📘 HDB Financial Services Limited IPO – Complete Investor Guide

hdb financial services ipo gmp

The issue is priced at ₹700 to ₹740 per share. The minimum order quantity is 20. The IPO opens on June 25, 2025, and closes on June 27, 2025.

IPO Price Band: ₹700 – ₹740

Issue Opens: 25 June 2025

Issue Closes: 27 June 2025

Face Value: ₹10 per equity share

Lot Size: 20 shares

Listing on: BSE & NSE

Market Cap (at upper band): ₹60,000 crore approx.

hdb financial services ipo gmp

🏢 Company Overview

Incorporated: 2007

Promoter: HDFC Bank Ltd

Category: Systemically Important NBFC – Upper Layer (NBFC-UL)

Registered Office: Ahmedabad | Corporate Office: Mumbai

🚀 Business Segments:

Enterprise Lending

Asset Finance

Consumer Finance

Business Process Outsourcing (BPO)

🔑 Key Strengths:

Omnichannel distribution network

Pan-India branch presence

Retail-focused diversified loan book

Strong parentage of HDFC Bank

Penetration in underserved semi-urban/rural India

🗓 IPO Details

🔒 Reservation

₹200 crore for Eligible Employees

₹12,500 crore for HDFC Bank Shareholders

🎯 Purpose of the Offer

💸 Fresh Issue – ₹2,500 crore

80%: Capital augmentation for loan book expansion

20%: General corporate purposes

🏦 Offer for Sale – ₹10,000 crore

HDFC Bank to partially monetize holding and meet regulatory compliance

👥 Shareholding Pattern (SHP)

📝 Post-IPO structure to reflect sizeable institutional and retail participation.

📊 Financial Summary (₹ in Million)

💰 Valuation Snapshot (at ₹740)

🌐 Industry Overview

Sector Size: Over ₹30 lakh crore

Retail NBFC CAGR (Next 5 Yrs): ~12–15%

Drivers:

Digital transformation

Financial inclusion in Tier 2–3 markets

Rising consumer & MSME credit demand

Tailwinds:

RBI’s regulatory clarity

Government credit push

Challenges:

Rising NPAs

Funding cost pressures

🧩 Peer Group Comparison (FY25)

🟢 Bajaj Finance stands out in profitability, margins, and return ratios, while HDB offers a diversified retail portfolio with HDFC support.

🔍 Basis of the Offer & Strengths

✅ Strong parentage from HDFC Bank

✅ Wide distribution across India

✅ Retail-focused secured lending

✅ Tech-driven underwriting & hybrid model

✅ High customer base and cross-sell potential

✅ Consistent growth in income & net worth

🎁 Shareholder Benefits

Reservation for HDFC Bank shareholders & employees

Strong promoter group track record (HDFC AMC, Life, Bank)

Potential long-term value creation through synergy

No retail discount offered, but likely strong investor interest

⚠️ Risks & Red Flags

🔴 Moderate RoE vs peers

🔴 High leverage (D/E near 6x)

🔴 Sensitive to interest rate cycles and credit costs

🔴 Dependent on wholesale funding markets

🔴 Industry-level risk of asset quality deterioration

🧭 Conclusion & Investor Action

The HDB Financial IPO offers investors access to a high-quality, retail-centric NBFC backed by HDFC Bank. While it’s priced slightly above industry average, its strong distribution network, diversified loan mix, and long-term demand outlook provide confidence.

However, for long-term investors, Bajaj Finance remains the benchmark in terms of profitability and growth consistency.

✅ Short-Term View: Likely listing gains due to brand and HDFC tag

📈 Long-Term View: Good potential with stable loan growth; 2–3 years holding recommended

🧠 Alternative Consideration: Bajaj Finance may offer better long-term compounding, albeit at higher valuations

hdb financial services ipo gmp

The issue is priced at ₹700 to ₹740 per share. The minimum order quantity is 20. The IPO opens on June 25, 2025, and closes on June 27, 2025.

