Introduction

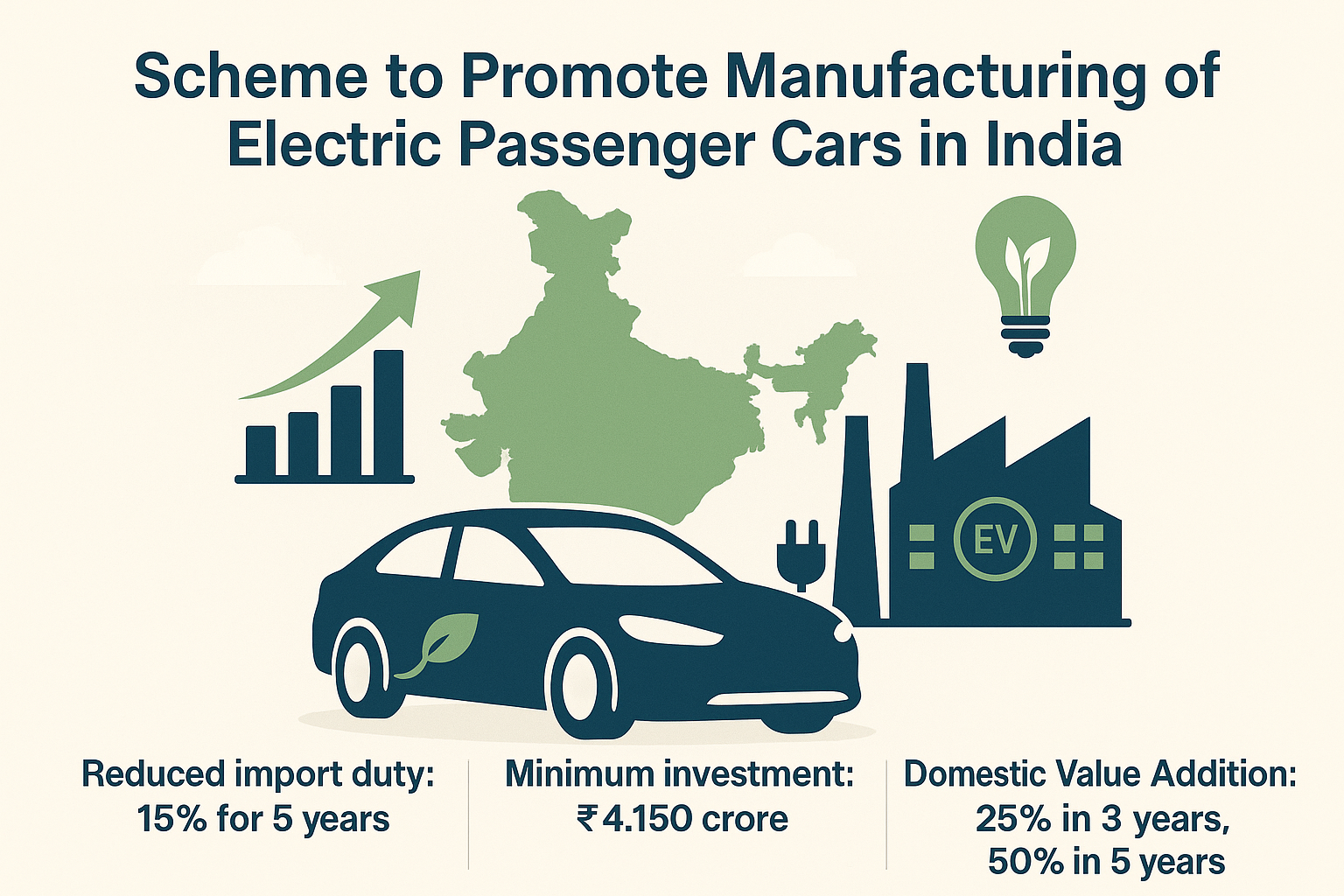

On June 2, 2025, the Ministry of Heavy Industries (MHI) issued detailed guidelines for the Scheme to Promote Manufacturing of Electric Passenger Cars in India (SPMEPCI). Aligned with India’s target of reaching net-zero emissions by 2070, the scheme aims to catalyze fresh investments—particularly from global Original Equipment Manufacturers (OEMs)—in the domestic electric vehicle (EV) passenger-car segment. As an investor, understanding this policy framework is crucial, since it reshapes the competitive landscape, strengthens India’s position as a manufacturing hub, and offers opportunities for long-term value creation.

