📊 India’s Q1 FY2025-26 GDP Analysis: What Investors Need to Know

Title: India GDP Q1 FY2025-26 Report – Key Insights & Investor Takeaways

Description: India’s GDP grew 7.8% in Q1 FY2025-26. Explore sector-wise performance, top indicators, and actionable investment strategies for long-term wealth.

🔎 Introduction

India’s economy started FY2025–26 on a strong footing. According to the National Statistics Office (NSO), real GDP expanded by 7.8% in Q1 (April–June 2025), higher than 6.5% growth in the same quarter last year. The recovery is being powered by robust industrial and service activity, while agriculture showed moderate improvement.

For investors, this macro data is not just a growth signal—it’s a sectoral map of where opportunities and risks lie.

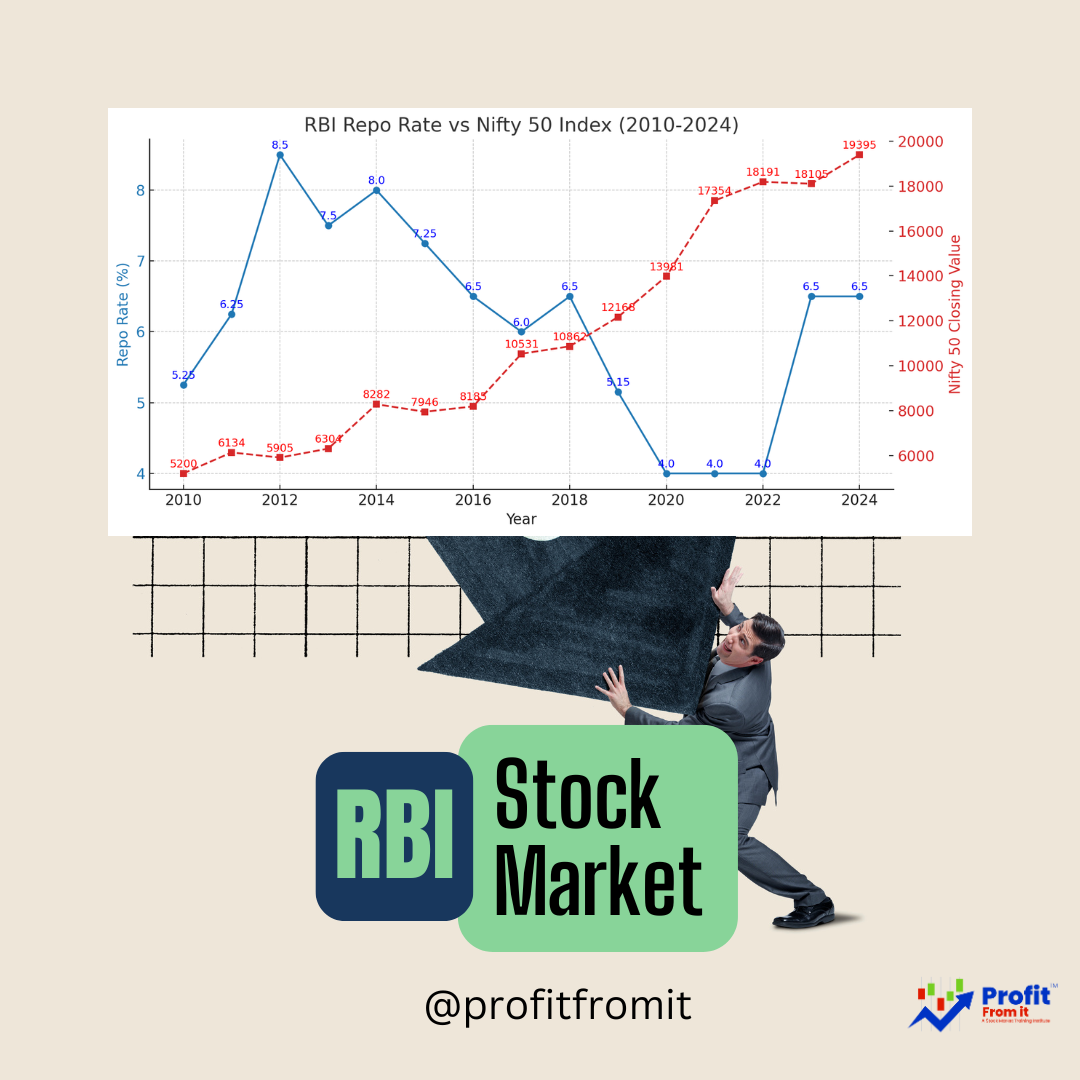

📈 Historical Growth Trend (Q1 – Last 4 Years)

Q1 FY2022–23: 13.5% (post-pandemic surge)

Q1 FY2023–24: 7.9%

Q1 FY2024–25: 6.5%

Q1 FY2025–26: 7.8%

👉 Growth momentum is back, showing India’s structural resilience amid global volatility.

🔑 Key Highlights of Q1 FY2025–26 GDP

Real GDP: ₹47.89 lakh crore, growth 7.8% YoY

Nominal GDP: ₹86.05 lakh crore, growth 8.8% YoY

Private Consumption (PFCE): +7.0% (vs 8.3% last year)

Government Spending (GFCE): +7.4% (bounce back from -0.3% last year)

Investments (GFCF): +7.8% (capex-led momentum)

Exports: +6.3% | Imports: +10.9% (trade deficit widening)

🏭 Sector-Wise Performance

🌾 Agriculture & Allied (15% of GVA)

Growth: 3.7% (up from 1.5% last year)

Drivers: Foodgrain & horticulture output, livestock.

Investor Impact: Positive for agri-inputs, fertilizers, irrigation, tractors, FMCG rural demand.

⛏️ Mining & Quarrying (2% of GVA)

Growth: -3.1% (decline)

Weakness in coal, crude oil, and natural gas output.

Investor Impact: Upstream energy & mining players pressured; cement/steel benefit from lower input costs.

🏭 Manufacturing (14% of GVA)

