India's Inflation Hits an 8-Month Low in February: What It Means for Your Investments

📉 Inflation Trends in India - February 2025 Update:

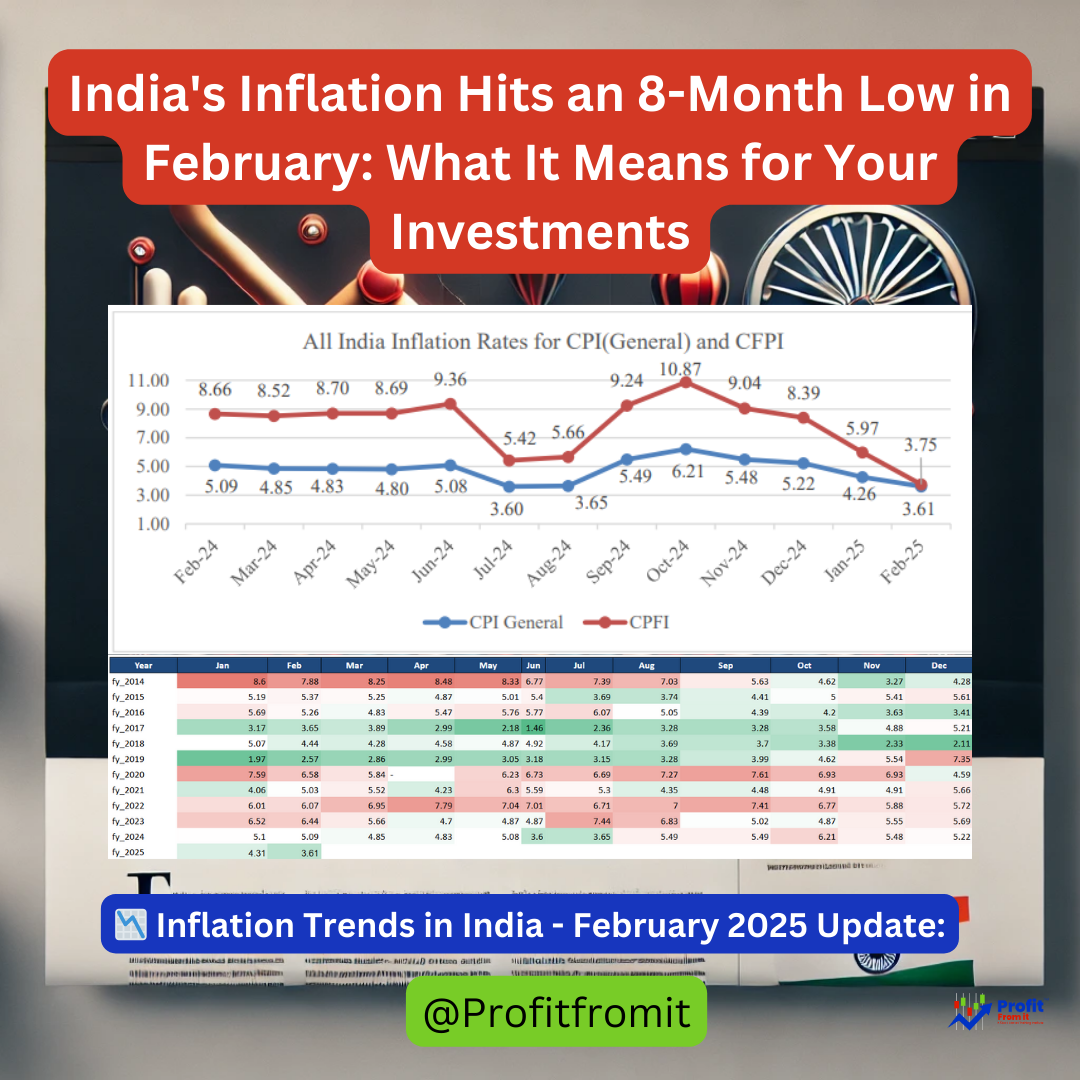

Overall Inflation: 📊 India observed a year-on-year inflation rate of 3.61% in February 2025, marking a significant decline from the previous month. This is the lowest year-on-year inflation since July 2024. 📉

Food Inflation: 🍲 The Consumer Food Price Index (CFPI) indicated a food inflation rate of 3.75% for February 2025, showcasing a substantial reduction, making it the lowest since May 2023. 🥦

🚀 Top 5 Items with Highest Inflation (February 2025):

Coconut Oil: 🥥 54.48%

Coconut: 🌴 41.61%

Gold: 🥇 35.56%

Silver: 🥈 30.89%

Onion: 🧅 30.42%

❄️ Top 5 Items with Lowest Inflation (February 2025):

Ginger: 🌿 -35.81%

Jeera (Cumin): 🌱 -28.77%

Tomato: 🍅 -28.51%

Cauliflower: 🥦 -21.19%

Garlic: 🧄 -20.32%

📈 Historical Inflation Trend:

The trend from past years shows moderate fluctuations, indicating economic shifts and seasonal adjustments. The current trend reflects a cooling in price pressures, suggesting a stable economic environment. 📉📈

🎯 Potential Impact on Market Segments:

Agriculture and Food Products: 🌾 Changes in food prices could affect consumer spending and profitability in the food supply chain.

Energy and Utilities: 🔋 Lower energy inflation could reduce operational costs for industries reliant on heavy energy consumption.

Healthcare: 🏥 Slight rises in health inflation could lead to increased costs in healthcare services, affecting consumer pricing and demand.

Housing and Real Estate: 🏠 Steady growth in housing inflation suggests stable demand in urban real estate markets.

Consumer Goods: 🛒 High inflation in personal care and specific food items could influence pricing strategies in the consumer goods sector.

💡 Investment Insights:

Investors might consider leveraging sectors with lower inflation rates, such as consumer discretionary, where increased disposable income could boost spending. Commodities like gold and silver could also be appealing as potential inflation hedges. 📈💰

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)