📊 India’s Inflation Update – May 2025: Sectoral Insights & Wealth-Building Stocks

📅 Published: 12 June 2025

📌 Source: Ministry of Statistics & Programme Implementation (MoSPI)

🔍 Focus: Sector Impact | Long-Term Stock Watch | Investment Signals

🔥 CPI Falls to 6-Year Low – What It Means for Investors?

India's headline retail inflation (CPI) cooled to 2.82% in May 2025, the lowest since Feb 2019, signaling stability in consumer prices. With food inflation dipping sharply to just 0.99%, household budgets are under less strain—an excellent environment for both consumers and businesses.

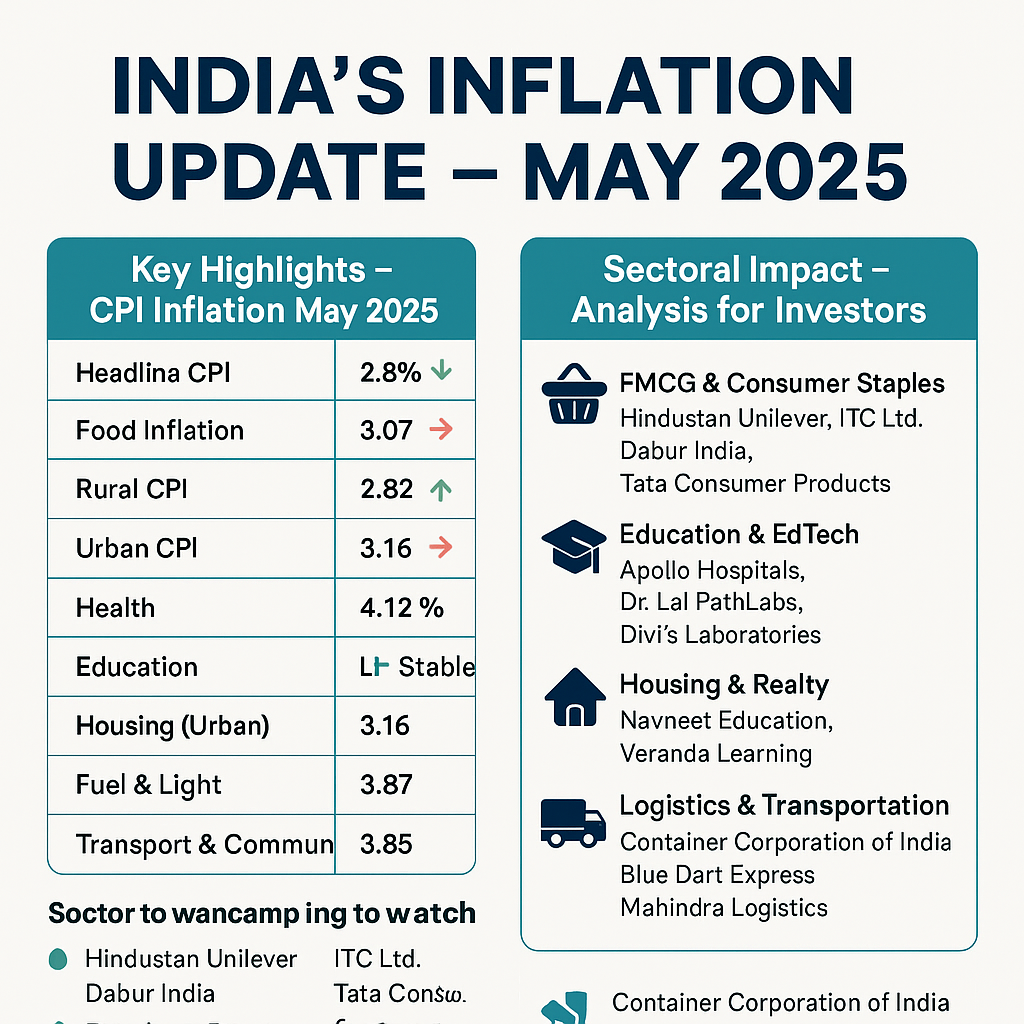

📈 Macroeconomic Dashboard – May 2025

| Indicator | Value (%) | Direction |

|---|---|---|

| Headline CPI (All India) | 2.82 | 🔻 Down |

| Food Inflation (CFPI) | 0.99 | 🔻 Sharply down |

| Health Inflation | 4.34 | 🔺 Up |

| Education Inflation | 4.12 | ➡ Stable |

| Transport & Communication | 3.85 | 🔺 Up |

| Fuel & Light Inflation | 2.78 | 🔻 Down |

| Housing Inflation (Urban only) | 3.16 | 🔺 Mildly up |

| Core Inflation (Excl. Food & Fuel) | ~4.5 est. | ➡ Sticky |

🏭 Sectoral Breakdown: Trends, Triggers & Top Stocks

1️⃣ FMCG & Consumer Staples 🛒

📌 Insight: Easing food prices (cereals, pulses, oils, vegetables) will expand gross margins for FMCG companies. Volume recovery in rural areas is likely.