Scheme Overview

Objectives

Encourage major global EV OEMs to establish manufacturing facilities in India.

Support “Make in India” and “Aatmanirbhar Bharat” by mandating Domestic Value Addition (DVA).

Drive employment generation and foster sustainable mobility.

Position India as a premium destination for automotive manufacturing and innovation.

Key Incentives

Reduced Import Duty: Approved applicants can import Completely Built-up Units (CBUs) of electric 4-wheelers (e-4W) with a Minimum CIF value of USD 35,000 at a reduced customs duty of 15% (versus the standard 60%+), valid for up to 5 years from approval.

Import Cap: Up to 8,000 CBUs per year, with carryover of unused quotas permitted.

Duty Foregone Limit: Cumulative reduced duty benefits capped at the lower of Rs. 6,484 crore or the applicant’s committed investment (minimum Rs. 4,150 crore).

Investment & DVA Requirements

Minimum Investment Commitment:

₹4,150 crore (~USD 500 million) within a 3-year window from approval.

No upper limit on total investment.

Domestic Value Addition (DVA) Milestones:

25% DVA within 3 years of approval.

50% DVA within 5 years of approval.

Eligible Expenditure:

New plant & machinery (excluding land).

Buildings (up to 10% of committed investment).

Charging infrastructure (up to 5% of committed investment).

Engineering research & development (ER&D).

Bank Guarantee:

Equivalent to either total duty foregone or ₹4,150 crore (whichever is higher), valid throughout the scheme period.

Eligibility Criteria (Table I)

| Parameter | Threshold |

|---|---|

| Global Group Revenue (latest audited year) | ≥ ₹10,000 crore |

| Global Group Fixed Assets (latest audited year) | ≥ ₹3,000 crore |

Note: “Group Company” implies ≥ 26% voting‐right control between entities.

Application Timeline

Application Window: 120 days (or more) from notification, with MHI reserving the right to reopen until March 15, 2026.

Application Fee: Non-refundable ₹5 lakhs.

Formal online application link to be published shortly on MHI’s website.

Implications for the EV Sector

1. Accelerated Localization & Supply-Chain Development

By tying reduced import duties to DVA targets, the scheme incentivizes global OEMs to accelerate localization of critical components, including:

Battery packs & modules (cell assembly, BMS procurement).

Electric drivetrains (motors, inverters).

High-voltage wiring harnesses.

Localization drives the emergence of tier-2 & tier-3 suppliers, which in turn fosters Indian sub-component manufacturing capabilities. Consequently:

Employment Generation: Manufacturing plants (automobile & ancillary) can add tens of thousands of direct jobs over a 3-5 year period.

Supply-Chain Resilience: Sourcing key EV parts domestically reduces dependency on imports, insulating the sector from currency fluctuations and global supply disruptions.

2. Shift in Competitive Dynamics

Domestic OEMs (Tata Motors, Mahindra & Mahindra, Maruti Suzuki, Ashok Leyland) will need to accelerate EV product launches, R&D, and capacity expansions to remain competitive.

Global Entrants (e.g., Hyundai/Kia, MG Motor, BYD, potentially Tesla) see a compelling reason to invest in India, leveraging duty concessions to test-market premium EV models.

Traditional ICE Players must retool existing facilities or establish greenfield EV plants, which can strain near-term cash flows but offer long-term upside.

3. Potential Reduction in Vehicle Prices

Though the reduced import duty applies only to high-value CBUs (CIF ≥ USD 35,000) and only for 5 years, economies of scale in localized EV manufacturing can:

Compress vehicle production costs.

Drive down end-customer prices by 10–20% over a 5-year horizon (estimated).

Encourage wider EV adoption, accelerating fleet electrification.

