Source: Provisional Estimates of Annual and Quarterly GDP for FY 2024-25, Ministry of Statistics & Programme Implementation, Press Note (Posted on 30 May 2025 by PIB Delhi)

Introduction

Provisional estimates for India’s Gross Domestic Product (GDP) provide critical insight into the economy’s health and growth trajectory. For FY 2024-25, these estimates signal a moderation in growth compared to prior years, yet remain robust in the face of global uncertainties. This blog dissects:

Annual Estimates and Growth Rates

Quarterly Estimates and Growth Rates

Methodology and Major Data Sources

Subsequently, we examine implications for the Indian stock market, identify long-term investment themes and companies poised to benefit (including the newly added names), and highlight other stock-market–related takeaways derived from the press note.

I. Annual Estimates and Growth Rates

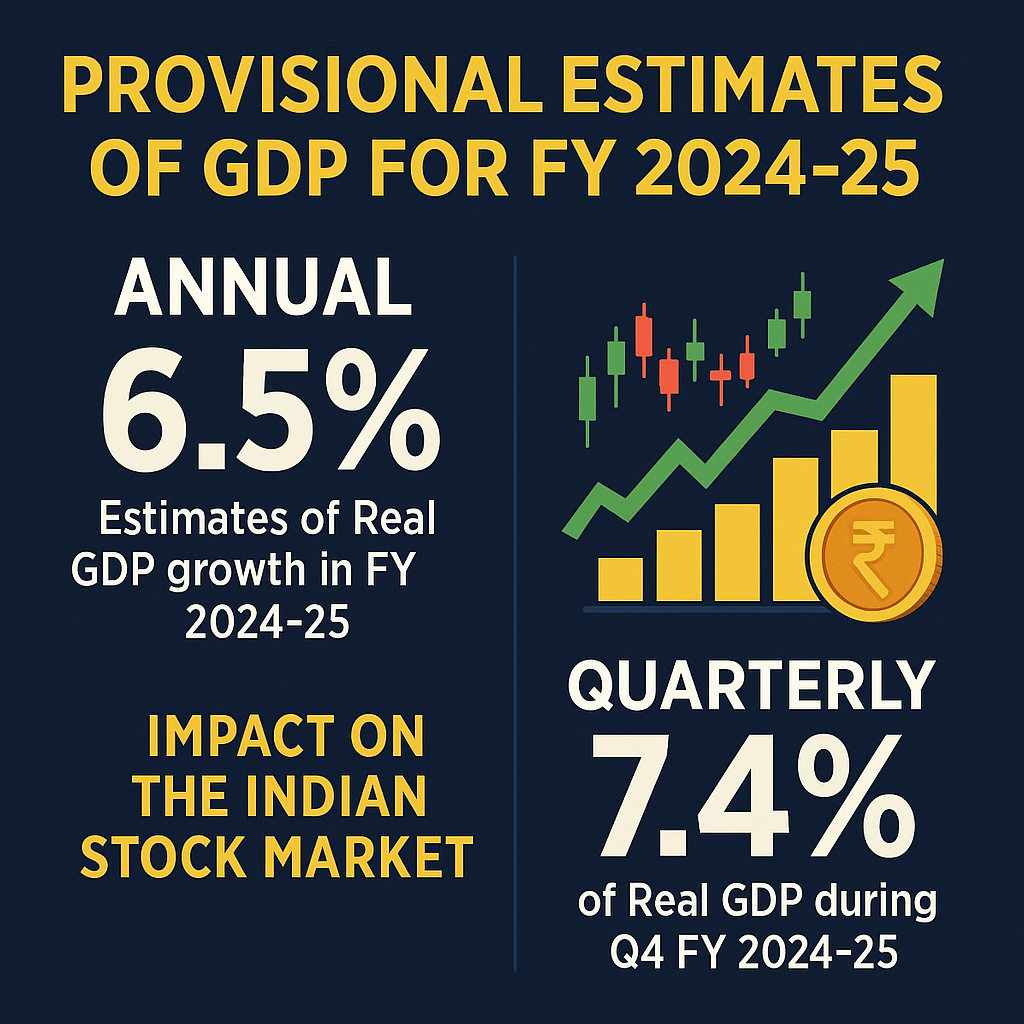

Real GDP (Constant 2011-12 Prices):

