On 30 May 2025, the Press Information Bureau (PIB), Delhi, published the Provisional/Unaudited Accounts of the Government of India for FY2024-25. These numbers serve as a near-final snapshot of fiscal aggregates—revenue receipts, non-tax income, transfers to states, and a breakdown of expenditure. For stock market investors, understanding the government’s fiscal health and spending priorities is crucial, as it directly influences sectoral growth, corporate earnings, and broader macroeconomic trends.

In this blog, we will:

Summarize the key fiscal aggregates (receipts and expenditures).

Analyze how these numbers—particularly revenue generation and capital outlay—translate into sectoral and company-level impacts.

Highlight specific industries and companies poised to benefit or face headwinds.

Key Fiscal Highlights (FY2024-25 Provisional)

| Particulars | Amount (₹ crore) | % of Revised Estimates (RE) |

|---|---|---|

| Total Receipts | 30,78,247 | 97.8 % of RE 2024-25 |

| • Tax Revenue (Net to Centre) | 24,98,885 | — |

| • Non-Tax Revenue | 5,37,544 | — |

| • Non-Debt Capital Receipts | 41,818 | — |

| – Recovery of Loans | 24,616 | — |

| – Miscellaneous Capital Receipts | 17,202 | — |

| Devolution to States (Share of Taxes) | 12,86,885 | ₹1,57,391 cr higher YoY |

| Total Expenditure | 46,55,517 | 98.7 % of RE 2024-25 |

| • Revenue Expenditure | 36,03,510 | — |

| – Interest Payments | 11,16,343 | — |

| – Major Subsidies | 3,88,036 | — |

| • Capital Expenditure | 10,52,007 | — |

Source: PIB Delhi (Posted 30 May 2025)

Interpretation:

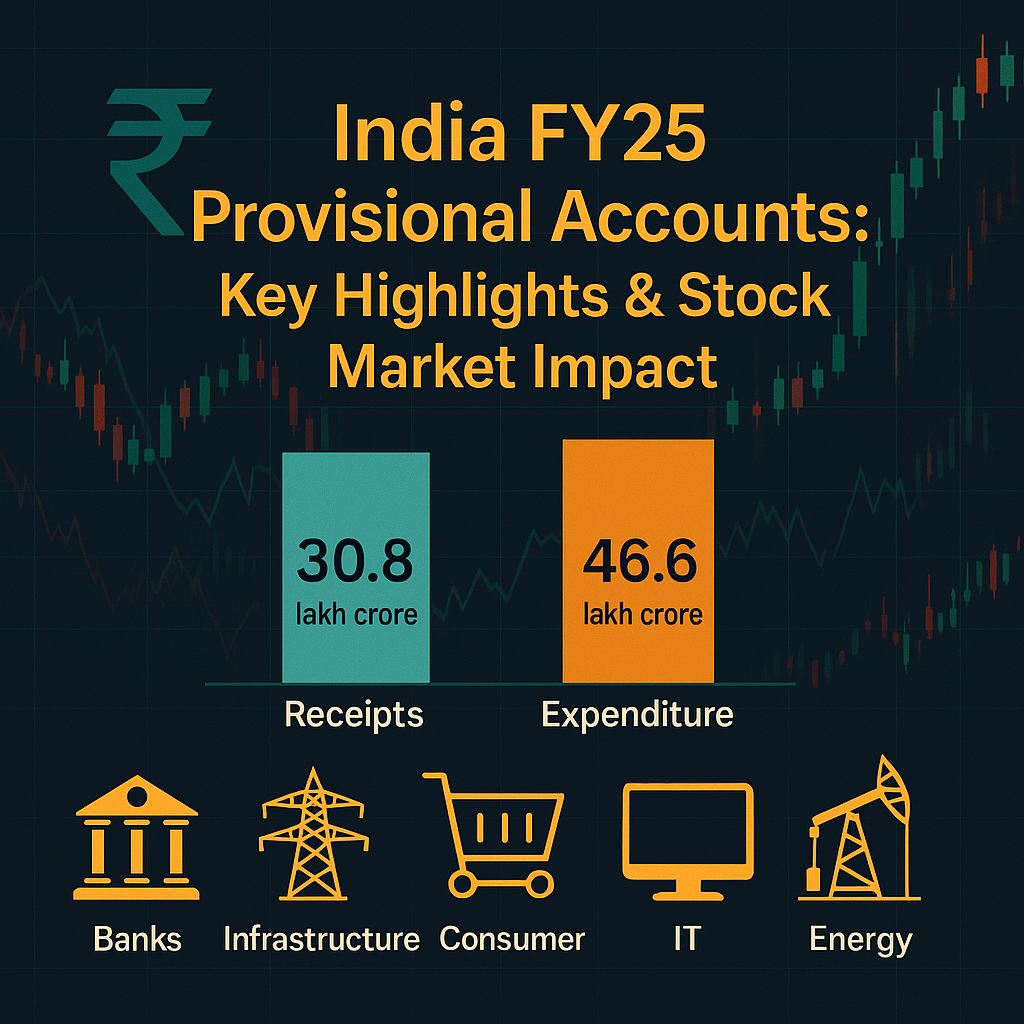

Receipts (~₹30.8 lakh crore) were almost in line with budgeted estimates, underscoring healthy tax collections and non-tax inflows.

Expenditure (~₹46.6 lakh crore) was nearly 99 % of RE, led by interest payments and capital outlay.

Large devolution to states (₹12.87 lakh crore) boosts sub-national spending capacity, which can indirectly stimulate demand.

Analysis of Revenue Receipts

Tax Revenue (₹24.99 lakh crore):

Constitutes ~81 % of total receipts.

Robust GST, direct tax collections (corporate and personal income tax) imply continued economic activity.

Implication for Banks/Financials:

Higher tax buoyancy suggests corporate profits are healthy—banks’ corporate lending and credit off-take likely solid.

PSU Banks may benefit from increased government-related transactions (e.g., GST, direct tax** flows) and dividend transfers from PSUs on profits.

Implication for Consumer & Retail:

Healthy consumption reflected in indirect taxes indicates resilient rural and urban spending.

Companies in FMCG, consumer electronics, and e-commerce can ride the consumption wave.

Non-Tax Revenue (₹5.38 lakh crore):

Includes dividends from PSUs, spectrum receipts, interest receipts, etc.

Implication for PSU Stocks:

Higher dividend/interest inflows from PSUs can translate into better balance sheets for state-owned enterprises—e.g., Coal India, ONGC, IOC.

Spectrum auctions drive telecom infrastructure players (Reliance Jio, Bharti Airtel) to recalibrate capex schedules; non-tax revenue is often lumpy.

Non-Debt Capital Receipts (₹41,818 crore):

Loans recovered (₹24,616 crore) and miscellaneous capital (₹17,202 crore).

Implication for NBFCs and Housing Finance:

Loan recoveries reflect stress-resolution in banking/finance sector.

Could signal improving asset quality for banks/NBFCs—beneficial for stocks like HDFC Ltd, Bajaj Finance.

Analysis of Expenditure

Revenue Expenditure (₹36.04 lakh crore):

Interest Payments (₹11.16 lakh crore):

Around 24 % of total expenditure goes to interest—reflects the government’s debt servicing burden.

Implication: Elevated interest outgo may cap fiscal room for capex in future budgets unless revenue receipts improve further. Keep an eye on bond yields and RBI’s monetary stance—higher yields could pressure interest costs.

Impact on Financials:

Banks may benefit from higher yields translating into better NIMs, but sustained high yields can dampen credit demand.

NBFCs face steeper funding costs; watch companies with better ALM (asset-liability management).

Major Subsidies (₹3.88 lakh crore):

Predominantly on food (PDS), fertilizers, petroleum.

Implication for Fertilizer & Ag Stocks:

Farmers’ input costs subsidized, possibly supporting rural demand.

Companies like Coromandel International, Rashtriya Chemicals & Fertilizers may see stable off-take.

Energy Sector:

Oil marketing companies (IOC, BPCL) feel the subsidy burden—profit margins hinge on ex-depot pricing and subsidy disbursements.

Capital Expenditure (₹10.52 lakh crore):

~23 % of total spending, higher than previous years—signals focus on infrastructure.

Implication for Infrastructure & Capital Goods:

Strong capex outlay benefits EPC (engineering, procurement, construction) companies (e.g., Larsen & Toubro, Reliance Infrastructure).

Railways, roads, and port development companies (IRCON, GMR Infrastructure) likely to win new orders.

Defence & Aerospace:

A significant portion of capex goes to defence modernization. Stocks like Bharat Electronics, BDL (Bharat Dynamics) can benefit.

Renewable Energy & Power Transmission:

Increasing allocation for renewable projects—positive for Adani Green Energy, Suzlon Energy, POWERGRID.

