Investing ₹10,000 every month con (1).png)

📈 "Harnessing Market Volatility: How a Smart SIP Strategy Can Transform Your Wealth Over 20 Years"

🧠 Introduction:

The stock market is a dynamic ecosystem characterized by phases of growth (rallies) and declines (corrections). Investors often get nervous during corrections, but history has consistently shown that these are the most opportune times to invest more. In this blog, we'll demonstrate how a disciplined SIP strategy and a simple yet powerful tweak — increasing investments during corrections and reducing them during rallies — can significantly enhance long-term returns. This gets aligned with what we have been teaching for a long time. Give Importance to

Equity as well as Fixed Securities as both have different characteristics useful in different economic cycles.

Invest 50:50 (50 in Equity v/s 50 in Gold - Realty - FD’s - Bonds etc)

Buy more in equity during fall (Adjust 75 - 25) and avoid buying more during Rallies (Adjust 25 - 75).

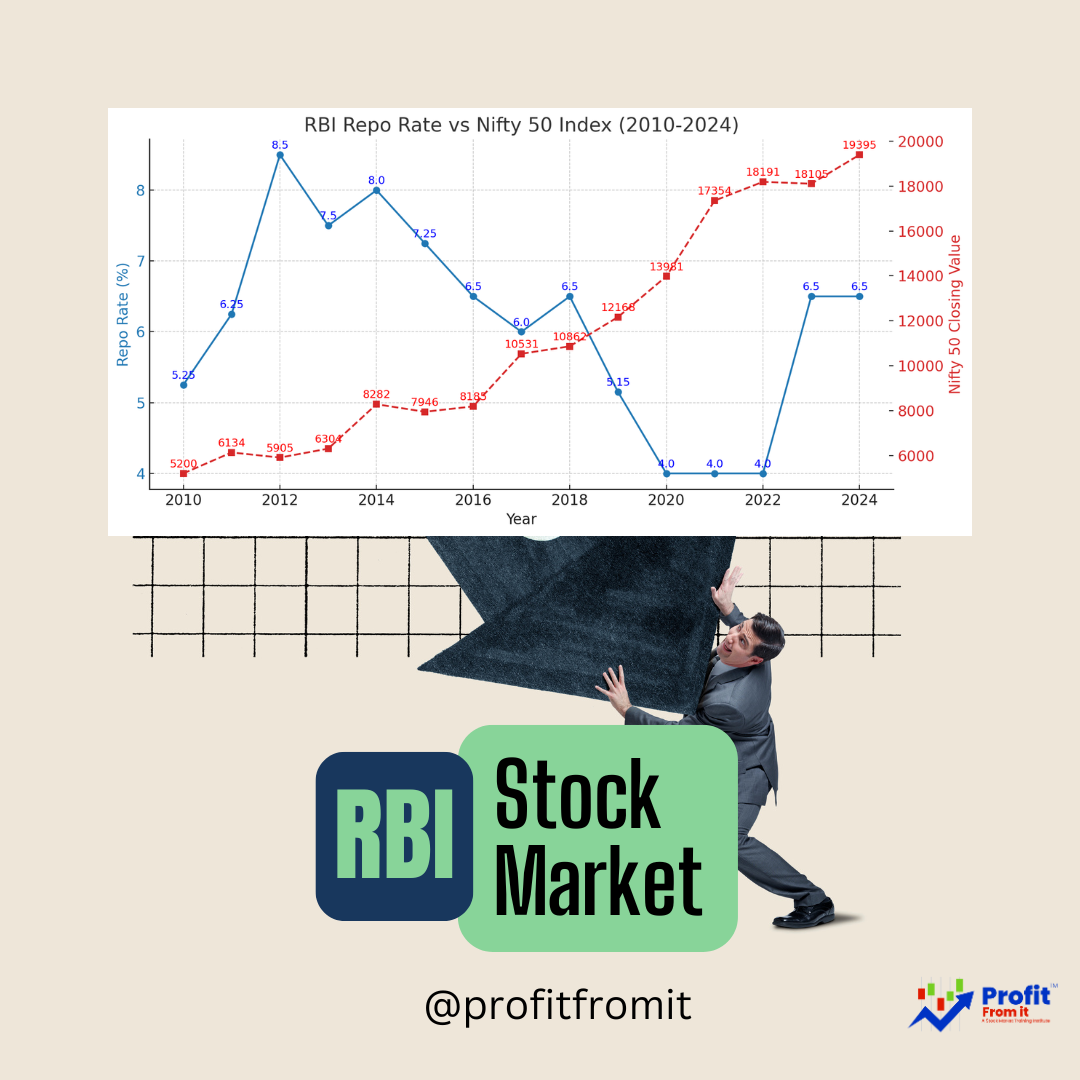

📊 The Historical Perspective:

Over the past 20 years, the Nifty 50 Index has experienced multiple corrections, some more severe than the recent 14% fall. Yet, investors who stayed invested and, more importantly, adopted a strategic investment approach have reaped impressive rewards.

🛠️ Investment Strategies We Analyzed:

Lump-Sum Investment:

Investing ₹10,000 in February 2004 and holding it for 20 years.Regular SIP (Systematic Investment Plan):

Investing ₹10,000 every month consistently, regardless of market conditions.Dynamic SIP (Volatility-Based SIP):

Invest ₹10,000 monthly as a base.

Double the SIP amount when the market corrects by 10% or more.

Halve the SIP amount when the market rallies by 10% or more.

🔍 The Results After 20 Years:

📈 Insights From the Results:

Lump Sum:

While ₹10,000 invested 20 years ago grew substantially, it pales in comparison to SIP-based strategies.

Timing the market with a single investment often results in missed opportunities for averaging during corrections.

Regular SIP:

Investing regularly every month without trying to time the market yielded a remarkable return of over ₹1 crore.

This showcases the power of disciplined investing.

Dynamic SIP:

By simply increasing investments during corrections and reducing them during rallies, the portfolio grew to a staggering ₹5.45 crore — more than 5 times the returns of a regular SIP!

This approach helps buy more units when the market is down and fewer units when the market is expensive.

🖼️ Visual Insights:

The chart above illustrates how a dynamic SIP strategy significantly outperformed a regular SIP, especially during periods of market corrections when more units were accumulated.

💡 Key Takeaways for Investors:

Discipline is Key:

Stay invested, irrespective of short-term noise.Volatility is an Opportunity, Not a Threat:

Corrections offer discounted prices to accumulate more.Simplicity Works:

The dynamic SIP strategy is simple yet remarkably effective.Invest Regularly and Systematically:

The combination of regularity and dynamic adjustments can yield extraordinary results.

🚀 Conclusion:

History proves that timing the market is nearly impossible. But, adjusting your SIP contributions based on market behavior can significantly enhance your returns. So, the next time the market corrects, don’t panic — invest more. Your future self will thank you!

Will Explain the strategy in the explainer Video soon…… ( For High Clarity)

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)