🌍 IMF World Economic Outlook 2025

📈 Long-Term Investment Insights, Sector Impacts & Companies

By Piyush Patel | Investment Strategist | Profit From IT

📅 Released: April 23, 2025

🧭 Executive Summary

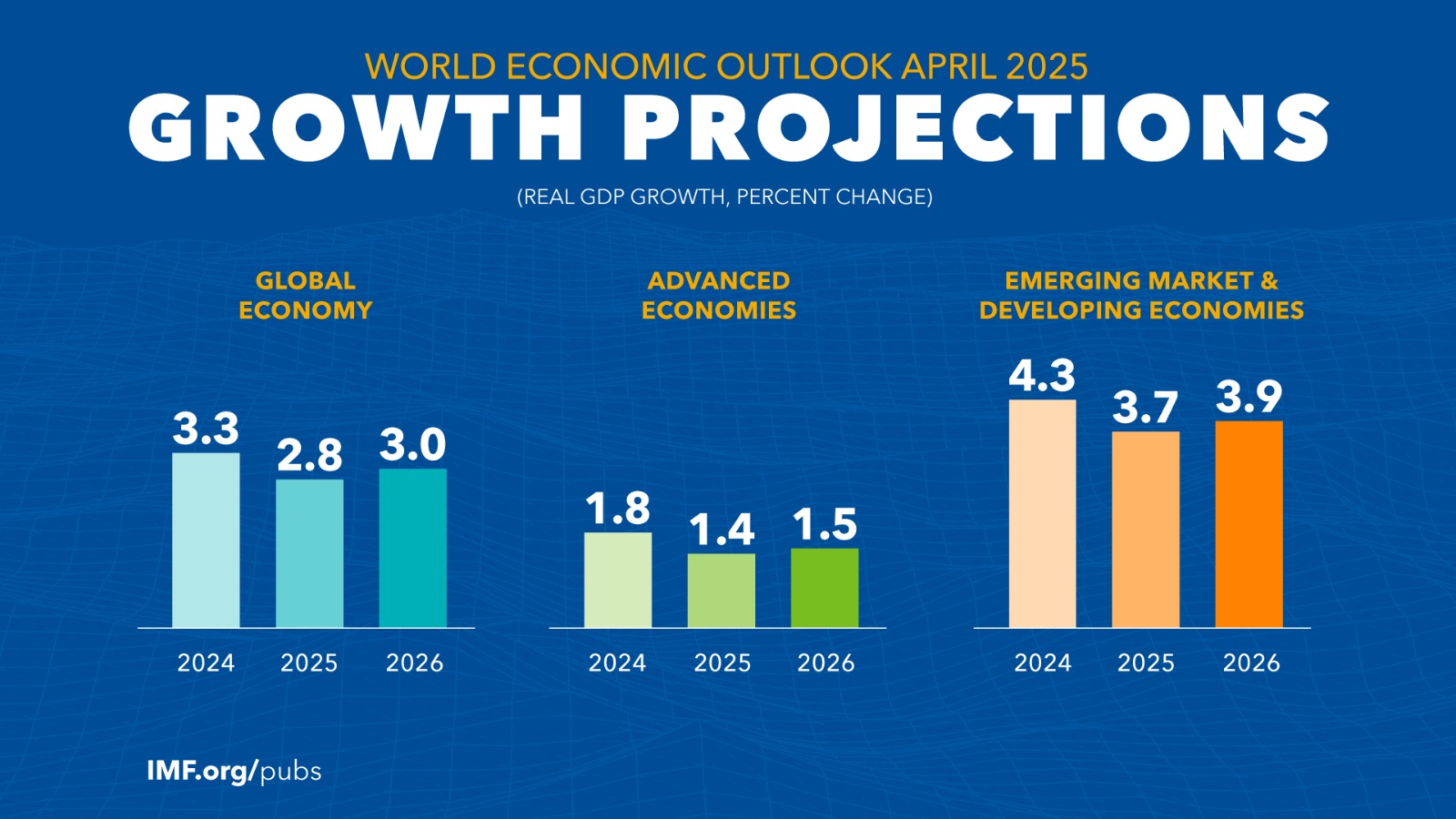

The IMF April 2025 Report projects a deceleration in advanced economies while spotlighting growth in India, Southeast Asia, and select emerging markets. For investors, this is a strategic asset allocation moment — to realign portfolios towards resilient economies and forward-looking sectors.