FY 2023-24 (First Revised Estimate): ₹176.51 lakh crore

FY 2024-25 (Provisional Estimate): ₹187.97 lakh crore

Growth Rate: 6.5%

Nominal GDP (Current Prices):

FY 2023-24: ₹301.23 lakh crore

FY 2024-25: ₹330.68 lakh crore

Growth Rate: 9.8%

Real Gross Value Added (GVA, Constant Prices):

FY 2023-24 (FRE): ₹161.51 lakh crore

FY 2024-25 (PE): ₹171.87 lakh crore

Growth Rate: 6.4%

Sectoral Highlights (FY 2024-25, Real GVA Growth):

Construction: 9.4%

Public Administration, Defence & Other Services: 8.9%

Financial, Real Estate & Professional Services: 7.2%

Primary Sector (Agriculture, Forestry, Fishing & Mining): 4.4% (vs. 2.7% in FY 2023-24)

Expenditure Components (FY 2024-25, Real Growth):

Private Final Consumption Expenditure (PFCE): 7.2% (vs. 5.6%)

Gross Fixed Capital Formation (GFCF): 7.1%

Key Takeaways for Investors:

✓ Real GDP growth of 6.5% indicates a healthy expansion, driven by infrastructure and services.

➡️ Construction remains the fastest-growing segment, reflecting strong government and private capex.

✓ Healthy PFCE growth suggests resilient consumer demand, a positive sign for consumer-facing companies.

➡️ Higher nominal growth (9.8%) versus real growth signals moderate inflation; still, corporate earnings have room to expand.

II. Quarterly Estimates and Growth Rates (Q4 FY 2024-25)

Real GDP (Constant Prices):

Q4 2023-24: ₹47.82 lakh crore

Q4 2024-25: ₹51.35 lakh crore

Growth Rate: 7.4%

Nominal GDP (Current Prices):

Q4 2023-24: ₹79.61 lakh crore

Q4 2024-25: ₹88.18 lakh crore

Growth Rate: 10.8%

Real GVA (Constant Prices):

Q4 2023-24: ₹42.86 lakh crore

Q4 2024-25: ₹45.76 lakh crore

Growth Rate: 6.8%

Quarterly Sectoral Highlights (Q4 FY 2024-25, Real GVA Growth):

Construction: 10.8%

Public Administration, Defence & Other Services: 8.7%

Financial, Real Estate & Professional Services: 7.8%

Primary Sector: 5.0% (vs. 0.8% in Q4 2023-24)

Quarterly Expenditure Components (Real Growth):

Gross Fixed Capital Formation (GFCF): 9.4%

Key Takeaways for Investors:

✓ Q4 outperformance (7.4% real growth) versus the annual average (6.5%) suggests momentum going into FY 2025-26.

➡️ Construction’s 10.8% quarterly surge highlights accelerated infrastructure spending.

✓ Primary sector rebound (5.0% in Q4) signals likely better rural demand in the months ahead.

➡️ Strong GFCF growth (9.4%) in Q4 indicates sustained capex across industries, boding well for industrial and capital goods firms.

III. Methodology and Major Data Sources

Benchmark-Indicator Method:

Annual and quarterly estimates are extrapolated from the prior year’s estimates (FY 2023-24) using leading indicators.

Key Indicators Employed (up to 27 May 2025):

Index of Industrial Production (IIP).

Financial performance of listed companies (latest quarterly results up to Q4).

Agriculture & Allied: Second advance estimates of crop production, livestock products, fish production.

Mining & Quarrying: Production of coal, crude oil, natural gas, cement; steel consumption.

Transportation: Rail net tonne-kilometres, passenger-kilometres; air passenger & cargo traffic; port cargo traffic.

Automotive: Sales of commercial vehicles.

