🚆 IRFC FY25 Results Update: Strengthening Tracks for India's Railway Financing 🚆

🛤️ Executive Snapshot

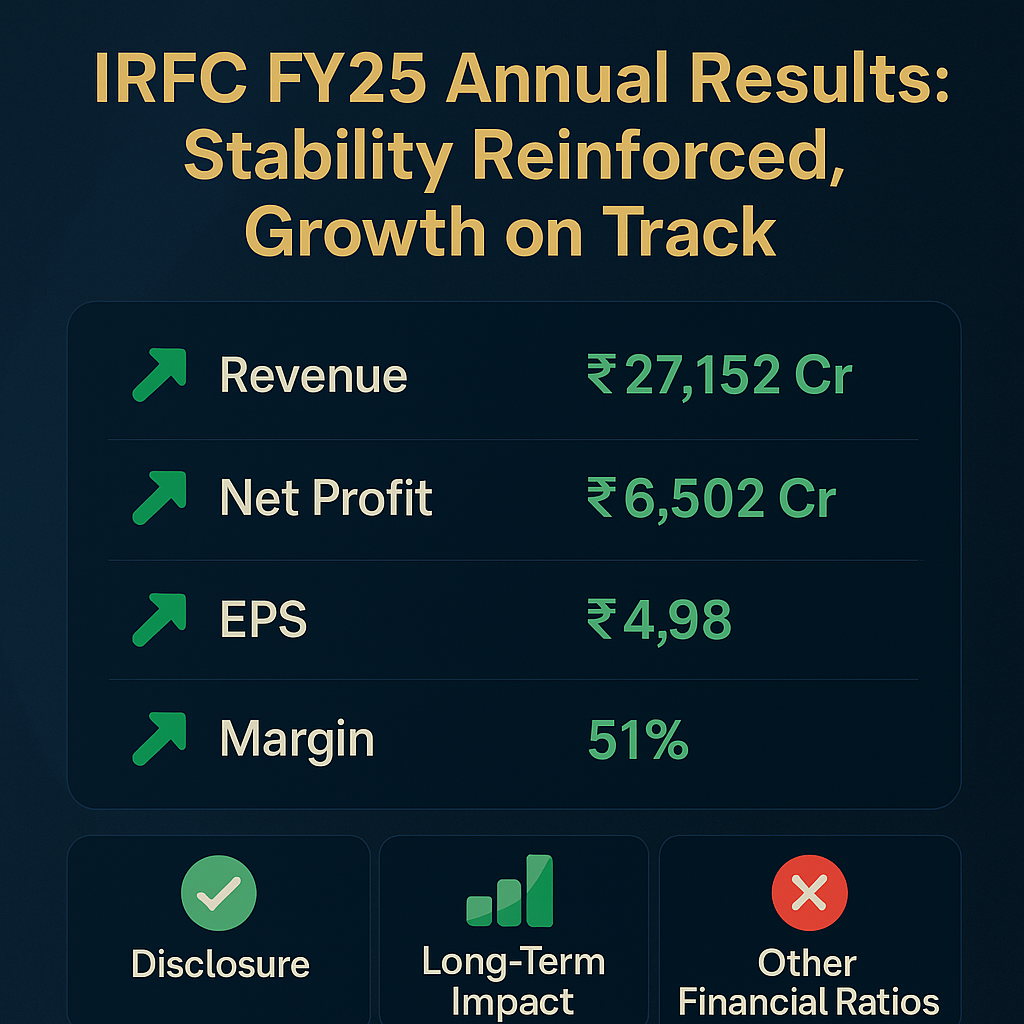

Indian Railway Finance Corporation Limited (IRFC) has demonstrated resilient financial performance in FY25, reinforcing its position as a pivotal player in India’s infrastructure funding landscape. This analysis provides a strategic breakdown of IRFC’s financial results, KPIs, solvency and liquidity health, valuations, and future outlook.

📊 1. Industry KPIs: Portfolio Expansion and Leasing Strength

📈 Advances & Lease Receivables:

Lease Receivables expanded +9.6% YoY to ₹2,84,689 Cr (vs ₹2,59,691 Cr).

New Lease Receivables for EBR-IF 2019-20 recognized from March 2025 — 🔒 securing future cash flows.

🏗️ Infrastructure Development:

Continues funding railway infrastructure under strategic long-term leasing models with Indian Railways (MoR).

🧾 2. Consolidated Financial Highlights

🗓️ Metrics Q4 FY25 Q4 FY24 Q3 FY25 FY25 FY24 📥 Revenue from Operations (₹ Cr) 6,724 6,475 6,764 27,153 26,649 💰 Net Profit (₹ Cr) 1,682 1,717 1,631 6,502 6,412 📝 Total Comprehensive Income (₹ Cr) 1,667 1,729 1,628 6,486 6,452 💹 EPS (Basic, ₹) 1.29 1.32 1.25 4.98 4.91

🔎 Key Insight: Sustained profitability, resilient margins despite sectoral headwinds, and incremental revenue growth underscore IRFC’s robust business model.

🏦 3. Solvency, Liquidity, and Profitability Matrix

📌 Key Ratios FY25 FY24 ⚖️ Debt-Equity Ratio 7.8x 8.3x 📈 Net Worth (₹ Cr) 52,668 49,179 🏦 Cash & Cash Equivalents (₹ Cr) 5,680 2,277 💹 Return on Equity (ROE %) ~12.3% ~13.0%

🧩 Observations:

Reduced leverage ratio signals prudent financial management.

Significant improvement in liquidity, ensuring operational flexibility.

Operating cash flow ₹8,229 Cr reflects high internal cash generation capabilities.

💼 4. Valuation Metrics (CMP: ₹128)

📈 PE Ratio (TTM): ~25.7x

📊 Price to Book Value: ~3.17x

💵 Dividend Yield: ~3.2%

🎯 Investment View:

Stable earnings visibility, sovereign backing, attractive dividend payouts, and India's railway mega expansion plans make IRFC a strategic long-term bet.

🔮 5. Strategic Outlook: Growth Engine in Motion

📅 Near-Term Catalysts (FY26)

🚀 ₹60,000 Cr fresh borrowing program approved (domestic + international).

🌱 ESG Bond launches for greener funding strategies.

📈 Long-Term Drivers (FY27–FY30)

🛤️ India's ₹11 lakh crore railway capex to turbocharge leasing demand.

🛡️ Secure business model with sovereign protection ensures minimal credit risk.

📊 Rising operating scale to enhance ROE and earnings momentum.

📜 6. Corporate Disclosure

This blog is issued strictly for informational and educational purposes. It does not constitute investment advice or a solicitation to buy/sell any securities. Investors must exercise due diligence

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)