📊 Havells FY25 Results Analysis: Robust Growth with Strategic Resilience

🔹 Revenue & Sales Growth – FY25 & Q4FY25

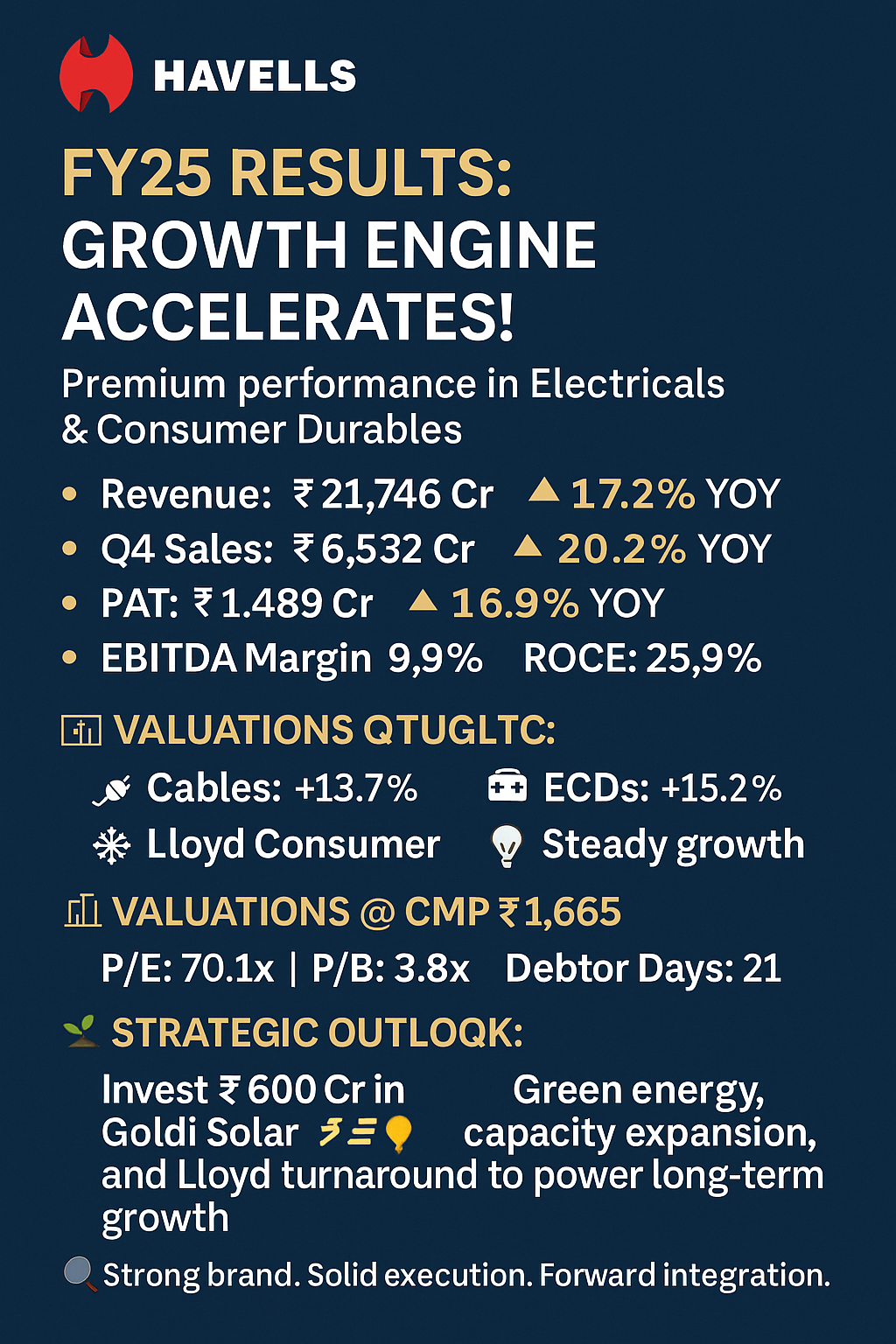

FY25 Net Revenue: ₹21,746 Cr — up +17.2% YoY from ₹18,550 Cr.

Q4FY25 Revenue: ₹6,532 Cr — up +20.2% YoY, led by Lloyd Consumer (+39.5%) and Cables (+21.2%).

Core segments like Switchgears (+6.7%), Lighting (+1.6%), and ECDs (+15.2%) maintained positive momentum.

🧩 Segmental Performance – FY25 & Q4FY25

📌 Insight: Lloyd segment turned around with full-year profitability; ECDs and Cables continue to scale with better product mix and capacity expansion.

💰 Profitability Analysis

⚙️ Commentary: Despite inflationary pressures, Havells maintained margin discipline aided by cost optimization and product premiumization.

🧮 Key Financial Ratios (FY25)

ROE: 18.8%

ROCE: 25.9%

Current Ratio: 1.8

Inventory Days: 67

Debtor Days: 21

Net Working Capital: 37 days (stable YoY)

💡 Liquidity remains strong, ensuring operational flexibility.

💼 Valuations at CMP ₹1,665

📈 While valuations appear rich, the premium is attributed to the brand’s strong moats, execution history, and return ratios.

🌐 Industry & Strategic Outlook

The electricals and consumer durables sector is witnessing a structural demand shift due to urbanization, premium housing, and lifestyle upgradation.

Lloyd’s turnaround and investment in Goldi Solar (₹600 Cr for 9.2% stake) signals Havells’ strategic pivot towards the green energy value chain.

🔮 Near-Term & Long-Term Outlook

🔸 Near-Term:

Seasonal headwinds may moderate ECD sales in Q1 FY26.

Margin outlook stable due to softening raw material costs.

🔸 Long-Term:

Industry tailwinds from real estate, infra push, and solar integration.

Sustained outperformance possible through brand, distribution, and energy solutions.

📢 Disclosure

This analysis is for informational purposes only and does not constitute investment advice.

Comments (0)

Categories

Recent posts

ITC Hotels and its strategic plans ...

30 Dec 2024

Reliance Leads Energy Revolution: 100% ...

22 Jan 2025 for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)

📊 Analysis of Nifty 500 Companies: ...

14 Feb 2025