Sectoral Impact

Below is a sector-by-sector breakdown of how FY25’s provisional numbers might translate into market opportunities or risks:

1. Banking & Financial Services

Key Drivers:

• Higher tax buoyancy → healthier corporate and retail credit demand.

• Improved loan recoveries reflected in non-debt receipts → better asset quality outlook.

Companies to Watch:

PSU Banks: SBI, Canara Bank, Bank of Baroda—stand to gain from increased government transactions and potential recapitalization (if required).

Private Banks: HDFC Bank, ICICI Bank—benefit from stable credit offtake and margin expansion (assuming lending rates don’t fall too quickly).

NBFCs & Housing Finance: Bajaj Finance, HDFC Ltd, PNB Housing Finance—improving recovery environment reduces NPL provisions; however, funding costs remain a watchpoint.

2. Infrastructure & Capital Goods

Key Drivers:

• Elevated capital expenditure → new order pipeline for EPC companies.

• Budgetary focus on roads, rail, and urban infrastructure.

Companies to Watch:

EPC Majors: Larsen & Toubro (L&T), GMR Infrastructure, IRCON International.

Building Materials: UltraTech Cement, Ambuja Cements—rising infrastructure activity → higher cement demand.

Industrial Machinery & Equipment: BHEL, Bharat Heavy Electricals; Crompton Greaves—benefit indirectly as suppliers.

3. Consumer & Retail

Key Drivers:

• Strong tax collections imply robust consumption.

• Devolution of share to states → increased spending at sub-national level, boosting consumer demand, especially rural.

Companies to Watch:

FMCG: Nestlé India, Hindustan Unilever, Dabur India – rural and urban consumption.

Retail Chains: Avenue Supermarts (DMart), Trent Ltd. – footfalls improve with higher disposable income.

Two-Wheeler & Three-Wheeler: Hero MotoCorp, Bajaj Auto—rural demand revival supports vehicle sales.

4. Information Technology & IT-Enabled Services

Key Drivers:

• Government digitalization projects, e-governance, and new tech initiatives benefit IT services.

• Continued tax receipts from the sector reflect stable exports.

Companies to Watch:

Tier-I IT Services: TCS, Infosys, Wipro—steady order inflows as public sector digitization ramps up.

Mid-Tier & Niche Players: Mphasis, Persistent Systems—potential angle if government contracts awarded.

5. Energy & Utilities

Key Drivers:

• Continued subsidies (petroleum and fertilizers) imply policy support but can compress margins of Oil Marketing Companies (OMCs).

• Renewable energy capex push translates into long-term growth.

Companies to Watch:

Oil & Gas: Reliance Industries (upstream and refining), ONGC, BPCL—keep an eye on subsidy discipline and OMC under-recovery burden.

Renewables & Power Transmission: Adani Green Energy, Suzlon Energy, NTPC – mixed outlook but long-term positive.

Utilities: NTPC, Power Grid Corporation – increased transmission capex.

6. Defence & Aerospace

Key Drivers:

• Capital outlay on defence modernization was elevated in FY25.

Companies to Watch:

PSU Defence: Bharat Electronics Limited (BEL), Bharat Dynamics Limited (BDL), Hindustan Aeronautics Limited (HAL)—orderbook visibility improves.

Private Defence Suppliers: Bharat Forge, L&T (defence division)—benefit from indigenization and offset contracts.

Company-Level Implications

Banks & NBFCs (e.g., SBI, HDFC Bank, Bajaj Finance):

Recurring Transactions: Growth in tax receipts suggests sustained corporate profitability—which drives corporate deposits, advances, and fee income.

Asset Quality: Higher loan recoveries and stable economic activity could reduce credit costs.

EPC & Construction (L&T, GMR Infrastructure, UltraTech Cement):

Order Inflows: Elevated capital expenditure (₹10.52 lakh crore) means more infrastructure projects.

Raw Material Demand: Cement, steel, and machinery companies see increased demand.

Consumer Companies (HUL, Nestlé India, Avenue Supermarts):

Rural Demand Boost: Transfer of ₹12.87 lakh crore to states boosts rural consumption—key growth driver for FMCG and retailers.

Inflation Watch: Subsidies on essential items keep consumer price inflation in check, sustaining discretionary spends.

IT Services (TCS, Infosys, Wipro):

Digital Initiatives: Government’s digital push (e-governance, data centers) opens avenues for large IT contracts.

Export Stability: Healthy tax collections from the sector point to steady revenue from exports.

