🚀 IIP Growth Analysis - January 2025: Insights for Investors 📈

📊 Key Highlights

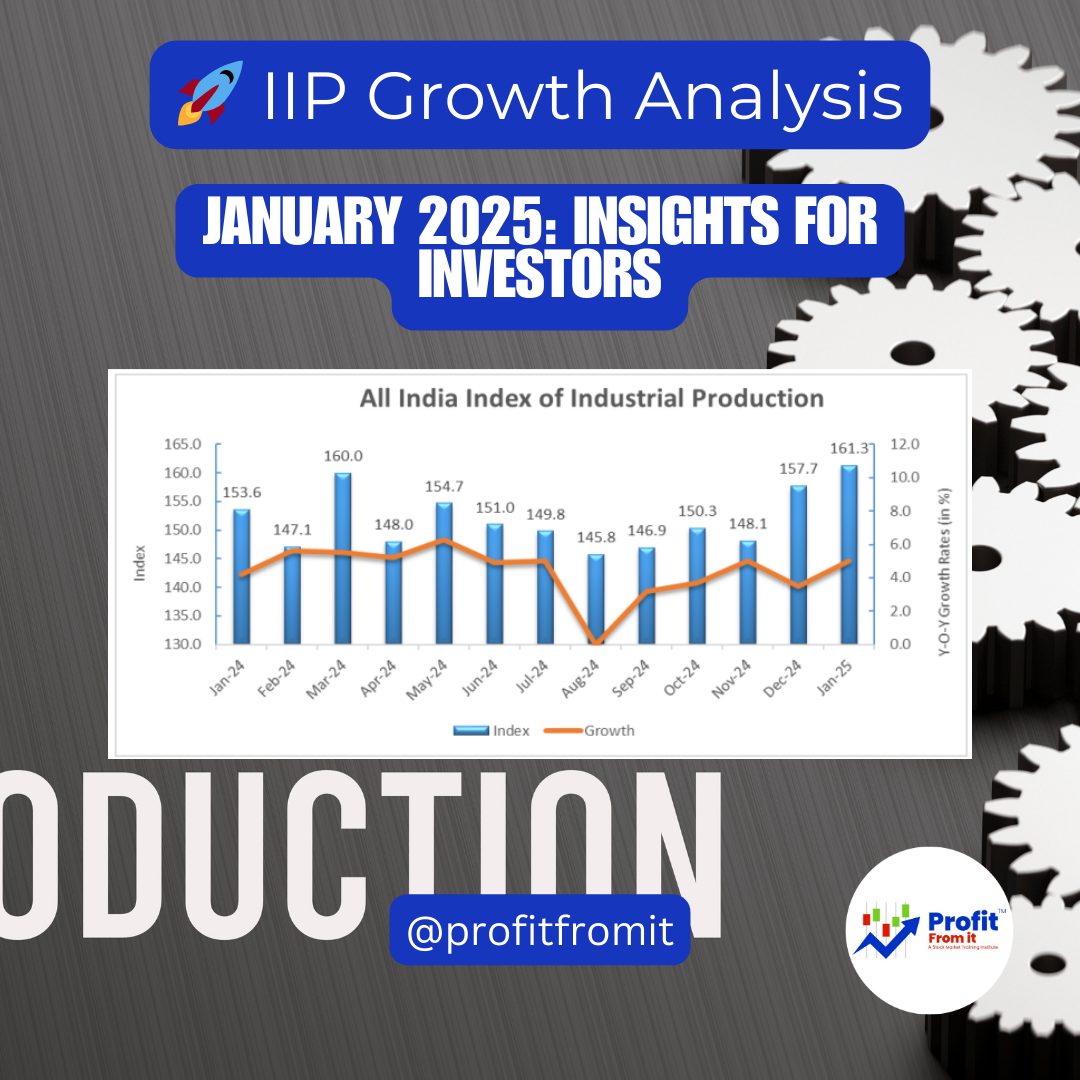

✅ Overall IIP Growth: 📈 5.0% (compared to 3.2% in Dec 2024)

✅ Sectoral Growth:

⛏️ Mining: 4.4%

🏭 Manufacturing: 5.5%

⚡ Electricity: 2.4%

✅ Manufacturing Leads Growth: 19 out of 23 industries saw positive growth.

✅ Top Industry Performer: 🔌 Manufacture of Electrical Equipment (+21.7%)

✅ Biggest Decline: 📉 Printing & Recorded Media (-9.4%)

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)