📘 India’s IIP April 2025 Report: Capital Goods Lead 20% Growth | Sectors & Stocks to Watch

Published on: May 28, 2025

By: Piyush Patel | Investment Mentor @ Profit From IT

📌 Key Insights from April 2025 IIP Data

Overall IIP Growth: 2.7% YoY (vs 3.0% in March 2025) Muted Growth.

Manufacturing Sector: Grew by 3.4% – key contributor to overall growth

Electricity Sector: Up 1.1% | Mining: Contracted by -0.2%

IIP Index Value: 152.0 in April 2025 (vs 148.0 in April 2024)

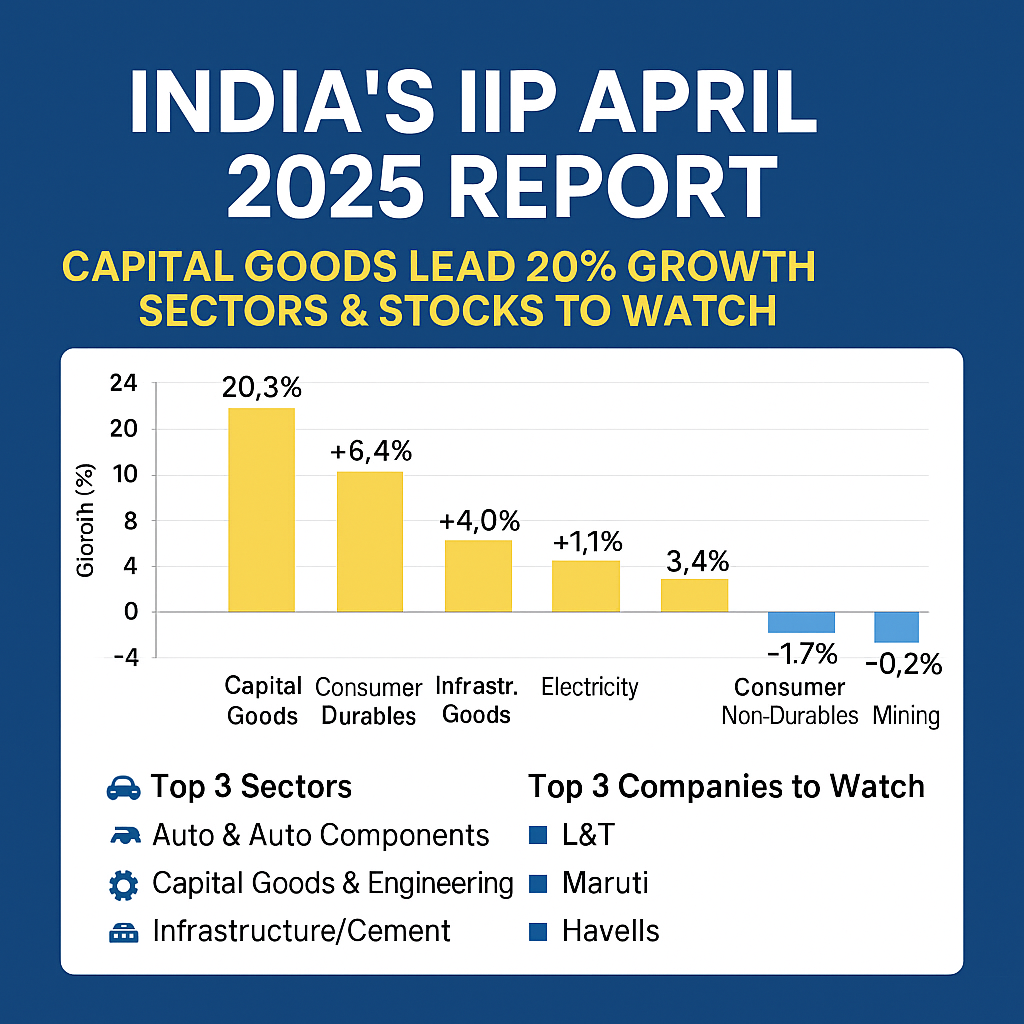

📊 Use-Based Sectoral Growth

🏭 Industry Highlights – Top & Bottom Performers

Top 5 Gainers (YoY):

🏗 Machinery & Equipment: +17.0%

🚗 Motor Vehicles: +15.4%

⚡ Electrical Equipment: +15.2%

🔩 Fabricated Metals: +12.7%

👕 Wearing Apparel: +10.8%

Bottom 3 Decliners:

⚠️ Other Manufacturing: -20.3%

💊 Pharmaceuticals: -3.9%

🧪 Chemicals: -3.6%

🔍 Sectors to Watch – Based on April Trends

Capital Goods: 🚀 Massive 20.3% growth – driven by machinery, tools, engines

Auto & Components: 📈 Revival continues in commercial vehicles & components

Infrastructure & Cement: 🧱 Supported by government capex and construction demand

Electricals: 🔌 Power equipment and appliances gaining momentum

📌 Company Watchlist (Sector-Linked Stocks)

🧠 Analyst’s Interpretation

Industrial output shows mild but broad-based growth.

Capital goods surge points to an investment-led recovery.

Caution in consumer non-durables and mining reflects demand uncertainty.

Manufacturing remains India’s economic backbone.

📅 What to Track Next

May IIP Data (Releases June 30)

Union Budget FY26 – Watch infra spending, PLI schemes

Rural demand trends – FMCG & textile sector impact

🧾 Investor Takeaways

✅ Focus on capital goods and infra-linked sectors

✅ Track auto and electrical space for further gains

✅ Stay cautious on non-durables and commodity-linked sectors

⚠️ Disclaimer

This blog is for educational purposes only and is not a recommendation to buy or sell any securities. Investors must conduct their own research before making any investment decisions.

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)