Energy & Utilities (Reliance, ONGC, NTPC, Adani Green):

Oil & Gas Margin Pressure: Continued subsidies may keep under-recovery costs elevated, impacting earnings of OMCs—look for potential government reimbursement timelines.

Renewable Energy Growth: Capex outlay signals policy support; long-term contracts (PPAs) in solar/wind segments create stable cash flows.

Defence (BEL, BDL, HAL, Bharat Forge):

Orderbook Visibility: Elevated defence capex ≈ new contracts/modernization orders.

Offset & Localization: Private players like Bharat Forge gain from indigenization push.

Risks & Watch-Outs

Interest Burden:

With ₹11.16 lakh crore in interest payments (~24 % of expenditure), any uptick in bond yields can pressure fiscal space in FY26. Investors in banks/finance must watch RBI’s monetary policy trajectory.

Subsidy Outflows:

₹3.88 lakh crore in major subsidies (food, fertilizer, petroleum) could strain state-owned oil companies’ margins if under-recoveries aren’t reimbursed promptly.

Global Slowdown Risks:

While domestic receipts are healthy, export-oriented sectors (IT, auto, pharma) could face headwinds from a weakening global demand environment.

State Finances:

Though central devolution to states is up by ₹1.57 lakh crore YoY, individual state fiscal health varies. Beware of states with high fiscal deficits that may borrow at higher rates—affecting local bond yields and banks’ asset quality in those regions.

Actionable Investor Takeaways

Overweight Banks & Financials (Selectively):

Tilt toward well-managed private banks (HDFC Bank, ICICI Bank) and NBFCs (Bajaj Finance, HDFC Ltd) with strong liability franchises and improving asset quality.

Consider PSU banks (SBI, Bank of Baroda) for long-term recovery plays—especially if government recapitalization remains supportive.

Infra & Capital Goods Exposure:

Increase allocation to construction & EPC (L&T, IRCON) and building materials (UltraTech Cement).

Track orderbook inflows on a quarterly basis; rerate potential as project execution picks up.

Consumer & Retail with Rural Tilt:

FMCG leaders (HUL, Nestlé India) and value retailers (Avenue Supermarts) stand to benefit from buoyant rural demand.

Watch for margin pressures from commodity inflation, but overall volume growth should be robust.

Selective Energy Plays:

Renewables: Adani Green, Suzlon—focus on companies with secured PPAs and healthy balance sheets.

Power Generation & Transmission: NTPC, Power Grid—benefit from increased capex in both green and conventional segments.

OMCs: Only if under-recovery reimbursements are timely; otherwise, margins remain challenged.

Defence & Aerospace for Secular Growth:

Allocate a small core holding to BEL or BDL for stable orderflow visibility and government-backed contracts.

Private defence suppliers (Bharat Forge, L&T defence arm) for long-term localization story.

IT Services—Quality & Execution:

Maintain exposure to tier-I IT (TCS, Infosys) with strong orderbooks; midcaps (Mphasis, Persistent) can be considered if valuations remain reasonable.

Focus on companies with digital transformation service lines, as government’s digital initiatives accelerate.

Conclusion

The FY2024-25 provisional accounts reveal a resilient revenue base (₹30.78 lakh crore receipts) and a strong capital expenditure push (₹10.52 lakh crore). For stock market investors, the biggest takeaways are:

Banking & Financials: Healthy corporate profits (implied by tax buoyancy) → strong credit demand, improved asset quality.

Infrastructure & Cap Goods: Elevated capex → orderbook growth for EPCs, cement, steel, and allied sectors.

Consumer & Rural: Higher state devolution → increased rural consumption → strong volumes in FMCG and retail.

Energy & Utilities: A dichotomy between subsidy-burdened OMCs (caution) and renewables/transmission (opportunity).

Defence & Aerospace: Modernization capex → secular growth visibility for defense manufacturers.

IT & Digital: Continued government digital spends → stable opportunities for IT services.

By aligning portfolios to these themes—while keeping an eye on interest rate trajectories, subsidy disbursement timelines, and global demand risks—investors can position themselves to capture the upside in FY26. Remember to balance cyclical exposures (infra, metals) with defensive segments (IT, select consumer staples), and continuously track quarterly fiscal updates to recalibrate allocations.

Disclaimer: This blog is for educational purposes only and does not constitute financial advice. Investors should conduct their own research before making any investment decisions.

Source: Ministry of Finance, Government of India (PIB Delhi – 30 May 2025)

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)