🇮🇳 India’s Poverty Reduction: Key Highlights & Investment Insights (2025)

📌 Global Revision: New Poverty Line

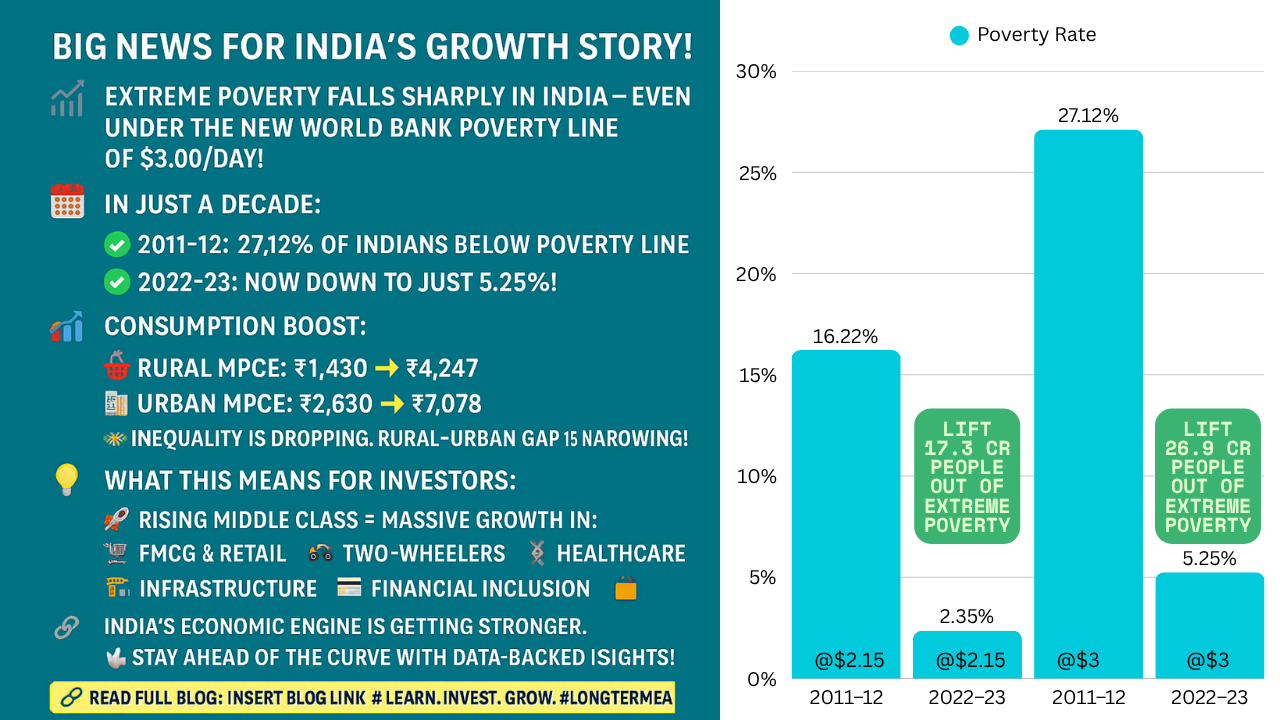

The World Bank has raised the International Poverty Line (IPL) from $2.15/day (2017 PPP) to $3.00/day (2021 PPP).

Global extreme poverty count increased by 125 million.

India emerged as an outlier, reducing its poverty count by 125 million, thanks to refined data and updated survey methods.

India’s adoption of updated consumption data and methodology significantly influenced the global poverty recalibration.

📊 Revised Poverty Statistics: Before vs After

🔍 Insight: Even with a higher threshold, India has drastically reduced poverty — a fall from 27.12% to 5.25% in just over a decade.

🏡 Household Consumption Expenditure Survey (HCES) 2023–24

📌 MPCE = Monthly Per Capita Consumption Expenditure

📉 Consumption Inequality (Gini Coefficient):

Rural: ↓ from 0.266 to 0.237

Urban: ↓ from 0.314 to 0.284

📈 Top State-Wise Gain:

Odisha recorded the highest rural MPCE increase (~14%)

🔎 Investor-Relevant Implications

✅ 1. Long-Term Consumption Boom

With higher MPCE, India is witnessing an expanding middle class and increased disposable income, benefiting:

FMCG & Consumer Staples

Retail & E-commerce

Discretionary Products

Automobiles & Consumer Durables

✅ 2. Rural Demand Resurgence

Rising rural consumption and reduced inequality = rural market expansion for:

Consumer durables

Two-wheelers

Affordable healthcare & education

Agri-inputs and allied services

Key Beneficiaries:

Consumer Staples & Discretionary: Boost in everyday spending and aspirational products

Retail & E-commerce: Wider rural adoption and spending

Automobiles: Entry-level vehicle sales to see strong traction

Agriculture & Allied Sectors: Higher rural income → investment in productivity

Financial Services (Rural Focus): Greater credit and insurance demand

✅ 3. Financial Inclusion & Credit Growth

As poverty declines:

Credit quality improves

Lending expands

📈 Sectors to benefit:

Microfinance Institutions (MFIs)

NBFCs

Small Finance Banks

✅ 4. Policy Stability & Capex Continuity

India’s progress is backed by:

Evidence-based governance

Reform-driven initiatives

⛳ Continued investment in:

Infrastructure

Rural development

Social welfare schemes

🏗️ Investment-worthy Sectors:

Capital Goods & Construction

Infra Developers

Rural Fintech & Agri-tech

🧠 Conclusion: Measurement + Momentum = Market Opportunity

India’s story is a model of transformation:

📈 Better data + Strong policy = Real growth

This shift lays the foundation for long-term investment opportunities across sectors — from rural consumption to infrastructure and financial services.

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)