📊 IEX FY25 and Q4FY25 Results Analysis

Executive Summary

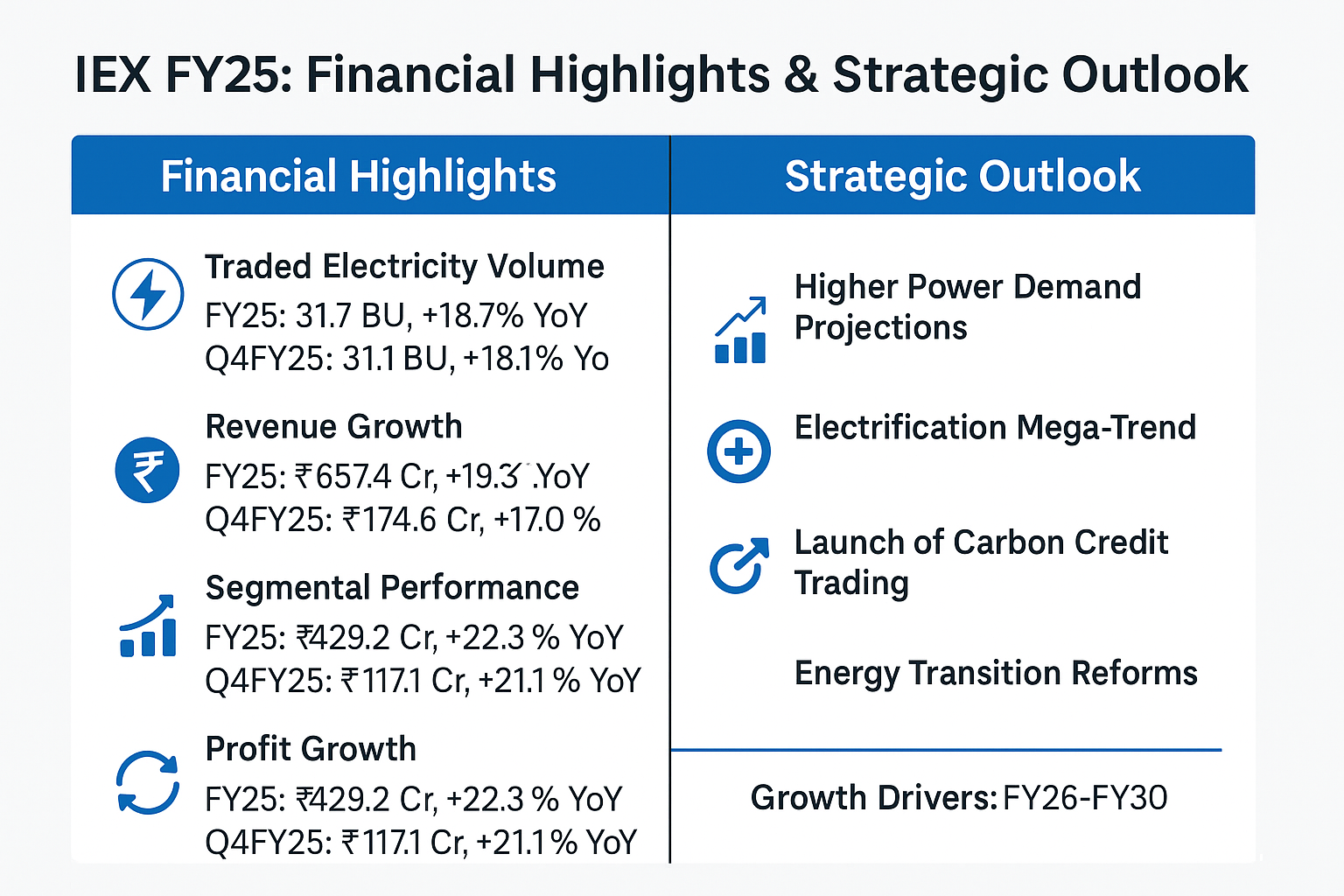

Indian Energy Exchange (IEX) has demonstrated robust operational performance in FY25, marked by a record high in electricity volumes, strong revenue and profit growth, and strategic positioning for future energy transitions. Favorable policy developments, a diversified product mix, technological advancements, and regulatory tailwinds are expected to sustain growth momentum over the medium to long term.

1. ⚡ Traded Electricity Volumes

FY25:

121 BU traded electricity volume

+18.7% YoY Growth

Q4FY25:

31.7 BU, marking the highest-ever quarterly volume

+18.1% YoY Growth

2. 💰 Revenue Growth

FY25 Consolidated Revenue:

₹657.4 Cr (+19.3% YoY)

vs ₹550.8 Cr in FY24

Q4FY25 Consolidated Revenue:

₹174.6 Cr (+17.0% YoY)

vs ₹149.3 Cr in Q4FY24

3. 📈 Segmental Growth and Share (FY25 & Q4FY25)

4. 📊 Profitability Analysis

Consolidated PAT (FY25):

₹429.2 Cr (+22.3% YoY)

Consolidated PAT (Q4FY25):

₹117.1 Cr (+21.1% YoY)

Standalone PAT (FY25):

₹414.6 Cr (+21.4% YoY)

Standalone PAT (Q4FY25):

₹112 Cr (+17.8% YoY)

🧮 Profit Margins

Margins remain best-in-class across the energy sector.

5. 🛡️ Solvency - Liquidity - Profitability - Cash Flow Metrics

6. 🛢️ Industry KPIs

India’s Power Consumption Growth:

+4.4% YoY to 1,694 BUDay Ahead Market (DAM) Clearing Price:

₹4.47/unit (↓14.7% YoY) due to 36% YoY rise in sell liquidityCoal Availability:

Coal production: +5% YoY

23 days inventory: Highest since 2021

Gas Market:

IGX volume grew +47% YoY

7. 🔮 Near Term and Long Term Outlook

Near Term Catalysts (FY26-FY28):

Increased traded volumes due to:

Higher power demand projections (CEA)

Load shifting to solar hours

Launch of Green RTM and Carbon Credit Trading

REC fungibility driving REC market expansion.

Long Term Growth Drivers (FY28-FY35):

Energy transition: Shift towards renewables (50% capacity share by 2030)

Electrification mega-trend: EVs, railways, industrial electrification

Market reforms: Capacity markets, derivatives trading, coal exchange

Expansion into Battery Energy Storage System (BESS) trading and Hydrogen Market Development

🏁 Strategic Conclusion

Indian Energy Exchange stands at the cusp of multi-dimensional growth, with a fortified market leadership (84% share), technology-driven platform, robust cash flows, and new market opportunities across power, gas, and carbon credits.

At the current CMP of ₹190, IEX trades at a reasonable forward valuation considering:

Premium business model

Monopoly-like status

Upcoming regulatory tailwinds.

Investors with a 5–10-year horizon can view IEX as a core holding for compounding opportunities aligned with India's energy sector transformation.

Disclaimer: This post is for informational purposes only and not a recommendation to buy or sell securities.

Comments (0)

Categories

Recent posts

ITC Hotels and its strategic plans ...

30 Dec 2024

Reliance Leads Energy Revolution: 100% ...

22 Jan 2025 for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)

📊 Analysis of Nifty 500 Companies: ...

14 Feb 2025