📈 HDFC Life FY25 Results: Strong Growth, Steady Profits & Enhanced Market Position

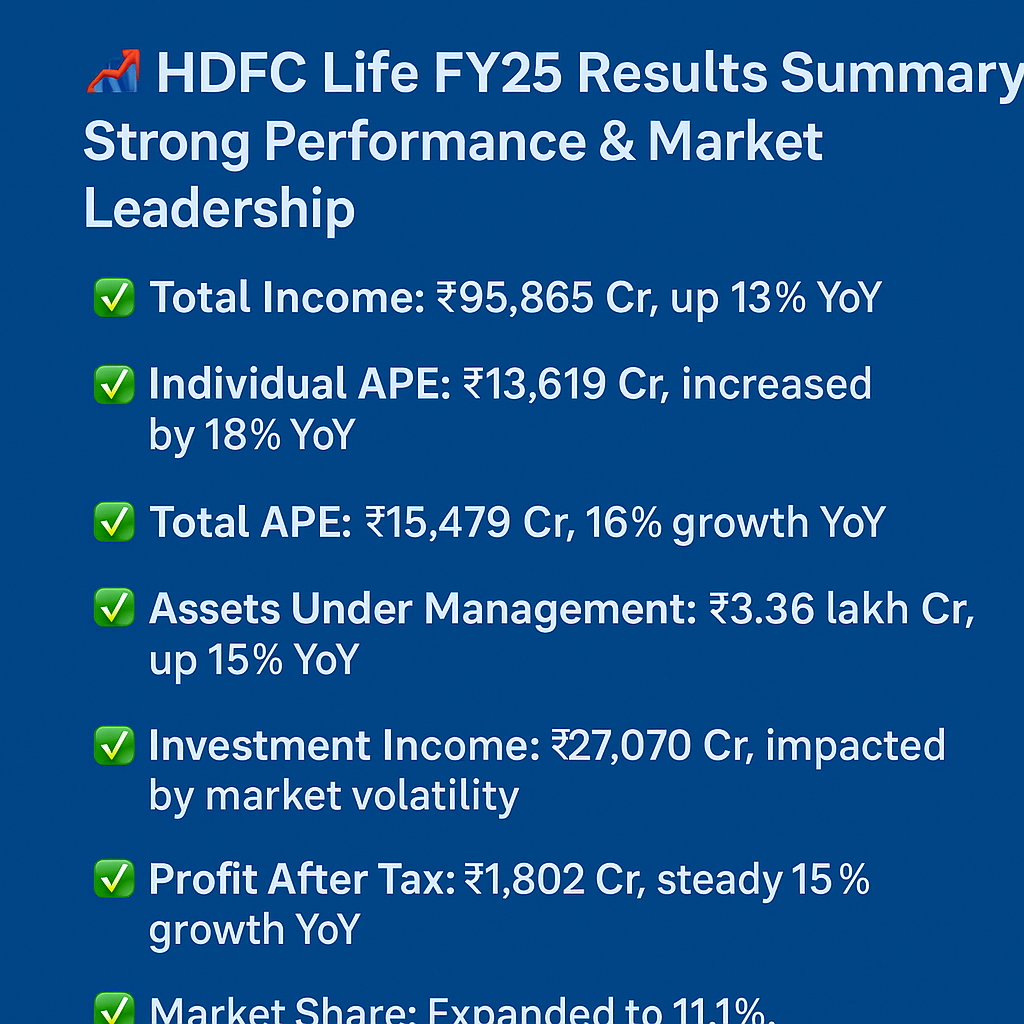

🚀 Financial Highlights:

Total Income Growth:

FY25: ₹95,865 Cr, up 13% YoY 📊

Q4FY25: ₹24,167 Cr, stable performance 🔍

Annual Premium Equivalent (APE) Growth:

Individual APE grew robustly at 18% YoY (₹13,619 Cr) 🆙

Total APE up 16% at ₹15,479 Cr 🚀

Assets Under Management (AUM):

₹3.36 lakh Cr, an impressive 15% growth YoY 🏦📈

Investment Income Growth:

FY25: ₹27,070 Cr, lower vs ₹39,354 Cr last year due to market volatility 📉

Q4FY25: ₹347 Cr, significantly down reflecting Q4 market pressures ⚠️

💰 Profitability & Margins:

Profit After Tax (PAT):

FY25: ₹1,802 Cr (+15% YoY) 📌

Q4FY25: ₹477 Cr (+16% YoY), showcasing strong quarterly performance ✅

Profit Margin:

Stable and consistent margins at ~2.5% for FY25, demonstrating resilience despite market headwinds 📌

Value of New Business (VNB):

Increased by 13% YoY to ₹3,962 Cr, indicating robust business quality 📊💎

New Business Margin at 25.6%, slightly down vs 26.3% last year, but still strong 🌟

🌐 Market Share & Industry Performance:

Market Share:

Overall market share improved by 70 bps to 11.1% 📌

Private sector share rose 30 bps to 15.7%, reaffirming leadership 🌟

Persistency Ratios:

13th Month Persistency: Strong at 87% 💪

Significant improvement in 61st-month persistency by 1000 bps (63%), highlighting excellent customer retention 🤝✨

📊 Key Industry KPIs (Year-over-Year Comparison):

⚖️ Valuation & Stock Metrics (at CMP ₹720):

Embedded Value (EV): ₹55,423 Cr, up 17% YoY 📈

Dividend: ₹2.1 per share proposed for FY25 💵🎯

🎯 Management’s Commentary:

🗣️ "FY25 was a remarkable year where we deepened market reach and strengthened our competitive edge, delivering robust 18% growth in Individual APE. Our long-term aim remains to consistently outperform industry growth, enhance profitability, and double key metrics every 4-4.5 years." – Vibha Padalkar, MD & CEO

🔮 Near-Term & Long-Term Outlook:

Near-Term: Positive trajectory with continued premium and AUM growth; market volatility could affect short-term investment income 🌤️

Long-Term: Strategic initiatives focused on increasing digital distribution, strengthening market share, and consistent growth in embedded value 🌞📅

📌 Investor Takeaways:

✅ Solid growth across all key metrics despite market volatility

✅ Improved market position and persistency highlighting strong management

✅ Healthy dividend payouts with stable profitability

📝 Disclaimer:

The content presented is solely for informational purposes and should not be considered investment advice. Investors must conduct their own due diligence before making investment decisions.

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)