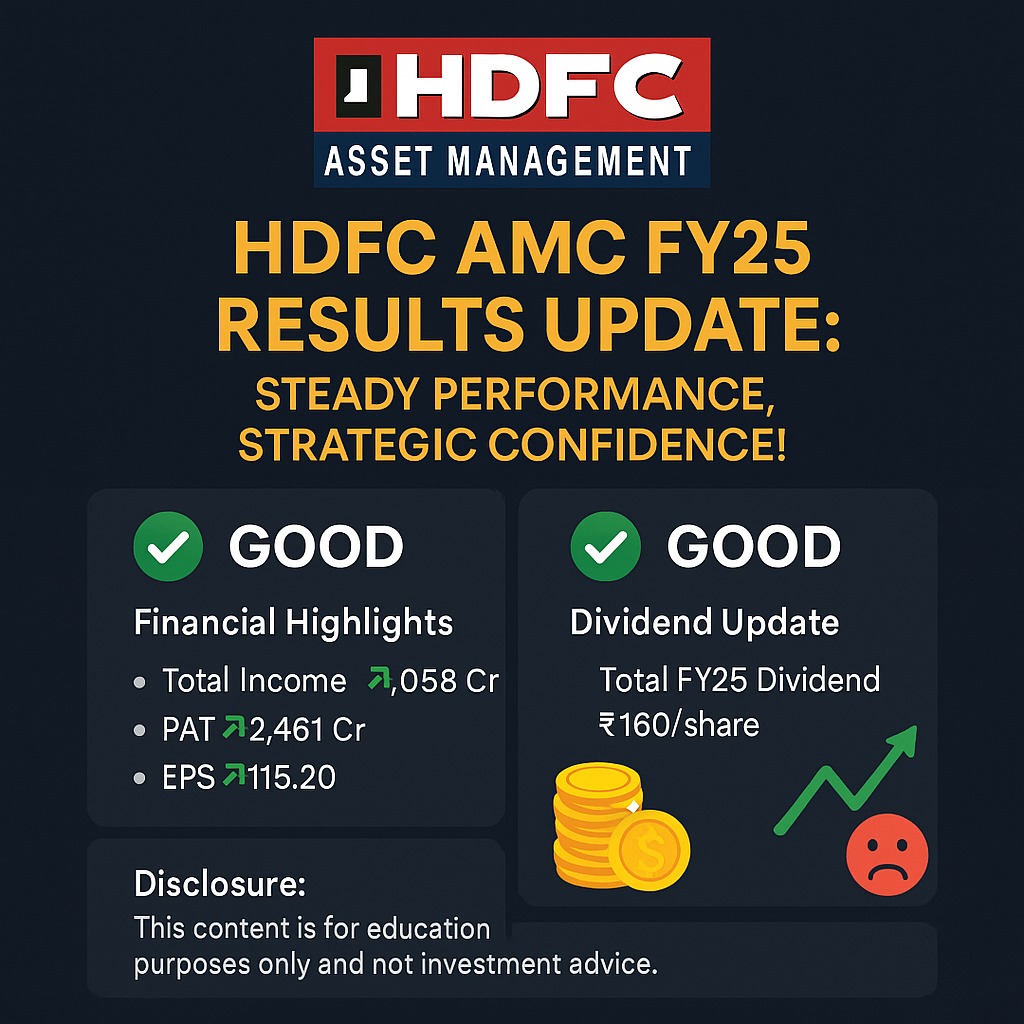

📈 HDFC AMC FY25 Results Update: Steady Performance, Strategic Confidence!

🗓 Released on: April 17, 2025

🏢 Company: HDFC Asset Management Company Limited (HDFCAMC)

🔍 Summary Verdict for Investors:

✅ Good – The company has posted strong earnings growth, maintained healthy margins, declared attractive dividends, and continues to be a trusted long-term wealth builder.

📊 Financial Highlights:

🔹 Total Income for FY25 stood at ₹4,058 crore, up 28.3% YoY from ₹3,162 crore.

🔹 Profit After Tax (PAT) rose to ₹2,461 crore, a growth of 26.4% over last year.

🔹 Basic EPS surged to ₹115.20 in FY25 from ₹91.15 in FY24, showing strong shareholder value creation.

🔹 EBITDA margins remain robust at over 81%, signifying operating efficiency.

💰 Dividend Highlights:

💵 Interim Dividend paid: ₹70 per share

🏆 Final Dividend proposed: ₹90 per share

📊 Total Dividend for FY25: ₹160 per share

🎯 At the current market price of ₹3,750, the dividend yield stands at ~4.3%

🔧 Key Strategic Developments:

📌 Adoption of the new ESOP & PSU Scheme 2025 to retain and incentivize talent.

📉 Cancellation of 8.73 lakh options under the previous ESOS 2020 scheme for better efficiency.

🧾 Statutory auditors have provided an unmodified audit opinion, enhancing investor trust.

📈 Performance Drivers & Outlook:

🟢 Continued growth in Assets Under Management (AUM) –

HDFC AMC’s AUM grew from ₹4.98 lakh crore in FY24 to approximately ₹6.14 lakh crore in FY25, reflecting a strong YoY increase of +23.3%. This is driven by growing SIP inflows, investor confidence in equity funds, and expansion in passive & debt fund categories.