Banking & Finance: Bank deposits & credit growth; insurance premium data (life & non-life).

GST-based Outward Supply of Goods & Services.

Government Accounts: Central & State expenditures, tax collections (GST and non-GST).

Taxes & Subsidies (Current vs. Constant):

Taxes on products: Sourced from CGA/CAG websites; volume extrapolation for constant-price estimates.

Product subsidies (central & state) compiled from budgeted expenditure data.

Data Caveats:

❗ Estimates are provisional and may be revised as more accurate data become available.

❗ Subsequent releases (e.g., Q1 FY 2025-26 due on 29 Aug 2025) will incorporate updated source agency data.

IV. Impact on the Indian Stock Market

A 6.5% real GDP growth in FY 2024-25, coupled with 7.4% in Q4, paints a picture of steady expansion. For equity investors, identifying sectors and companies that leverage this growth is paramount. Below, we outline key themes and company watch-lists (including additions):

Infrastructure & Construction

Banking & Financial Services

Consumer & Retail

Information Technology & IT-Enabled Services

Energy & Utilities

Agri & Agrochemicals

Pharma & Life Sciences

V. Companies to Watch for Long-Term Investment

Based on sectoral momentum and policy tailwinds, the following names merit attention for a long-term (3–5 year) horizon. This list is illustrative—conduct regular due diligence on each:

| Sector | Company | Rationale |

|---|---|---|

| Infrastructure & Construction | Larsen & Toubro (L&T) | Diversified EPC order book, strong government backlog, digital/automation services. |

| UltraTech Cement | Largest cement manufacturer, scaling capacity, pricing power in key markets. | |

| PNC Infratech (PNC Infra) | NHAI hybrid annuity model (HAM) projects, strong BOT portfolio. | |

| Godrej Properties | Residential demand aided by rural & semi-urban income growth. | |

| Banking & Financial Services | HDFC Bank | Superior asset quality, digital leadership, high CASA ratio. |

| Kotak Mahindra Bank | Granular retail portfolio, low leverage, high capital adequacy. | |

| Bajaj Finance | Leadership in consumer loans/SME financing, robust NIMs, best-in-class risk management. | |

| Bajaj Housing Finance | Growing affordable housing finance portfolio; tie-ups with developer networks; retail loan growth. | |

| HDFC Asset Management Company (HDFC AMC) | Leading mutual fund house with strong AUM growth; diversified equity & debt schemes; brand recall. | |

| Consumer & Retail | Hindustan Unilever (HUL) | Pan-India distribution, rural reach, premiumization, consistent margin profile. |

| Reliance Retail (RIL subsidiary) | Fastest-growing offline & online retail network, integrating Jio platforms. | |

| DMart (Avenue Supermarts) | Efficient cost management, high footfall stores, strong same-store sales growth, rural expansion. | |

| ITC Limited | Diversified conglomerate: FMCG, Hotels, Paper, Agri; strong cash flows, attractive dividend yield. | |

| Information Technology & IT-Enabled Services | Tata Consultancy Services (TCS) | Market-leading deal wins, digital transformation tailwinds, margin expansion, global diversification. |

| Infosys / Wipro | Strong order books; focus on cloud, AI, cybersecurity. | |

| HCL Technologies | Niche in engineering R&D and digital services. | |

| Affle | Mobile advertising and analytics platform; growing footprint in digital marketing solutions; high-margin business model. | |

| MapmyIndia | Geospatial mapping & location intelligence; strategic tie-ups for digital maps; strong eGov and enterprise demand. | |

| Energy & Utilities | Power Grid Corporation | Monopoly in interstate transmission with stable regulated returns. |

| Adani Green Energy | Aggressive capacity additions, long-term PPAs, government support for renewables. | |

| NTPC / NTPC Renewable Energy | Government’s largest power generator; diversification into solar/wind. | |

| Torrent Power | Mix of generation & distribution; focus on rooftop solar. | |

| IREDA (Indian Renewable Energy Development Agency) | Apex financial institution for renewable energy projects; stable credit profile; high growth as green energy policy intensifies. | |

