India's Economic and Demographic Trend Analysis

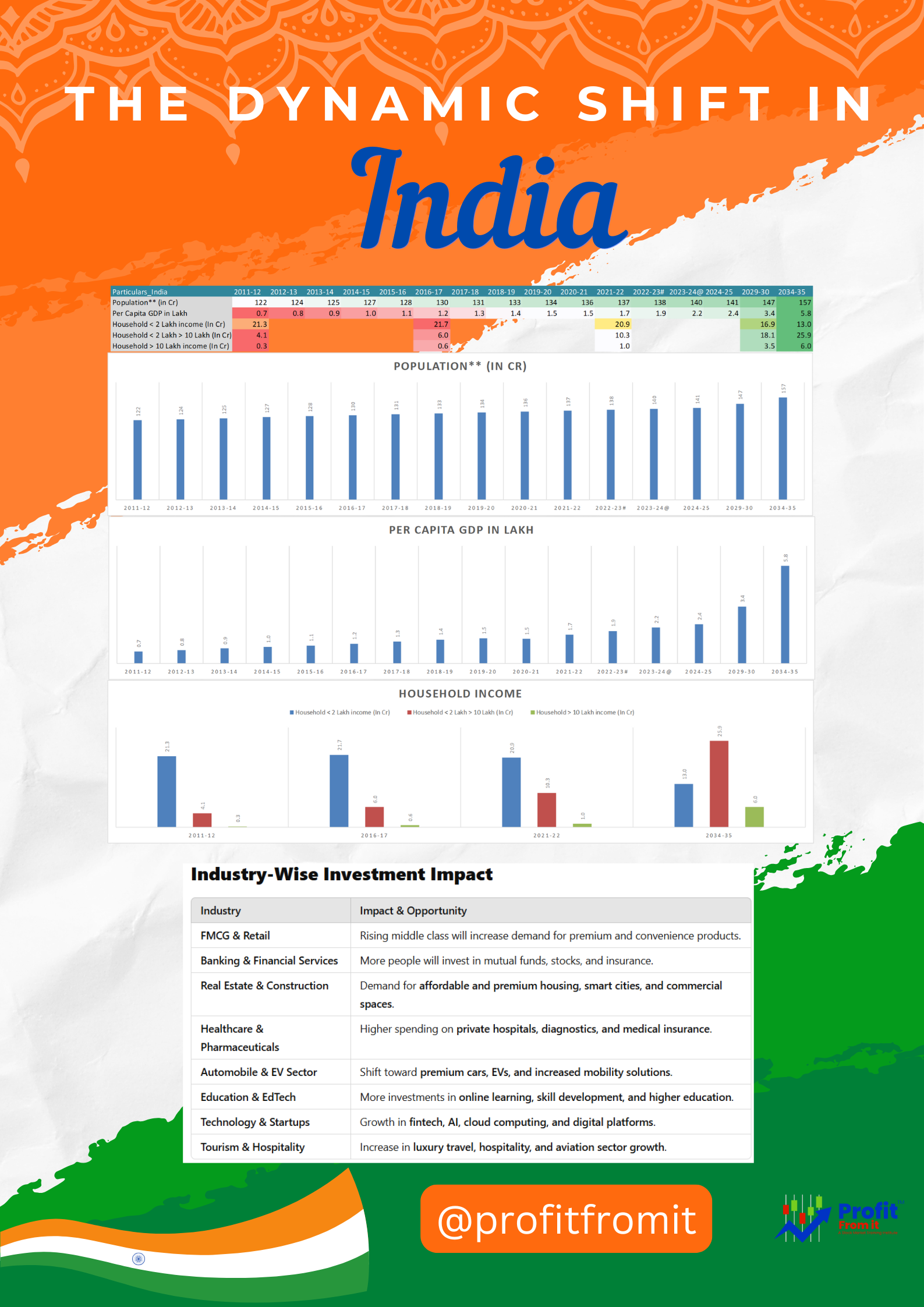

As shown in the image, The dataset presents historical economic trends along with projections for FY2030 & FY2035. Analysis of key trends, their investment implications, and potential opportunities across industries.