🔍 May Data:

Cereals: +4.7% YoY

Pulses: -8.3% YoY

Oils: +19% YoY

Vegetables: -13.3% YoY

💡 Opportunity: Companies with rural penetration + strong brands will benefit.

✅ Stocks to Watch:

Hindustan Unilever (HUL)

ITC Ltd.

Marico

Godrej Consumer Products

2️⃣ Healthcare & Diagnostics 🏥

📌 Insight: With inflation at 4.34%, healthcare remains a non-discretionary, inflation-resilient sector. Rising insurance penetration and diagnostics demand will drive growth.

💡 Opportunity: Long-term demand for diagnostics, pathology, and preventive care.

✅ Stocks to Watch:

Dr. Lal PathLabs

Metropolis Healthcare

Apollo Hospitals

Max Healthcare

3️⃣ Education & Skill Development 📚

📌 Insight: Education inflation holds steady. Government schemes, private K12, and edtech are expanding due to urban aspirations and upskilling demand.

💡 Trend: NEP 2020 implementation, rise in vocational courses, and hybrid learning.

✅ Stocks to Watch:

Navneet Education

Veranda Learning

S Chand

CL Educate

4️⃣ Real Estate & Affordable Housing 🏘️

📌 Insight: Urban housing inflation rising to 3.16% shows steady demand for rentals and new homes. EMI affordability is stable due to falling inflation.

💡 Opportunity: Focus on urban mid-income and affordable projects.

✅ Stocks to Watch:

Godrej Properties

Mahindra Lifespaces

DLF

Brigade Enterprises

5️⃣ Logistics & Transport 🚛

📌 Insight: Transport inflation rising to 3.85% indicates healthy freight movement and travel activity. Key driver: E-commerce, retail, and infra capex.

💡 Emerging Trend: EV logistics and warehousing expansion.

✅ Stocks to Watch:

Delhivery

Blue Dart

Mahindra Logistics

VRL Logistics

6️⃣ Power, Energy & Utilities ⚡

📌 Insight: Fuel inflation easing to 2.78% indicates manageable input costs. Demand is rising with summer peak loads.

💡 Supportive Tailwinds: RE push, transmission expansion, and capex cycle.

✅ Stocks to Watch:

NTPC

Power Grid

Adani Energy Solutions

CESC

7️⃣ Personal Care, Apparel & Discretionary 🧴👗

📌 Insight: Personal care inflation at 13%+ shows strong pricing power. Clothing and footwear also show resilience.

💡 Consumer Play: Premiumisation trend, urban lifestyle shift.

✅ Stocks to Watch:

Page Industries

Titan Company

Nykaa (FSN E-Commerce)

Bata India

🌍 State-Level CPI Insight – For Regional Demand Themes

| State | Inflation (%) | Sector Focus Potential |

|---|---|---|

| Kerala | 6.46% | Healthcare, Food Retail |

| Punjab | 5.21% | Agri-inputs, Consumer |

| Karnataka | 3.19% | IT, Urban Housing |

| Maharashtra | 3.21% | Auto, Real Estate |

| Gujarat | 2.67% | Textiles, Midcaps |

📈 Investment View: Where to Position Capital?

✅ Focus on margin expansion beneficiaries – FMCG, consumer durables, realty

✅ Stay invested in defensive plays – Healthcare, Education

✅ Watch for capex beneficiaries – Infra, Logistics, Power

✅ Avoid sectors with raw material cost pressure – Some agri-inputs, commodities

💬 Expert Takeaway

“Declining CPI is not just a macro event—it’s a profit expansion signal for quality businesses. Look for companies with strong pricing power, rising volumes, and low debt to compound wealth consistently.”

⚠️ Disclaimer (Educational Use Only):

Disclaimer:

This blog is for educational and informational purposes only. The content does not constitute investment advice or a recommendation to buy/sell securities. Readers are encouraged to conduct their own research

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)