🚨 ICICI Securities Delisting: What It Means for Investors & What You Should Do Now

🔔 March 24, 2025 marked a pivotal day for thousands of investors as ICICI Securities Limited (ISEC) officially got delisted from the stock exchanges. If you're holding ISEC shares and wondering "What now?", this post breaks it all down for you—clear, simple, and with actionable insights.

🧩 What Happened?

ICICI Securities has been merged into its parent company, ICICI Bank, via a Scheme of Arrangement approved by regulators and shareholders. With all formalities completed, the delisting is now effective.

Last trading day for ISEC: ✅ Over

Record date: 📅 March 24, 2025

Swap ratio: 🔄 67 ICICI Bank shares for every 100 ICICI Securities shares

💥 Impact on Shareholders

Here’s what this means for you if you held ISEC shares as of the record date:

Your ICICI Securities shares will be cancelled

You will receive ICICI Bank shares instead (automatically in your demat account)

No cash payout – it’s a share swap, not a buyback

ICICI Securities is now a private subsidiary under ICICI Bank

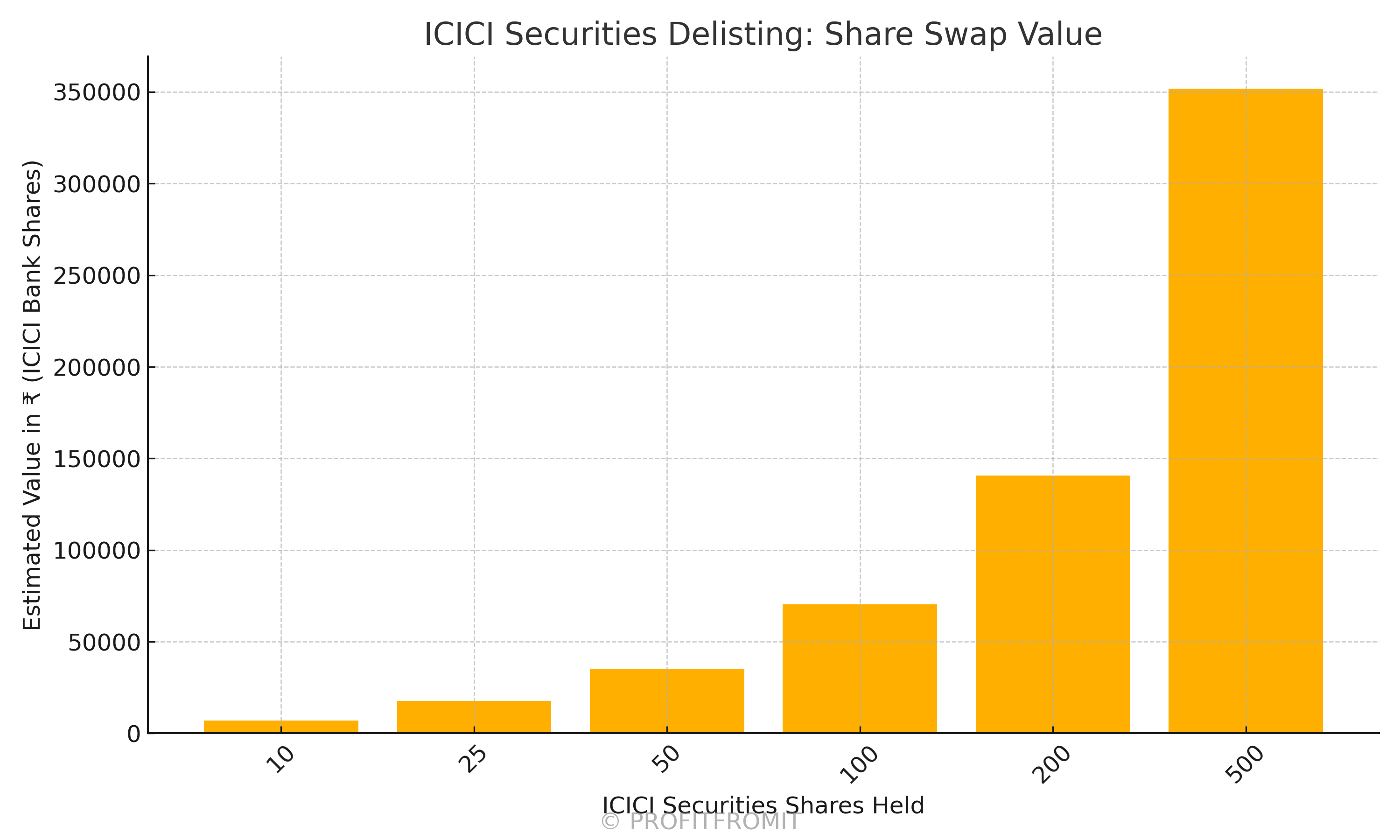

📊 What Will You Get? [With Real Examples]

Here’s how the swap plays out depending on how many shares you owned:

🧮 Note: Fractional shares (e.g., 0.75) may be paid out in cash or adjusted later — keep an eye on announcements.

💡 So… Is This Good or Bad?

✅ Positives:

ICICI Bank is a fundamentally strong company with higher market liquidity and broader institutional interest.

You now hold shares in a banking giant, potentially offering better long-term value.

⚠️ Watch-Outs:

Immediate notional loss possible if you bought ISEC at higher levels (e.g., ₹850/share).

Your holding is now tied to ICICI Bank’s performance, not ISEC's standalone business.

📝 What Should You Do Now?

Do nothing — the share swap is automatic via your broker/demat account.

Track your ICICI Bank share allocation — should reflect in a few days post-record date.

Update your portfolio accordingly.

If needed, consult your tax advisor — there may be capital gains implications based on original ISEC purchase price.

📢 Final Thoughts

This delisting is part of a broader strategy by ICICI Bank to streamline its business units and offer consolidated financial services. While there may be short-term confusion, long-term investors may actually benefit from being part of a larger, more diversified entity.

🗣️ Share this post with your fellow investors — especially those holding ISEC shares. It might save them a lot of panic and confusion!

💬 Got Questions?

Drop them in the comments. Let’s help the investor community make sense of this big move! 🚀

Comments (0)

Categories

Recent posts

ITC Hotels and its strategic plans ...

30 Dec 2024

Reliance Leads Energy Revolution: 100% ...

22 Jan 2025 for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)

📊 Analysis of Nifty 500 Companies: ...

14 Feb 2025