Key Trends & Insights

1. Population Growth (Demographic Expansion)

Historical Data (2011-22): India's population grew from 122 Cr (2011-12) to 137 Cr (2022-23).

Future Projections: Expected to reach 147 Cr by FY2030 and 157 Cr by FY2035.

Trend Analysis:

Steady population growth supports a growing labor force and consumer base.

Rising urbanization will fuel demand for housing, transport, and urban infrastructure.

Young population demographics will drive digital adoption, technology, and innovation.

Investment Opportunities:

FMCG & Consumer Goods: Expanding demand for daily essentials, packaged food, and personal care.

Real Estate & Infrastructure: Higher urbanization requires housing, smart cities, and commercial spaces.

Healthcare & Pharmaceuticals: Increased need for hospitals, diagnostics, and medical insurance.

2. Per Capita GDP Growth (Economic Expansion)

Historical Growth: Increased from ₹0.7 Lakh (2011-12) to ₹2.3 Lakh (2024-25).

Future Projection: Expected to reach ₹3.4 Lakh by FY2030 and ₹5.8 Lakh by FY2035.

Trend Analysis:

Rapid rise in per capita GDP signals economic expansion and improved living standards.

Rising disposable income will accelerate premiumization and discretionary spending.

Transition from a low-income to a middle-income economy drives infrastructure, education, and financial growth.

Investment Opportunities:

Luxury & Premium Consumer Goods: Apparel, automobiles, and electronic gadgets will see higher demand.

Banking & Financial Services: Increased savings, investments, and credit expansion.

Travel & Tourism: Higher affordability for both domestic and international travel.

3. Income Distribution Shift (Rising Middle & High-Income Households)

Low-Income Households (< ₹2 Lakh)

Historical: 21.3 Cr in 2011-12 → 20.9 Cr in 2021-22 (gradual decline) despite increasing households in India.

Future: Expected to drop significantly to 10.3 Cr (2034-35).

Implication: Declining low-income households indicate poverty reduction and a transition toward a higher-income economy.

Middle-Class Households (₹2-10 Lakh)

Historical: 4.1 Cr (2011-12) → 10.3 Cr (2021-22).

Future Projection: 25.9 Cr by FY2035.

Implication: The explosive growth of the middle-class segment will be the key driver of consumer demand, retail, and housing.

High-Income Households (> ₹10 Lakh)

Historical: 0.3 Cr (2011-12) → 1.0 Cr (2022-23).

Future Projection: 6.0 Cr by FY2035.

Implication: India is witnessing an emerging affluent class, which will drive demand for luxury products, premium healthcare, and investment services.

Investment Opportunities:

Retail & Ecommerce: Rapid shift toward premium brands, online shopping.

Automobiles & EVs: Growth in premium car demand and electric vehicle adoption.

Education & EdTech: Higher spending on quality education, online learning, and skill development.

Industry-Wise Investment Impact

Investment Recommendations

Instant Impact:

E-commerce, fintech, and digital services (rising internet penetration and digital adoption).

EdTech and skilling platforms (growing demand for online education and upskilling).

Slow but steady Impact:

EV and Automobile Industry (transition from fuel to electric).

Financial Services (investment in mutual funds, insurance penetration).

Long-Term Impact:

Luxury Consumer Goods & Premium Retail (affluent class expansion).

Smart Cities & Real Estate (mass urbanization and infrastructure demand).

Final Takeaway for Investors

India’s economic transition is clear: Higher incomes, expanding middle-class, and urbanization.

Sectors benefiting most: E-commerce, fintech, automobiles, real estate, healthcare, and luxury goods.

Long-term growth story: A shift toward a consumer-driven economy with increasing affluence.

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)