📊 Industrial Production in India – February 2025 Snapshot

🔍 Key Highlights

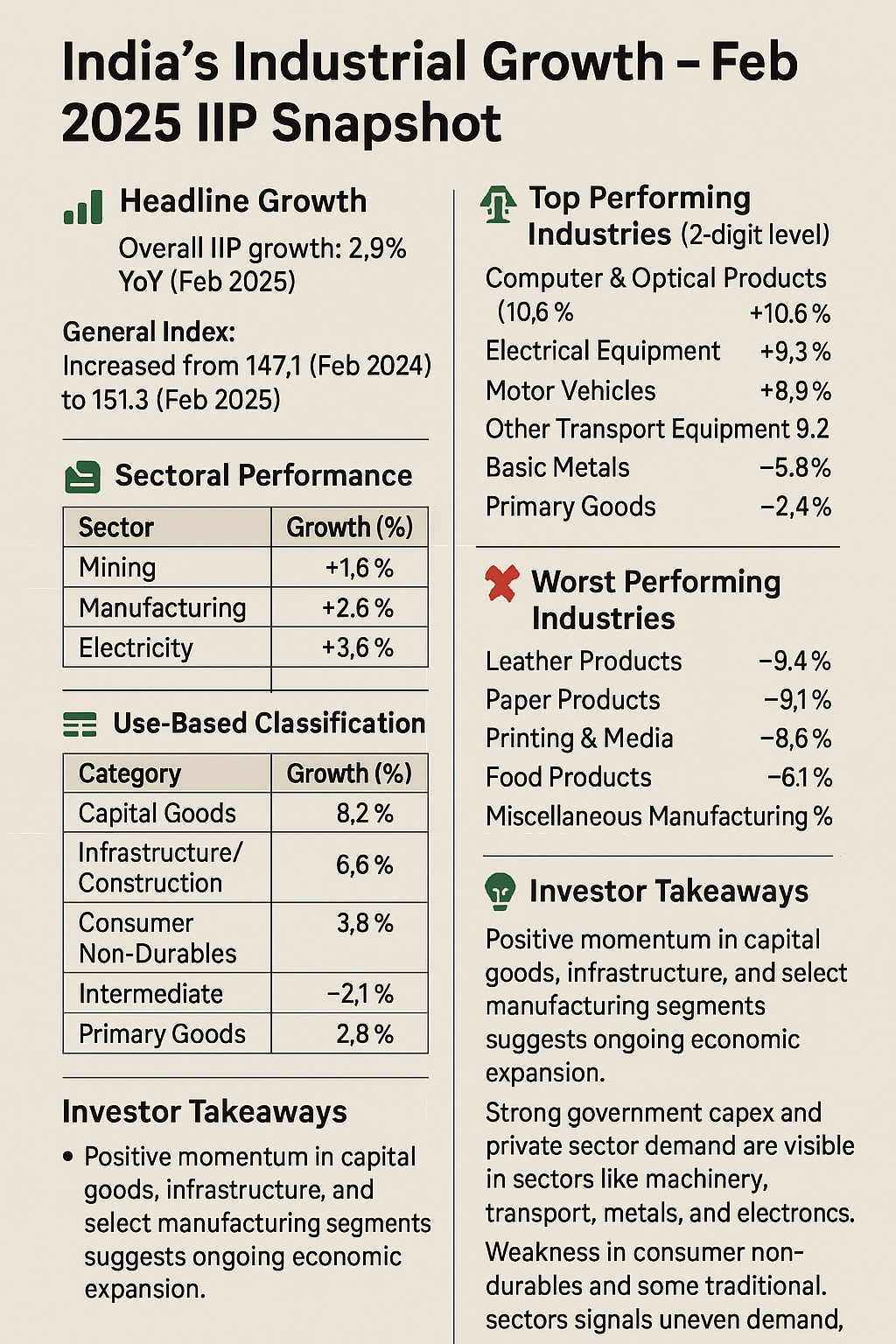

Overall IIP growth stood at 2.9% in February 2025 compared to 5.0% in January 2025.

The General Index rose to 151.3 in Feb 2025 from 147.1 in Feb 2024.

Sectoral growth:

Mining: +1.6%

Manufacturing: +2.9%

Electricity: +3.6%

📈 Sectoral Trend (YoY)

Manufacturing continues to dominate the IIP composition, with the highest weight (77.6%).

🏭 2-Digit Industry Growth – Top & Bottom Performers

🥇 Top Performing Industries (YoY Feb 2025):

❌ Worst Performing Industries:

🧰 Use-Based Classification – Growth Analysis

🧠 How Should Investors Interpret This?

Moderate IIP Growth: While Feb's IIP growth (2.9%) is lower than Jan's (5.0%), the trend still signals economic activity, especially in capital-intensive sectors.

Manufacturing Momentum: Key industrial sectors (autos, metals, electronics) show healthy momentum, indicating selective investment opportunities.

Infra Play: Capital goods and infrastructure goods categories grew over 6%, signaling government capex and housing boom are still strong levers.

Watch Consumer Non-Durables: A decline suggests cautious consumer sentiment or rural slowdown. FMCG investors should be watchful.

Look Beyond Headlines: Sectoral and 2-digit industry analysis is more important than the headline number. Investors can target outperforming micro-sectors.

📌 Conclusion

The IIP for February 2025 reinforces India's multi-speed industrial recovery. While headline growth is slower, the underlying strength in capital goods, infrastructure, and specific manufacturing segments is a bullish signal for long-term investors. Focus on sector rotation, align with government spending trends, and watch for cyclical plays in electronics, auto, and capital goods.

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)