Impact on Stock Market Sectors

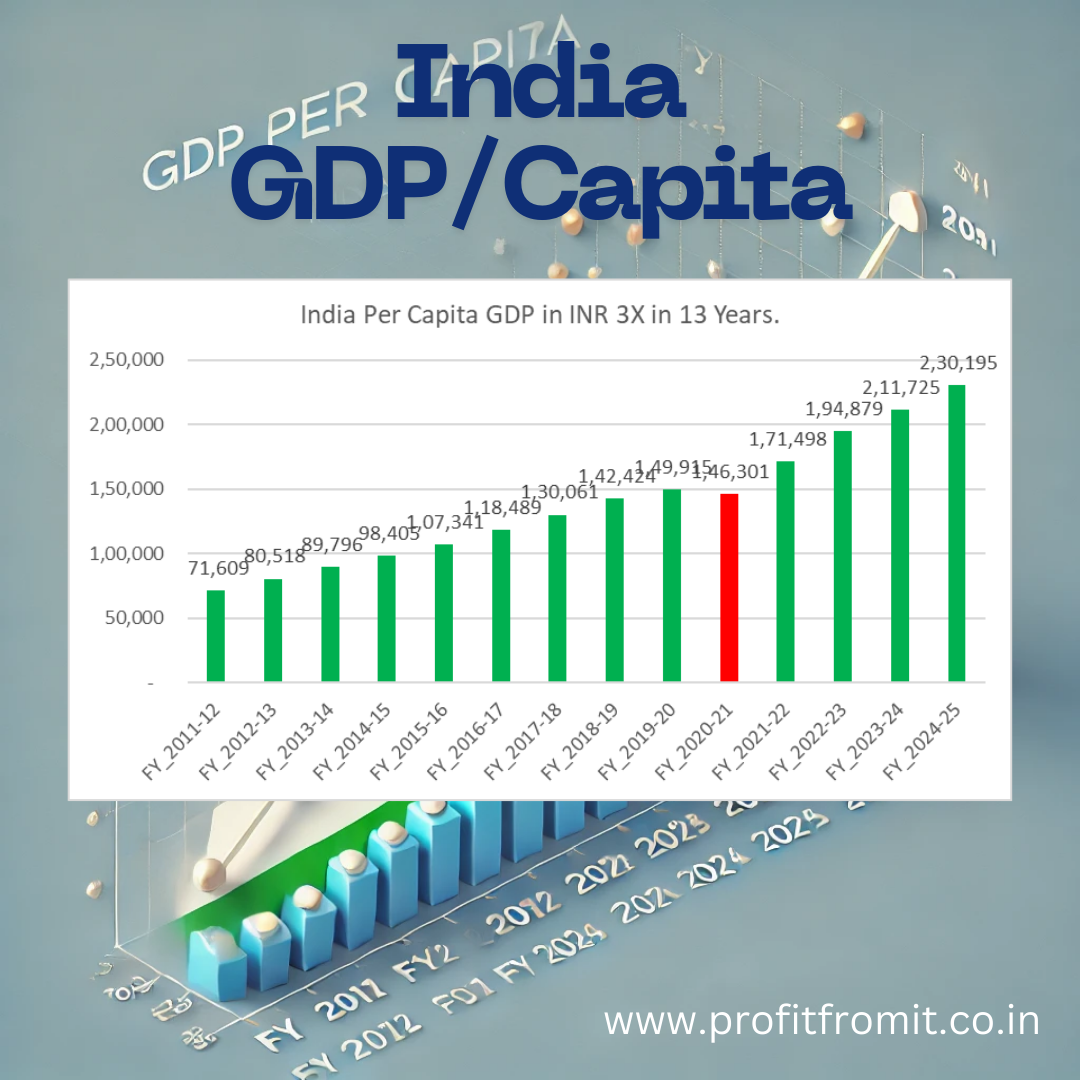

The changes in GDP per capita reflect economic growth and its distribution among the population, affecting consumer behavior and investment patterns. Here's how these trends might impact specific sectors:

Impact on Stock Market Sectors

Consumer Discretionary 🛍️: Strong growth in GDP per capita generally boosts disposable income, supporting higher spending on non-essential goods and services. This trend benefits sectors like retail, hospitality, and luxury goods, which thrive as consumers have more discretionary spending power.

Real Estate 🏠: Increasing GDP per capita often correlates with better funding for housing and infrastructure development, supporting real estate and construction sectors. This can lead to higher property prices and increased activity in housing and commercial real estate markets.

Financial Services 🏦: As incomes rise, more individuals and businesses seek financial services, including banking, investment, and insurance products, driving growth in this sector.

Technology 💻: With more disposable income, both consumers and businesses are likely to invest in new technologies, which can spur growth in IT services, electronics manufacturing, and software development.

Healthcare 🏥: Increased wealth allows for more spending on healthcare services and products, benefiting the healthcare sector, including hospitals, pharmaceuticals, and biotechnology firms.

Automotive 🚗: As people's purchasing power increases, so does their ability to buy vehicles, supporting the automotive industry and its ancillary sectors.

These insights can help investors pinpoint which sectors might offer potential growth opportunities based on the economic conditions indicated by the GDP per capita growth rates.

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)