🌐 Top Growth Projections – 2025 (GDP %)

| 🌏 Country | 📊 Projected Growth |

|---|---|

| 🇮🇳 India | 6.2% |

| 🇨🇳 China | 4.0% |

| 🇮🇩 Indonesia | 4.7% |

| 🇸🇦 Saudi Arabia | 3.0% |

| 🇪🇬 Egypt | 3.8% |

| 🇺🇸 USA | 1.8% |

| 🇧🇷 Brazil | 2.0% |

| 🇷🇺 Russia | 1.5% |

| 🇬🇧 UK | 1.1% |

| 🇩🇪 Germany | 0.0% |

🔗 Source – IMF World Economic Outlook April 2025

🏭 Sector-Wise Impact Analysis

| 🏷 Sector | 📉 Developed Markets | 📈 India / EMs | 📌 Notes |

|---|---|---|---|

| 🏗 Infrastructure | 🔻 Limited Capex in EU | 🚀 Govt & Private-led Infra boom | L&T, KNR Construction, IRB Infra |

| 🏦 Financial Services | ⚖️ Cautious lending | 💹 Growing retail credit & UPI penetration | HDFC Bank, ICICI, Bajaj Finance |

| 🔌 Energy / Renewables | 🌿 Green shift, but slow | ⚡ Focus on solar, hydrogen, RE | Adani Green, JSW Energy, Borosil Renewables |

| 🛒 Consumption | 😐 Slow recovery in EU/US | 🍛 Rising middle class in India | DMart, HUL, ITC, Titan |

| 🧠 Tech & AI | 🎯 Focused US expansion | 💡 India’s SaaS & automation growth | Infosys, TCS, Zoho, Tata Elxsi |

| 🚗 EV & Mobility | 🚧 Flat in EU/US | ⚙️ EV ecosystem expansion in Asia | Tata Motors, Exide, M&M, Greaves |

| 🏥 Healthcare | ⚠️ Neutral to slow | 🏥 Insurance & diagnostics boom | Apollo, Dr. Lal, Star Health |

| 📦 Manufacturing | 📉 EU Deindustrializing | 🏭 PLI-led Capex in India | Dixon, Syrma SGS, Amber, Tata Electronics |

📌 Key Observations for Investors

🇮🇳 India: A Beacon of Growth (6.2%)

📈 Double-engine growth: Government infra & private capex.

📱 Tech, manufacturing, consumption, and BFSI lead the charge.

✅ Beneficiary Stocks:

L&T, HDFC Bank, TCS, DMart, Titan, ICICI Bank, Dixon Tech, Adani Green

🇨🇳 China: Restructuring Phase (4.0%)

🏭 Shift from real estate to tech, clean energy, and export focus.

🎯 Caution due to regulatory and geopolitical risks.

✅ Beneficiaries: BYD, NIO (Global EVs), Alibaba Cloud

⚠️ Risk: Real Estate exposure, Property ETFs

🇺🇸 USA: Resilient but Cooling (1.8%)

💉 Healthcare, AI, and defense tech remain strong.

🏦 Rate-sensitive sectors underperform.

✅ Companies: Microsoft, Nvidia, Lockheed Martin, UnitedHealth

⚠️ Risk: Banking & REITs in rate-sensitive zones

🇩🇪 🇫🇷 🇮🇹 Eurozone: Stagnation Alert

🧊 Germany’s 0.0% reflects industrial slowdown.

🔻 Manufacturing, auto, energy vulnerable.

⚠️ Avoid: EU-focused industrial ETFs, auto-heavy funds

🌍 Emerging Markets & Middle East

🌐 Diversification into Egypt, Indonesia, Saudi Arabia offers tailwinds.

⛽ Energy, tourism, and infrastructure play a big role.

✅ Companies: Saudi Aramco, Telkom Indonesia, Egypt’s CIB

Funds: iShares EM ETF, India + ASEAN-focused mutual funds

📈 Portfolio Action Plan – 2025 & Beyond

🧩 Reallocation Strategy:

✅ Increase exposure to: India, ASEAN, MENA

⚠️ Reduce allocation to: EU, Japan, over-leveraged global REITs

🔄 Rebalance into sector ETFs: infra, green energy, consumption, AI

💼 Tactical Allocation by Investment Instruments

| 🎯 Asset Class | 🛠 Suggested Focus |

|---|---|

| 📊 Equities | India/EM stocks, US Tech |

| 📦 Mutual Funds | Global Innovation, India Capex, EM Blend |

| 💰 Debt | Short-duration, India Corporate Bonds |

| 🏠 Real Assets | REITs (India), InvITs |

| 💎 Alternates | Gold (10–15%), Thematic SIPs (EV/Green) |

🔐 Final Word from the Strategist

🌟 The IMF’s 2025 roadmap clearly signals a pivot towards growth markets, with India at the forefront. Investors should align their capital towards macro-backed long-term compounding stories—not short-term noise.

📢 Invest in the direction of the wind, not against it.

🔐 Disclosure

This blog is intended for informational and educational purposes only and does not constitute financial advice or a recommendation to buy or sell any securities, mutual funds, or other investment products.

All growth projections and macroeconomic data cited are based on the IMF World Economic Outlook – April 2025, which are subject to revisions based on evolving global events and economic indicators.

Sectoral trends and company mentions are based on public data and industry performance as of the date of publication. Past performance is not indicative of future results.

Investing in equities, global markets, and mutual funds involves market risks.

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)