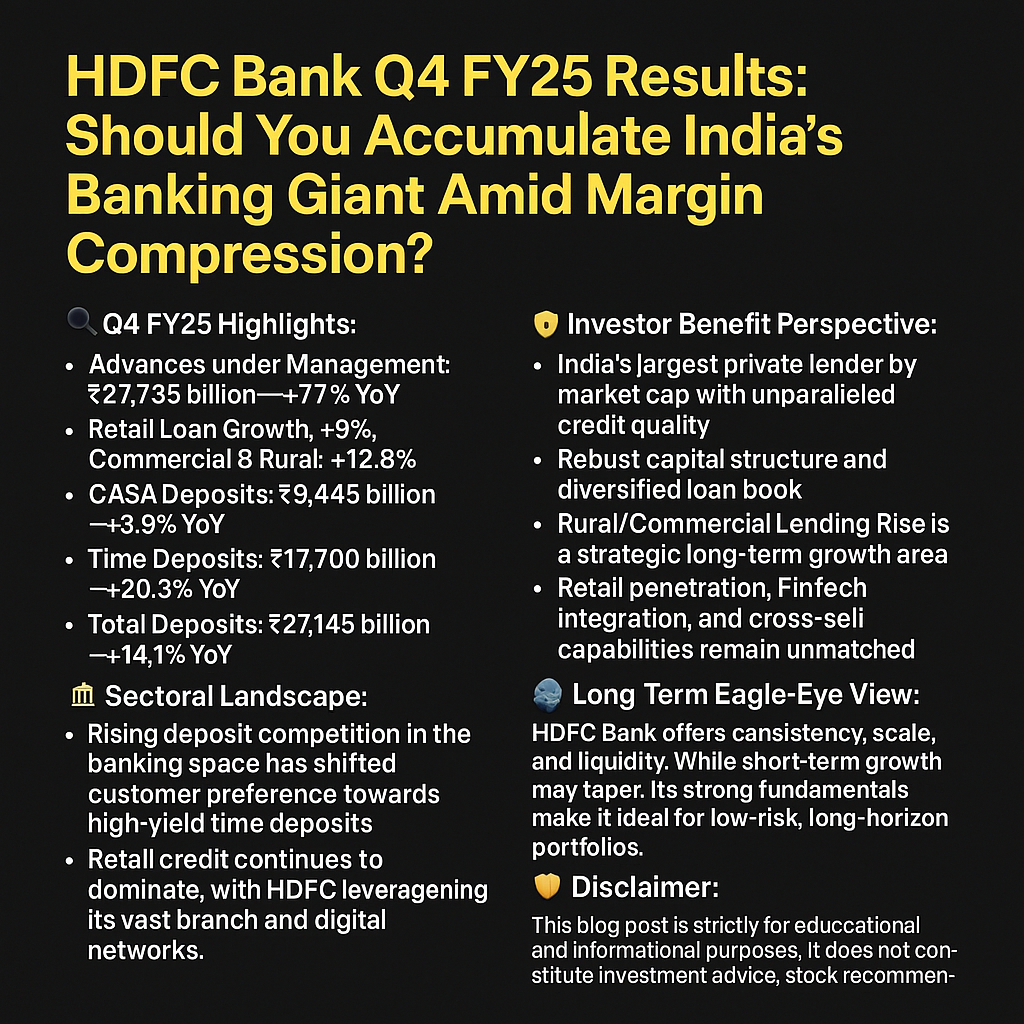

HDFC Bank Q4 FY25 Results: Should You Accumulate India’s Banking Giant Amid Margin Compression?

🔎 Q4 FY25 Highlights:

Advances under Management: ₹27,735 billion — +7.7% YoY

Retail Loan Growth: +9%, Commercial & Rural: +12.8%

CASA Deposits: ₹9,445 billion — +3.9% YoY

Time Deposits: ₹17,700 billion — +20.3% YoY

Total Deposits: ₹27,145 billion — +14.1% YoY

🏦 Sectoral Landscape:

Rising deposit competition in the banking space has shifted customer preference towards high-yield time deposits.

Retail credit continues to dominate, with HDFC leveraging its vast branch and digital networks.

The Indian banking sector is entering a cycle of margin normalization after pandemic-led liquidity surges.

🎯 Investor Benefit Perspective:

India’s largest private lender by market cap with unparalleled credit quality

Robust capital structure and diversified loan book

Rural/Commercial Lending Rise is a strategic long-term growth area

Retail penetration, FinTech integration, and cross-sell capabilities remain unmatched

⚠ Risk Factors:

CASA Ratio Pressure: Slower growth may affect cost of funds

Margin Compression Risk: Rising time deposit share reduces Net Interest Margin

Corporate Loan Book Weakness: Decline of ~3.6% YoY indicates caution or loss of market share

🧠 Long-Term Eagle-Eye View:

HDFC Bank offers consistency, scale, and liquidity. While short-term growth may taper, its strong fundamentals make it ideal for low-risk, long-horizon portfolios.

🛡 Disclaimer:

This blog post is strictly for educational and informational purposes. It does not constitute investment advice, stock recommendation, or solicitation to buy/sell securities. Investors are advised to perform their own due diligence or consult a certified investment advisor. Stock markets are subject to market risk.

Comments (0)

Categories

Recent posts

ITC Hotels and its strategic plans ...

30 Dec 2024

Reliance Leads Energy Revolution: 100% ...

22 Jan 2025 for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)

📊 Analysis of Nifty 500 Companies: ...

14 Feb 2025