Growth: 7.7%

Supported by capital goods demand (+9.8% IIP).

Investor Impact: Favourable for industrials, auto ancillaries, engineering companies.

🏗️ Construction (9% of GVA)

Growth: 7.6%

Driven by infra push & housing demand.

Investor Impact: Strong outlook for cement, steel, infra developers.

⚡ Utilities (3% of GVA)

Growth: 0.5%

Drag from lower electricity output.

Investor Impact: Power utilities may see margin pressure near term.

💼 Services (52%+ of GVA, highest growth contributor)

Overall Growth: 9.3%

Trade, hotels, transport: 8.6%

Financial & real estate: 9.5%

Public admin & defence: 9.8%

Investor Impact: Banks, NBFCs, real estate, hospitality, logistics, and IT remain structural winners.

📊 Top Performers vs Laggards

Winners:

✅ Services (9.3%)

✅ Manufacturing (7.7%)

✅ Construction (7.6%)

Struggling Sectors:

❌ Mining (-3.1%)

❌ Utilities (0.5%)

❌ Private Vehicles Sales (-5.4%)

💡 What This Means for Investors

Banking & Financials: Strong credit (+10.4%) and deposits (+10.3%) → BFSI earnings momentum.

Infra & Capex Cycle: GFCF +7.8% → Big boost for capital goods, cement, engineering, infra.

Consumption: Slower PFCE → FMCG & 2-wheeler demand still cautious; urban stronger than rural.

Exports vs Imports: Trade deficit rising → Negative for rupee, but positive for import-dependent sectors.

Agri Economy: Rural demand revival potential—positive for fertilizers, seeds, tractors, FMCG.

🛠️ Investor Strategy

Overweight: Banking, Infra, Capital Goods, Hospitality, Logistics.

Neutral: FMCG, IT (steady but global risks remain).

Underweight: Mining, Utilities, Upstream Oil & Gas.

📝 Conclusion

India’s Q1 FY2025–26 GDP report confirms the resilient growth story with 7.8% expansion, driven by services and manufacturing. For investors, the message is clear:

🔑 Align with India’s capex cycle, financial deepening, and service sector growth.

