🏢 Godrej Properties Q4 & FY25 Result Analysis: Booking Boom & Financial Resilience

📈 Key Highlights & Strategic Insights

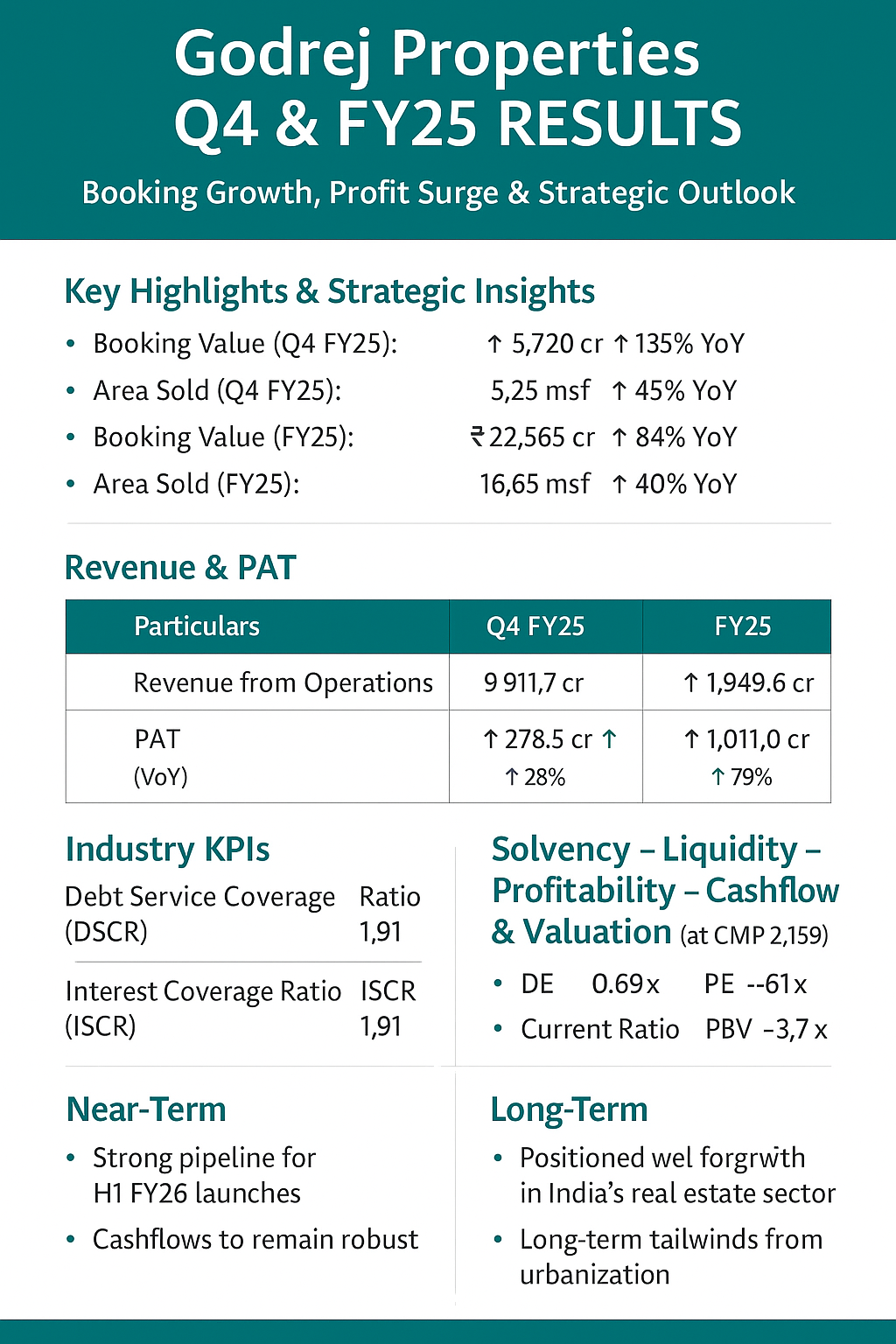

Area Sold (Q4 FY25): 5.25 million sq. ft. ⬆️ 45% YoY

Booking Value (Q4 FY25): ₹5,720 Cr ⬆️ 135% YoY

Area Sold (FY25): 16.65 million sq. ft. ⬆️ 40% YoY

Booking Value (FY25): ₹22,565 Cr ⬆️ 84% YoY

Collections (FY25): ₹13,008 Cr ⬆️ 25% YoY

💰 Revenue & Profit Performance

📊 Segment & Balance Sheet Overview

Net Worth: ₹17,444 Cr vs ₹10,512 Cr YoY

Debt-to-Equity (Gross): 0.69x; Net: 0.25x (significant deleveraging)

Total Assets: ₹43,944 Cr (↑ 57% YoY)

Inventory: ₹15,313 Cr (↑ 66% YoY)

Cash & Equivalents: ₹821 Cr

Book Value Per Share: ₹580+

💡 Industry KPIs & Capital Efficiency

Debt Service Coverage Ratio (DSCR): 1.91

Interest Coverage Ratio (ISCR): 1.91

Current Ratio: 1.73

Operating Margin: 10.24% (improved from -94.98% in Q3)

🔍 Valuation Metrics (CMP ₹2,159)

🔮 Outlook: Near-Term & Long-Term

Near-Term:

Strong pipeline for launches in H1 FY26.

Focus on premium residential and redevelopment projects.

Likely sustenance of cash flow strength via high bookings and collections.

Long-Term:

Positioned as a top player in India’s organized real estate sector.

Focus on asset-light model via joint ventures and land partnerships.

Real estate formalization trend and urbanization to act as long-term tailwinds.

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)