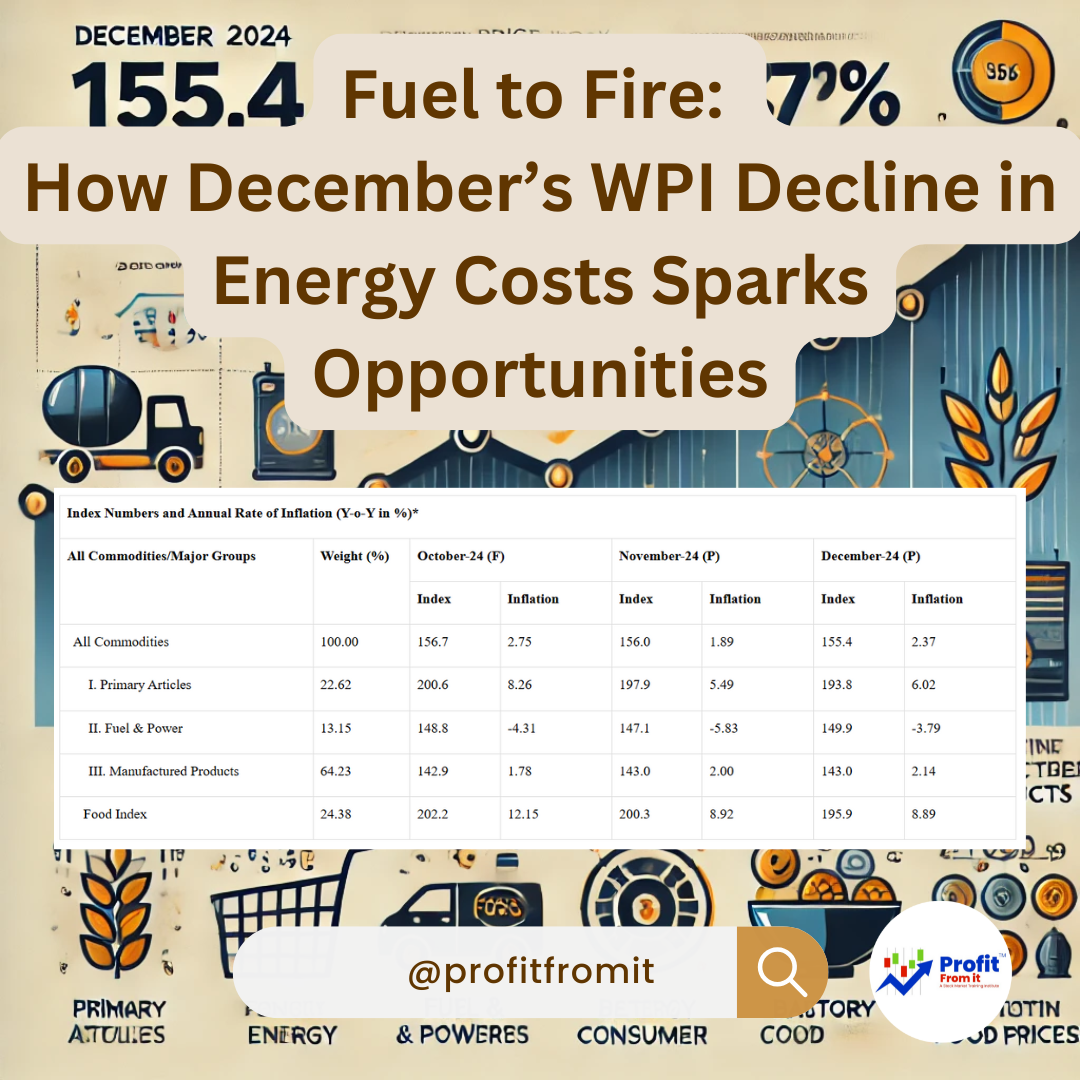

Fuel to Fire: How December’s WPI Decline in Energy Costs Sparks Opportunities

The recent data from the Wholesale Price Index (WPI) for December 2024 reveals several important trends and fluctuations that can impact the stock market and investment strategies:

General WPI Trends 📈:

The overall WPI increased to 155.4, with a year-over-year inflation rate of 2.37%. This indicates a moderate rise in wholesale prices, potentially leading to upward pressure on consumer prices.

Sector-Specific Insights:

Primary Articles 🌾: Saw a significant increase with an inflation rate of 6.02%, mainly due to food articles. This segment impacts consumer expenses and can increase costs for companies in the food industry.

Fuel & Power ⛽: Experienced a decrease in prices with a -3.79% inflation rate, which might benefit sectors that are heavy consumers of energy by potentially lowering operational costs and enhancing profit margins.

Manufactured Products 🏭: Showed a slight increase in prices with an inflation rate of 2.14%. This indicates a gradual pass-through of raw material costs to consumers.

Implications for the Stock Market:

Consumer Goods 🛒: Companies in this sector might face higher production costs due to increased prices in primary articles and manufactured products. This could lead to higher retail prices, impacting consumer spending patterns.

Energy Sector 🔋: The decrease in fuel and power costs could be advantageous for companies in industries such as manufacturing and transportation, potentially boosting their stock performance due to lowered expenses.

Food Industry 🍲: The significant rise in prices for food articles, particularly vegetables and cereals, could impact companies in the food industry by affecting their cost structures and pricing strategies.

Strategic Investment Recommendations 📊:

Investors might consider sectors that benefit from lower energy costs or those that have strong pricing power to pass on increased costs to consumers.

Monitoring companies in the consumer staples sector is crucial as they might be impacted by fluctuating prices of primary articles.

Given the moderate overall inflation, it's important to watch for signs of increasing inflationary pressures that could prompt monetary policy adjustments.

Overall, the WPI report provides valuable insights into sector-specific trends and general economic indicators that can influence investment decisions and stock market dynamics.

Comments (0)

Categories

Recent posts

ITC Hotels and its strategic plans ...

30 Dec 2024

Reliance Leads Energy Revolution: 100% ...

22 Jan 2025 for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)

📊 Analysis of Nifty 500 Companies: ...

14 Feb 2025