⚠️ Be cautious in energy/mining where structural challenges persist.

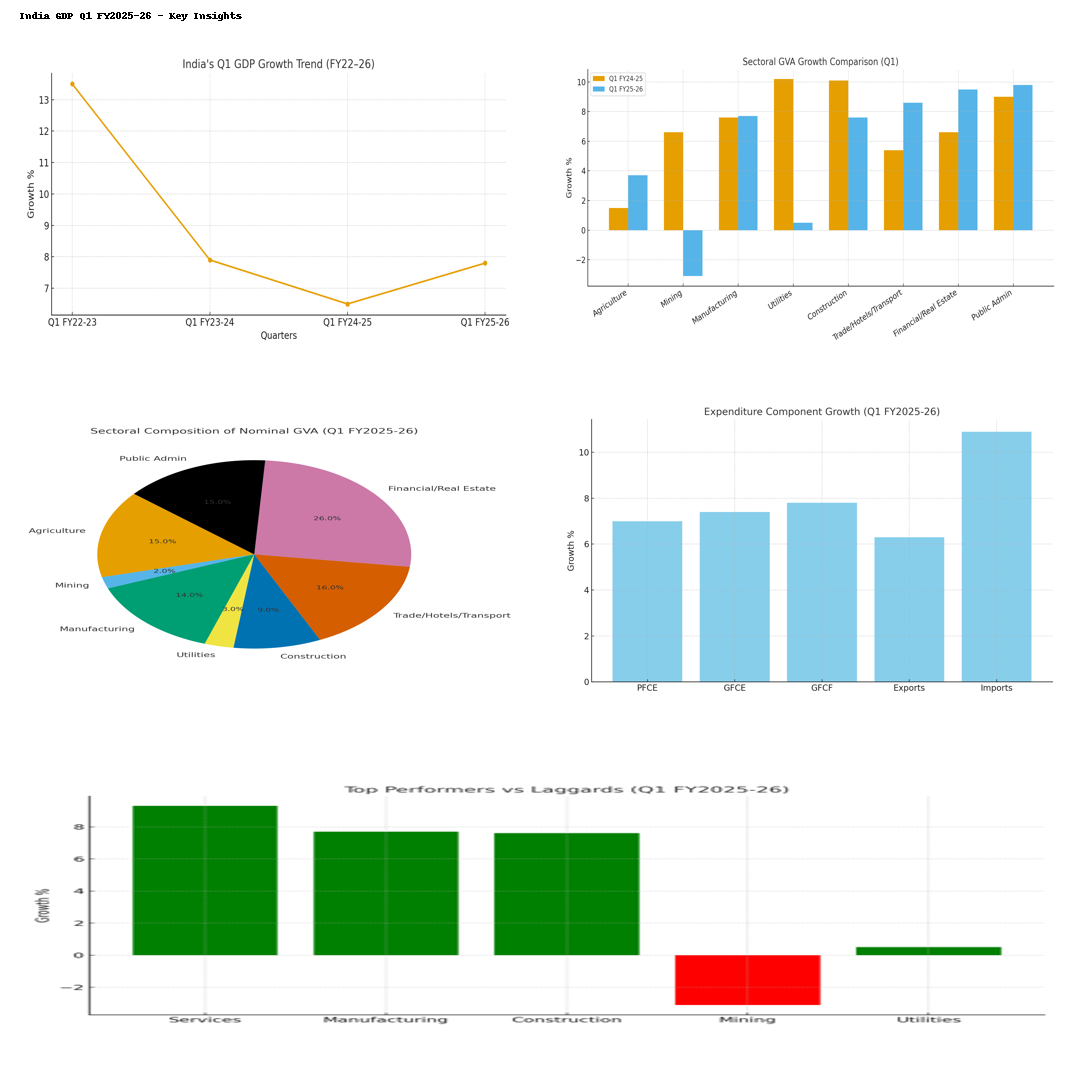

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)