🛫 IndiGo Q4 FY25 Results: Record Profits, Rising Passengers & Strong Outlook

Published on: May 2025

Author: Piyush Patel, Research Analyst & Investment Mentor

🔗 www.profitfromit.co.in

✈️ Overview

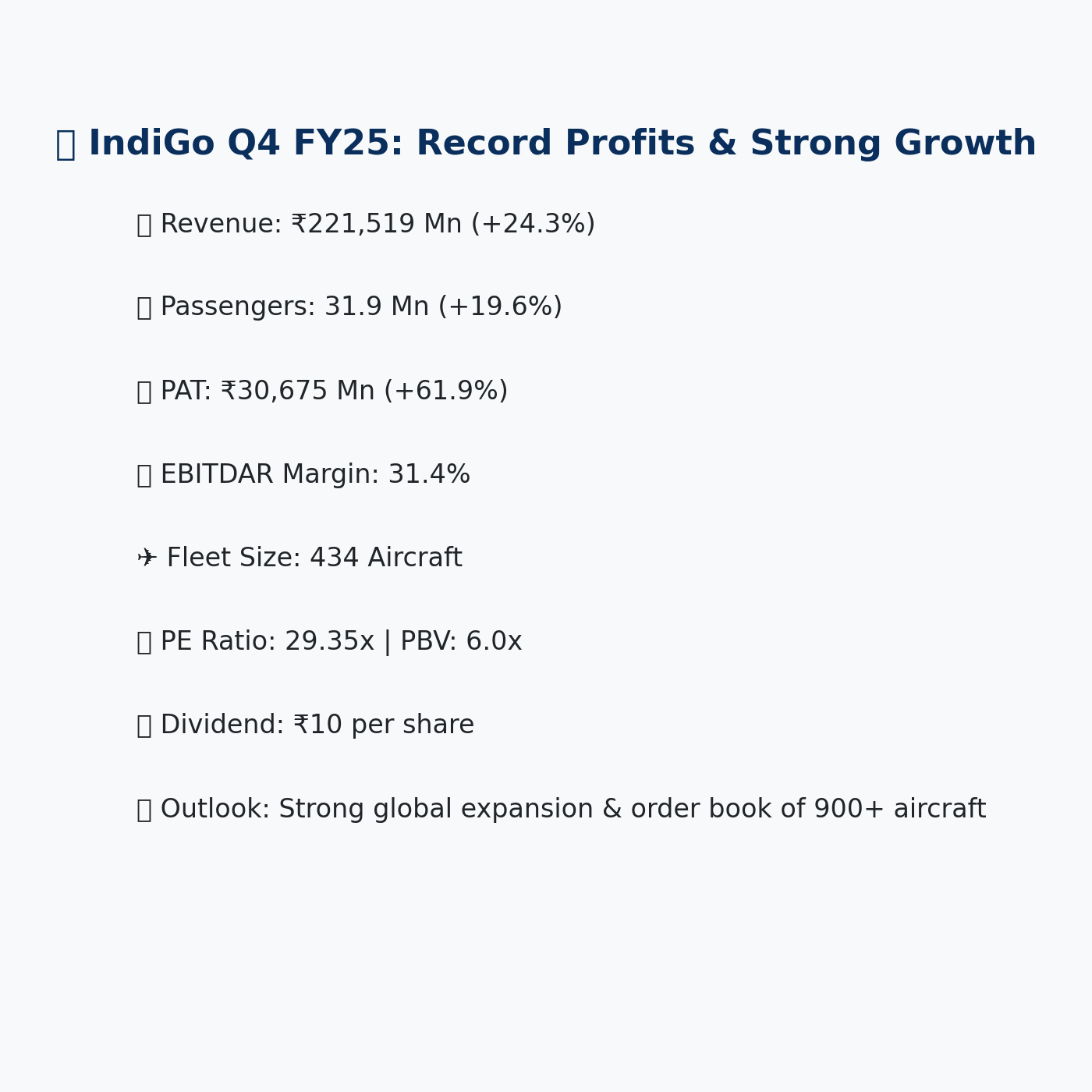

India’s largest airline, IndiGo (InterGlobe Aviation Ltd), has announced record-breaking numbers in its Q4 FY25 and full-year FY25 results, showcasing robust profitability, growing passenger volumes, and continued network expansion. The company has also achieved a historic milestone by securing its first international investment-grade credit rating (Baa3) from Moody’s — a strong validation of its balance sheet quality and execution strength.

📌 Key Operational Metrics

💰 Financial Performance

🔹 Consolidated Income Statement

📊 Balance Sheet Summary (₹ Mn)

💸 Cash Flow Statement (₹ Mn)

🏆 Key Achievements

Dividend Declared: ₹10 per share (100%)

Fleet Strength: 434 aircraft

New Destinations: Added 10+ new international cities

First Investment-Grade Rating (Moody’s): Baa3, Stable Outlook

🔮 Near-Term Outlook

✔ International expansion (Europe, Central Asia)

✔ Consistent yield and passenger growth

✔ Strong cost management (fuel cost ↓6.6% YoY in Q4)

📈 Long-Term Outlook

🚀 Rising demand for air travel in Tier 2/3 cities

🛫 900+ aircraft on order ensures long-term capacity expansion

🧾 Improving financial discipline and global credit access

⚠ Risks to Monitor

Fuel price volatility and INR depreciation

Regulatory changes in aviation or tax norms

Global economic or geopolitical disruptions

📢 Disclaimer

This analysis is for educational purposes only. It does not constitute a recommendation to buy or sell any stock. Please perform your own research.

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)