✅ Disclaimer: This blog is for educational purposes only. Please read the full RHP before applying and evaluate based on your own financial understanding.

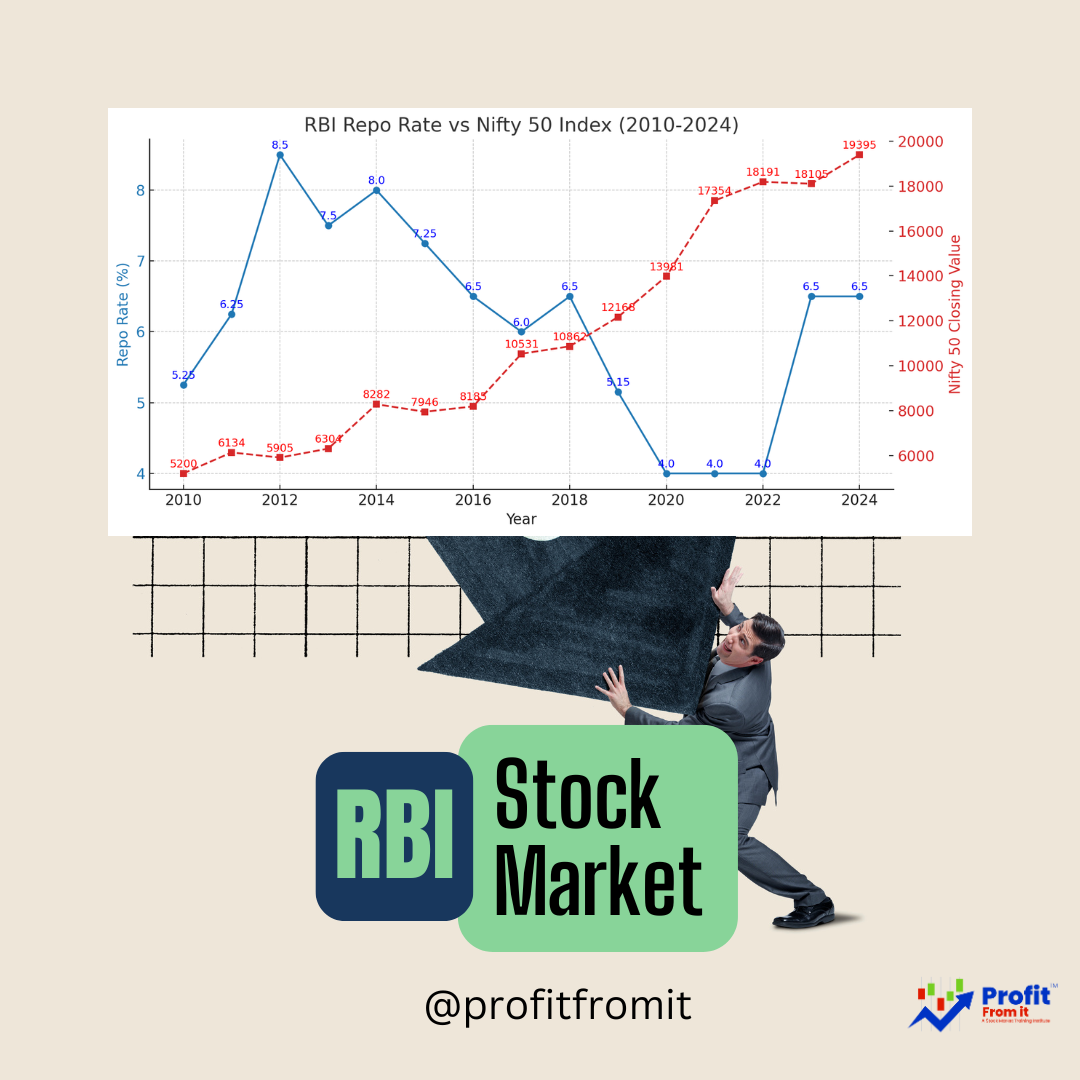

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)