🔍 HDFC AMC Q4FY25 & FY25 Results: Strong Performance, Robust Growth & Healthy Margins

Date: April 19, 2025

Author: Profit From IT

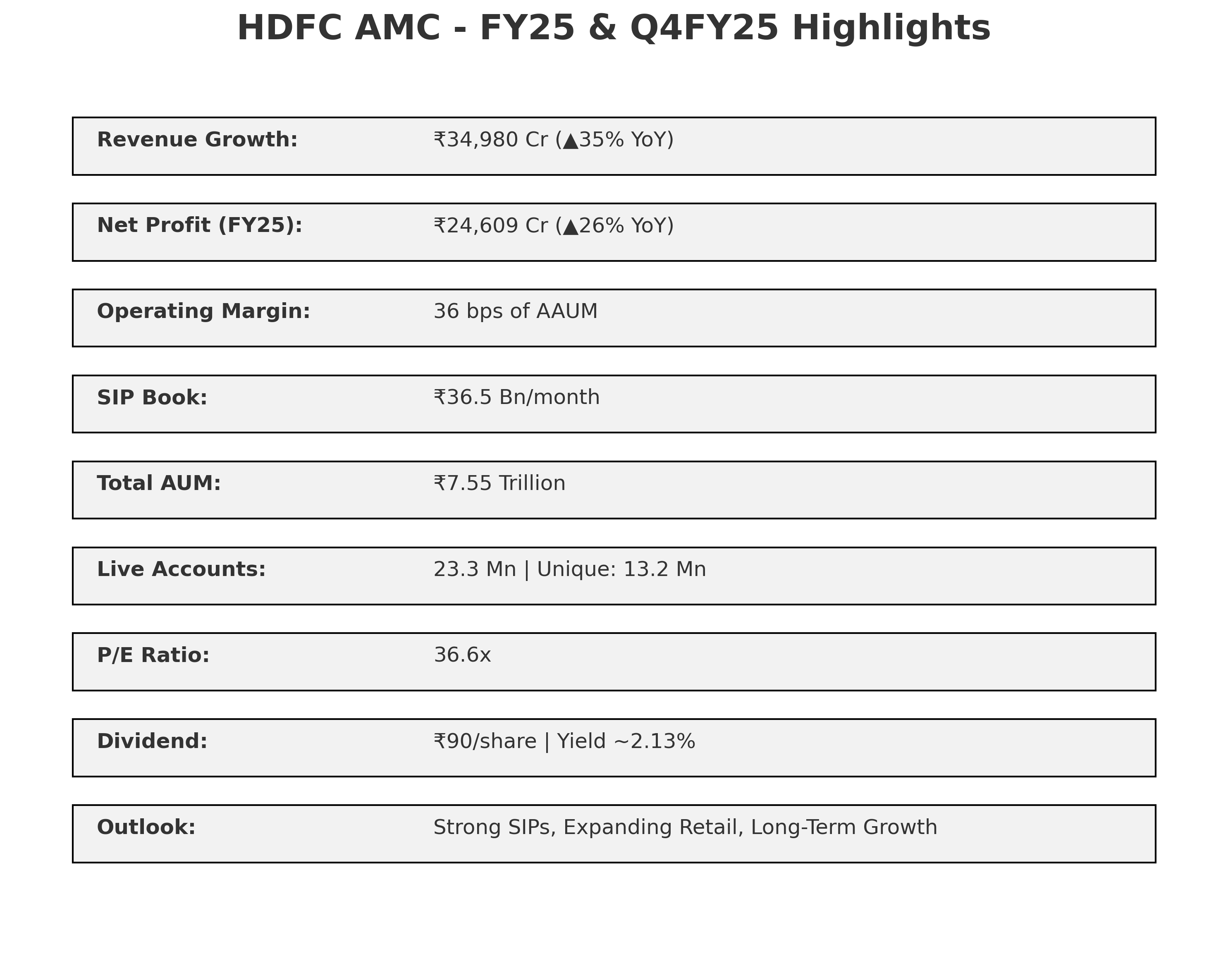

📢 Key Highlights at a Glance

FY25 Net Profit up 26% YoY to ₹24,609 million

Revenue from operations rose 35% YoY to ₹34,980 million

Final Dividend of ₹90/share declared

Assets Under Management (AUM) hit ₹7.55 trillion

Systematic Investment Plans (SIPs) saw robust monthly flows of ₹36.5 billion

Total Live Accounts crossed 23.3 million

📊 Q4FY25 Results – Strong Quarter

📅 Full Year FY25 Performance

Margins:

Operating Margin: 36 bps of AAUM (improved from 35 bps)

PAT Margin: ~60.7% of Total Income

💼 AUM & SIP Growth – FY25

📊 Valuation Metrics @ CMP ₹4,216

📈 Valuation Overview (FY25)

🔮 Outlook – What's Ahead?

Near-Term (6–12 months):

Continued traction in SIPs and strong retail participation likely to drive consistent inflows.

Equity markets remain volatile, but HDFC AMC’s positioning in actively managed funds offers alpha generation potential.

Operational leverage and cost controls support margin resilience.

Long-Term (3–5 years):

Massive tailwinds from financialization of savings.

Expanding reach in B30 cities (now 19.1% of AUM).

Focus on digital distribution, ESG, and customer engagement will be key growth levers.

High Return Ratios and robust balance sheet provide a strong compounding story.

📝 Conclusion

HDFC AMC has posted strong growth across revenue, profits, AUM and investor base, backed by operational efficiency and brand leadership. The company remains a top choice for long-term wealth creation in India's booming asset management space.

CMP: ₹4,216 | Rating: Long-Term Positive

📢 Disclosure

This article is intended for informational and educational purposes only. It is not investment advice. Readers are advised to do their own research before making any investment decisions.

Comments (0)

Categories

Recent posts

ITC Hotels and its strategic plans ...

30 Dec 2024

Reliance Leads Energy Revolution: 100% ...

22 Jan 2025 for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)

📊 Analysis of Nifty 500 Companies: ...

14 Feb 2025