India–UK Free Trade Agreement: A Transformative Leap for Indian Investors

Introduction

India and the United Kingdom have successfully concluded a landmark Free Trade Agreement (FTA), announced on 6th May 2025. This FTA is a strategic step towards enhancing economic ties between the two countries, promoting trade, investment, and job creation. The agreement is expected to have a transformative impact on multiple sectors of the Indian economy, aligning with India’s vision of becoming a global economic powerhouse.

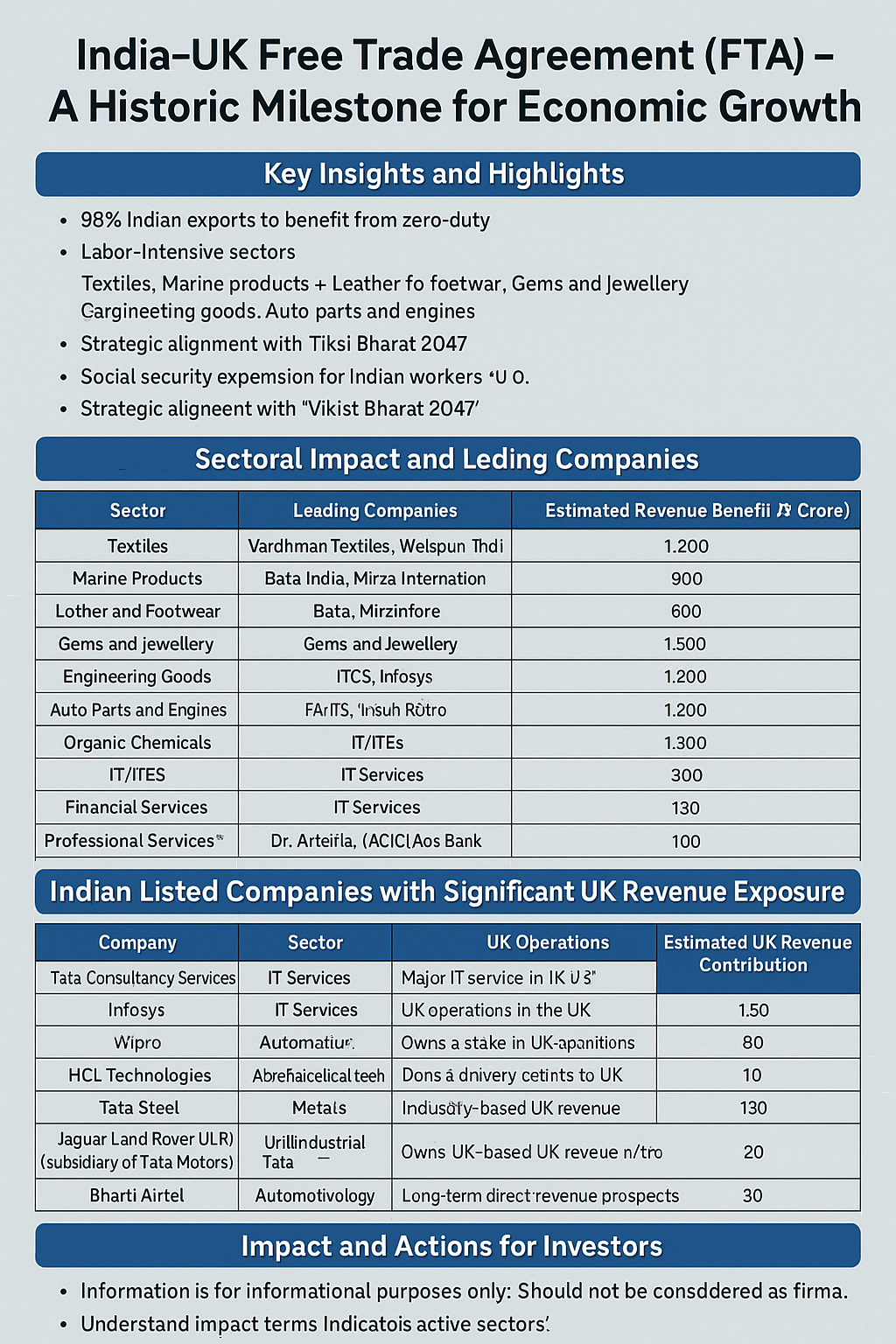

Key Insights and Highlights

Historic FTA: The India-UK Free Trade Agreement is a comprehensive deal that aims to boost bilateral trade, create jobs, and enhance global competitiveness for both nations.

Zero-Duty Exports: 99% of Indian exports to the UK will benefit from zero-duty access, enhancing the competitiveness of Indian products in the UK market.

Labour-Intensive Sector Growth: The FTA provides significant opportunities for Indian sectors such as:

Textiles

Marine Products

Leather and Footwear

Gems and Jewellery

Engineering Goods

Auto Parts and Engines

Organic Chemicals

Service Sector Expansion: Indian professionals in IT/ITeS, financial services, professional services, educational services, and other business services will gain enhanced market access.

Social Security Exemption: Indian workers in the UK are exempted from social security payments for three years under the Double Contribution Convention, making Indian service providers more competitive.

Sectoral Impact and Leading Companies

Indian Listed Companies with Highest UK Revenue Exposure

Impact and Actions for Investors

Enhanced Export Competitiveness: Indian exporters, especially those in labour-intensive and technology sectors, will gain a significant advantage due to zero-duty access in the UK.

Rising Revenue for Leading Companies: Investors should focus on companies that have strong exposure to the UK market.

Boost for Service Sector: IT/ITeS, financial, and professional services will see increased demand from the UK.

Impact and Action for Investors

Immediate Impact

Export-oriented companies are likely to see improved margins and higher export volumes.

IT/ITeS and professional services firms benefit from easier market access and lower costs.

MSMEs and startups gain new opportunities in the UK market, especially in technology and innovation.

Recommended Actions

Increase exposure to export-driven companies in textiles, engineering, gems, and IT.

Identify mid-cap and small-cap stocks with direct UK revenue for potential outperformance.

Monitor quarterly results for UK-specific growth in sales and margins.

Consider thematic funds focused on export and global trade.

Near-Term and Long-Term Outlook

Near-Term (6–12 months)

Gradual uptick in export orders and improved quarterly results from leading beneficiaries.

Stock price momentum in major exporters and IT companies.

Monitor currency trends (INR–GBP) for short-term volatility.

Long-Term (2026–2030)

Sustained revenue growth as trade volumes double.

Job creation and skill development in export-oriented sectors.

Greater global integration for Indian companies, especially in manufacturing and services.

New investments and JVs between Indian and UK firms.

Disclosure

This blog is for informational purposes only and should not be considered as financial advice. Investors are advised to conduct their own research before making any investment decisions.

Comments (0)

Categories

Recent posts

ITC Hotels and its strategic plans ...

30 Dec 2024

Reliance Leads Energy Revolution: 100% ...

22 Jan 2025 for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)

📊 Analysis of Nifty 500 Companies: ...

14 Feb 2025