4. Boost to Charging Infrastructure and Ancillary Services

The scheme allows up to 5% of committed investment on charging infrastructure. This injection of capital will:

Stimulate installation of fast-charging stations around major highways & urban centers.

Catalyze growth of EV-friendly real-estate developments (e.g., malls, offices).

Enhance after-sales service networks, including battery swapping or replacement facilities.

Companies to Watch for Long-Term

Focusing on companies with strong EV roadmaps, financial robustness, and visible capacity expansions:

| Company | Business Segment / EV Initiatives | Recent EV-Related Actions |

|---|---|---|

| Tata Motors Ltd. | - Market leader in Indian EV segment with models like Nexon EV, Tigor EV. - Plans to invest ₹10,000 crore over 3 years in EV R&D & capacity. | - Announced Gigafactory JV with Tata Group’s JV for battery cell manufacturing. - Capacity expansion: New EV plant in Pune (capacity: 200,000 units). |

| Mahindra & Mahindra Ltd. | - Pioneer in Indian EV pickups; launched e-Verito, e-KUV100. - Partnered with Ford for EV platform development. | - Commissioned EV component manufacturing facility (Chakan, Maharashtra). - Plans to launch a new EV SUV (2025). |

| Maruti Suzuki India Ltd. | - Late entrant; announced partnership with Toyota for EV platform. - Prototype EV (eVX) ready; production expected 2026. | - Increased R&D spend by 25% in FY25 (to ₹1,200 crore) for EV/Hybrid tech. - Signed MoU with battery maker to co-develop cells by 2027. |

| Mahindra Electric | - Wholly owned subsidiary; focuses on e-Auto, e-2W, e-3W, and e-4W light commercial vehicles. | - Collaboration with Ola Electric for 2W components. - Commissioned 1GWh battery assembly unit (Bengaluru). |

| BYD India | - Global EV giant; launched e6 electric MPV & Dolphin hatchback. | - Announced ₹1,000 crore investment to expand EV plant in Andhra Pradesh (capacity: 100,000 units). |

| MG Motor India | - Retailing ZS EV SUV; project “Rise” to localize EV production. | - Set up new EV assembly line at Halol plant (Gujarat). - Plans ₹2,000 crore capex to localize key parts by 2026. |

| Hyundai Motor India Ltd. | - Launched Kona EV, Ioniq 5. Plans multiple EV launches by 2026 (e.g., Ioniq 7). | - Commissioning second EV line in Sriperumbudur plant (capacity: 50,000 units). - Investing in battery module assembly (capacity: 2GWh). |

| Reliance Industries Ltd. | - Through Reliance New Energy Solar (RNES), planning gigafactories for Li-ion cells. | - Partnered with Jio - Adani JV for battery precursors. - Target: 10GWh capacity by 2027. |

| Exide Industries Ltd. | - Leading battery maker; eyeing EV battery manufacturing. | - Announced JV with Suzuki to produce EV batteries (capacity: 1.5GWh by 2025). - R&D center for solid-state battery research. |

| Tata Consumer Products | Note: Not a direct EV player but part of Tata Group; may benefit from industrial expansion | - |

Table 1: Selected companies with EV initiatives & recent actions.

Investment Considerations

Valuation Metrics

Tata Motors (NSE: TATAMOTORS):

P/E (FY26E): ~25x (Industry EV peer: 30–35x).

EV/Sales (FY26E): ~0.8× (Global EV OEM avg: 1.5×).

Mahindra & Mahindra (NSE: M&M):

P/E (FY26E): ~28x.

ROCE (FY25): 15% (vs. Auto sector avg: 12%).

Mahindra Electric (Subsidiary): Smaller cap, higher multiple but plays niche commercial EV segment.

Policy Risks & Timelines

Applicants must meet DVA targets—failure can trigger clawbacks.

Three-year window for plant commissioning means investors should monitor execution schedules closely.

Global semiconductor or battery raw-material supply constraints could delay production.

Market Demand

Domestic EV passenger-car penetration (FY25): ~5.2% of total PV sales.

Government’s FAME (Faster Adoption & Manufacturing of Hybrid & EV) subsidies tapering by March 2025.

Rising urban pollution, lower operating costs, and improving charging network will accelerate adoption—targeting 30–35% EV share by FY30.