🟢 Operational expenses have grown moderately despite significant income growth.

🟢 Cash from operations stood at ₹2,076 crore for the year.

🟢 Zero debt and consistent high ROE (~30%) make it a fundamentally strong bet.

🟢 Digital reach, innovative product suites, and rising mutual fund penetration support long-term scalability.

⚠️ Key Risks to Monitor:

🔻 Deferred tax liability rose due to LTCG indexation withdrawal (impact: ₹69.75 crore).

🔻 Revenue remains dependent on capital market performance and AUM inflows.

🔻 Regulatory and tax policy shifts may affect profitability metrics.

🔬 Sectoral Insight:

The asset management industry is benefiting from the broader trend of household financialization, expanding SIP culture, and digital fund distribution. HDFC AMC continues to dominate due to its strong brand, innovative products, and legacy trust.

✅ Final View:

🏆 HDFC AMC continues to be a top-tier compounder in India’s financial landscape.

💎 It is well-positioned for long-term investors focused on consistent returns, dividends, and low volatility.

📘 Ideal for passive wealth creators and dividend-focused portfolios.

HDFC AMC FY25, Mutual Fund Growth, Asset Management Insights, AUM Growth India, AMC Dividend Stock, Long-Term Investment India, High ROE Stocks, Wealth Creation, HDFC Group, SIP Investing

📜 Disclosure:

This content is published solely for educational and informational purposes and should not be construed as investment advice or a recommendation to buy or sell any securities. Investors are advised to conduct their own research.

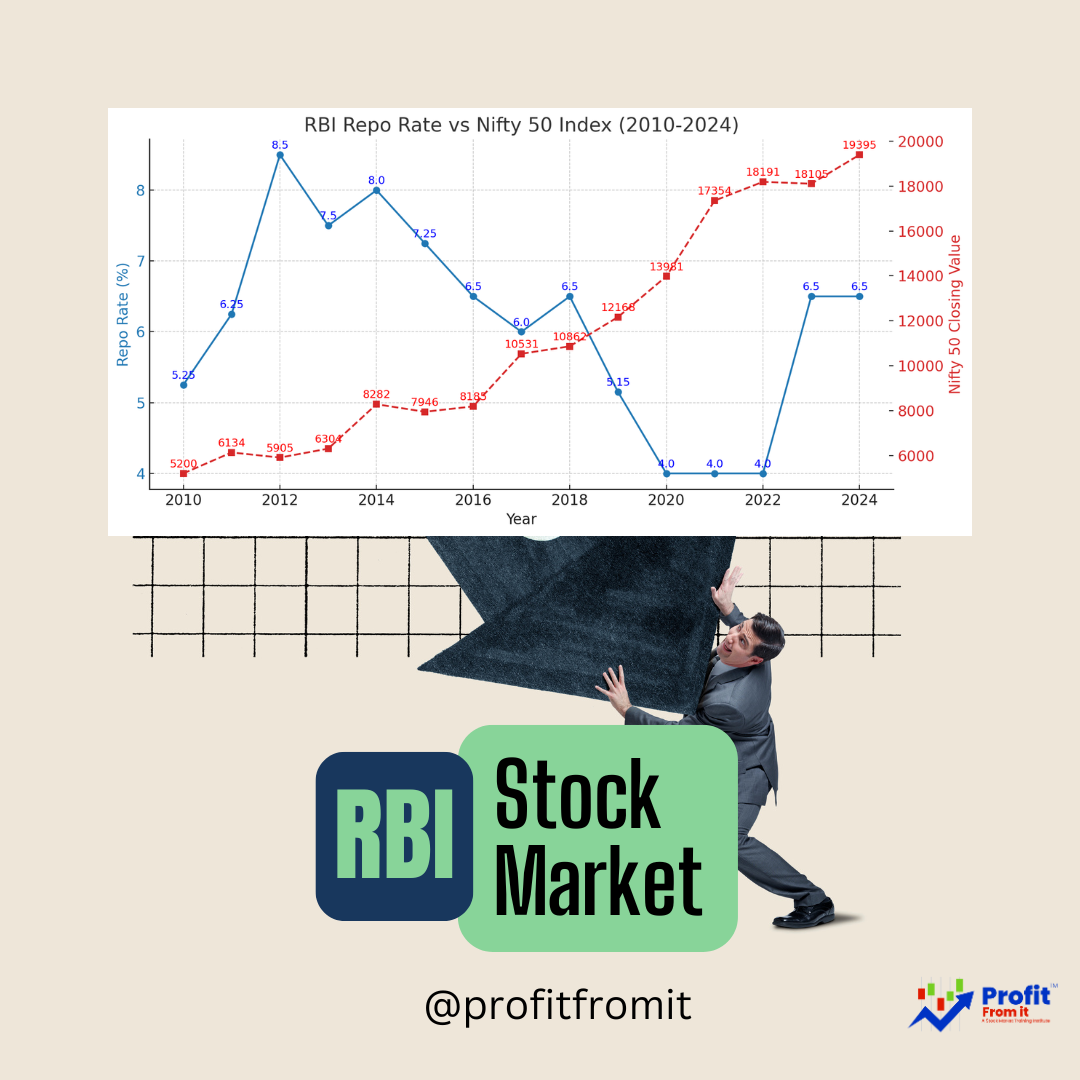

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)