| Waaree Energies | Leading solar PV module manufacturer; export-oriented; beneficiary of domestic solar capex push. | |

| Agri & Agrochemicals | PI Industries | Improving R&D pipeline, strong export orientation, stable margins. |

| Mahindra & Mahindra (Tractor Segment) | Leading tractor manufacturer; rural demand outlook supportive. | |

| KRBL Ltd. | Basmati rice exporter; benefiting from record rice production. | |

| Pharma & Life Sciences | Dr. Reddy’s Laboratories | Diversified portfolio (formulations, API, biosimilars), strong R&D, global presence. |

| Sun Pharma | Largest domestic pharma, global exports portfolio, specialty therapies focus. | |

| Divi’s Laboratories | Leading manufacturer of active pharmaceutical ingredients (APIs); strong export order book; R&D-driven specialty ingredients. |

✅ Stock-Market Insight:

Look for companies with robust order books (e.g., L&T, PNC Infra), pricing power (UltraTech Cement, HUL), and high-margin business models (Affle, HDFC AMC).

In Banking & Financial Services, prefer high CASA ratios (HDFC Bank), granular retail loans (Kotak Mahindra), and affordable-housing finance (Bajaj Housing Finance).

DMart stands out in retail thanks to its focus on everyday low pricing and efficient supply chain.

Renewable Energy names—IREDA and Waaree Energies—are poised to benefit from India’s net-zero commitments and solar capex.

IT/ITeS firms like Affle and MapmyIndia cater to the digital economy—monitor their ad-revenue growth and enterprise contracts.

Divi’s Laboratories in Pharma: API strength, long-term global contracts, and R&D orientation support stable margins and potential multiple expansions.

VI. Other Stock-Market–Related Details

Inflation & Nominal Growth: Nominal GDP grew 9.8%, indicating mild inflation (~3.3% implied). Moderate inflation supports corporate pricing power without choking demand.

Government Expenditure: Robust Public Administration & Defence growth (8.9% annually; 8.7% in Q4) suggests elevated government spending. Defense, infrastructure, and welfare outlays can bolster related businesses (e.g., defense suppliers, public sector undertakings).

High-Frequency Indicators: The methodology leverages IIP, GST collections, banking credit growth, and corporate financial results. Investors should track monthly GST growth, IIP releases, and bank credit growth as leading signals for quarterly GDP revisions.

Exports & Services: Healthy services growth implies strong services exports (IT, BPO, remittances, tourism). Monitor trade data—especially in IT (TCS, Infosys, Affle) and pharmaceuticals (Divi’s, Dr. Reddy’s)—for earnings guidance.

VII. Additional Observations

GST Receipt Trends: Strong GST growth generally signals resilient consumption and industrial activity. Investors should watch monthly GST collection data for potential early signals of earnings beats in consumer, auto, and capital goods sectors.

Bank Credit Growth: Rising credit to industry and retail suggests an uptick in lending demand, which often precedes revenue growth in cyclical businesses. Track RBI’s monthly banking data for sector-wise credit flows; this supports names like Bajaj Finance, HDFC AMC, and Bajaj Housing Finance.

IIP & PMI Data: A rebound in the Purchasing Managers’ Index (PMI, manufacturing & services) above 50 typically correlates with GDP upside surprises. IIP Y-o-Y growth in mining, manufacturing, and electricity also helps anticipate sectoral earnings.

Fiscal Deficit & Government Borrowing: While not explicitly in the press note, rising Public Administration growth hints at higher government expenditure. Fiscal discipline (deficit targets) will impact interest rates, bond yields, and banking sector net interest margins.

Inflation Trajectory: The spread between nominal (+9.8%) and real (+6.5%) GDP growth (~3.3%) approximates inflation. If inflation remains under RBI’s 4% target, real growth momentum can be sustained without monetary tightening.

Disclaimer

Disclaimer: This blog is intended for educational purposes only and does not constitute financial advice or a recommendation to buy or sell any securities. Investors should conduct their own thorough research.

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)