Technology & R&D

Battery cost remains ~US $120–$130/kWh (June 2025); long-term goal to reach $80–$90/kWh by 2028.

Companies investing in solid-state battery R&D (Exide, Tata) may gain an edge by FY30.

Software & digital features (ADAS, connectivity, over-the-air updates) will differentiate premium EVs (e.g., Hyundai Ioniq 7, MG’s upcoming SUV).

Sector Impact Analysis

Automotive Manufacturing GDP Contribution

Pre-scheme (FY24): Automobile manufacturing contributed ~7.1% to India’s GDP.

Post-scheme: Projected incremental GDP boost of ₹15,000–₹20,000 crore annually by FY28 via new plant investments and allied industries.

Employment & Skill Development

Direct jobs in new EV plants: Estimated 15,000–20,000 by 2027.

Indirect jobs (tier-2/3 suppliers, charging infra, service centers): ~30,000–40,000 by FY30.

Upskilling programs (e.g., automotive electrician, battery cell technicians) will be crucial.

Supply-Chain Localization

Battery cell manufacturing: India aims for 50 GWh domestic capacity by 2030; scheme accelerates early movers.

Raw materials (lithium, nickel) sourcing: Companies like Tata and Reliance exploring partnerships for local precursor production.

Environmental & Social Impact

CO₂ emission reduction target: ~7 million tonnes per year by FY30 if EV adoption reaches 20% of PV sales.

Air-quality improvement in Tier-1 cities (e.g., Delhi, Mumbai) by 15–20% PM2.5 reduction.

Enhanced energy security: Reduced diesel/petrol import bill by ~$2 billion by FY30.

Companies to Monitor: Detailed Profiles

This section provides brief investor-focused snapshots of select companies.

Tata Motors Ltd. (NSE: TATAMOTORS)

EV Portfolio: Nexon EV, Tigor EV, X Pro (due 2026).

Strengths: Backed by Tata Group’s deep pockets; JV with Panasonic for battery cells; established dealer network.

Risks: Global commodity price exposure; aftermarket service costs can be high initially.

Mahindra & Mahindra Ltd. (NSE: M&M)

EV Portfolio: eXUV300 (launched Q1 FY26), eBolero, eVerito (fleet segment).

Strengths: Early mover in domestic EV LCV/LCV segment; solid balance sheet (net debt/EBITDA: 1.2×).

Risks: Unproven premium EV consumer market penetration; capital intensive to scale EV platform.

Maruti Suzuki India Ltd. (NSE: MARUTI)

EV Plans: eVX concept; partnering with Toyota for e-Axle tech.

Strengths: Deep rural distribution; cost leadership in ICE cars; superior service network.

Risks: Late EV entry; internal combustion engine (ICE) business decline risk; margin pressure.

BYD India Pvt. Ltd.

EV Models: Dolphin, e6, Atto 3 (planned).

Strengths: Global leader in EV tech; strong battery integration; price-competitive.

Risks: Limited brand recall; after-sales network still building.

MG Motor India (SAIC Motor)

EV Offering: ZS EV, Comet (upcoming sub-₹15 lakh EV).

Strengths: Early premium EV entrant; good tech tie-ups (SAIC, General Motors).

Risks: Relatively low volumes; dependent on imported components until full localization.

Conclusion

India’s SPMEPCI represents a paradigm shift in the EV passenger-car manufacturing landscape. By aligning duty concessions with minimum investment and DVA targets, the scheme strikes a balance between luring global OEMs and building indigenous capabilities. As an investor, monitoring how companies—both domestic and foreign—navigate these policy incentives is critical. Firms with robust balance sheets, clear EV roadmaps, and demonstrated execution prowess (e.g., Tata Motors, Mahindra & Mahindra, and BYD India) are best positioned to capitalize over the next 5–10 years. Additionally, keep a close watch on Tier-1 and Tier-2 component suppliers (e.g., Exide Industries, Bharat Forge) that can participate in the localization drive.

Standard Disclaimer

This blog post is for educational and informational purposes only and does not constitute financial, investment, or legal advice. Readers should conduct their own due diligence

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)