🇮🇳 India Hits Record FDI Inflow of USD 81.04 Billion in FY 2024–25 🚀

How This Impacts the Stock Market, Sectors & Key Companies

📅 Posted On: 27 May 2025

📰 Source: PIB | Ministry of Commerce & Industry | Azadi Ka Amrit Mahotsav

🔍 Overview:

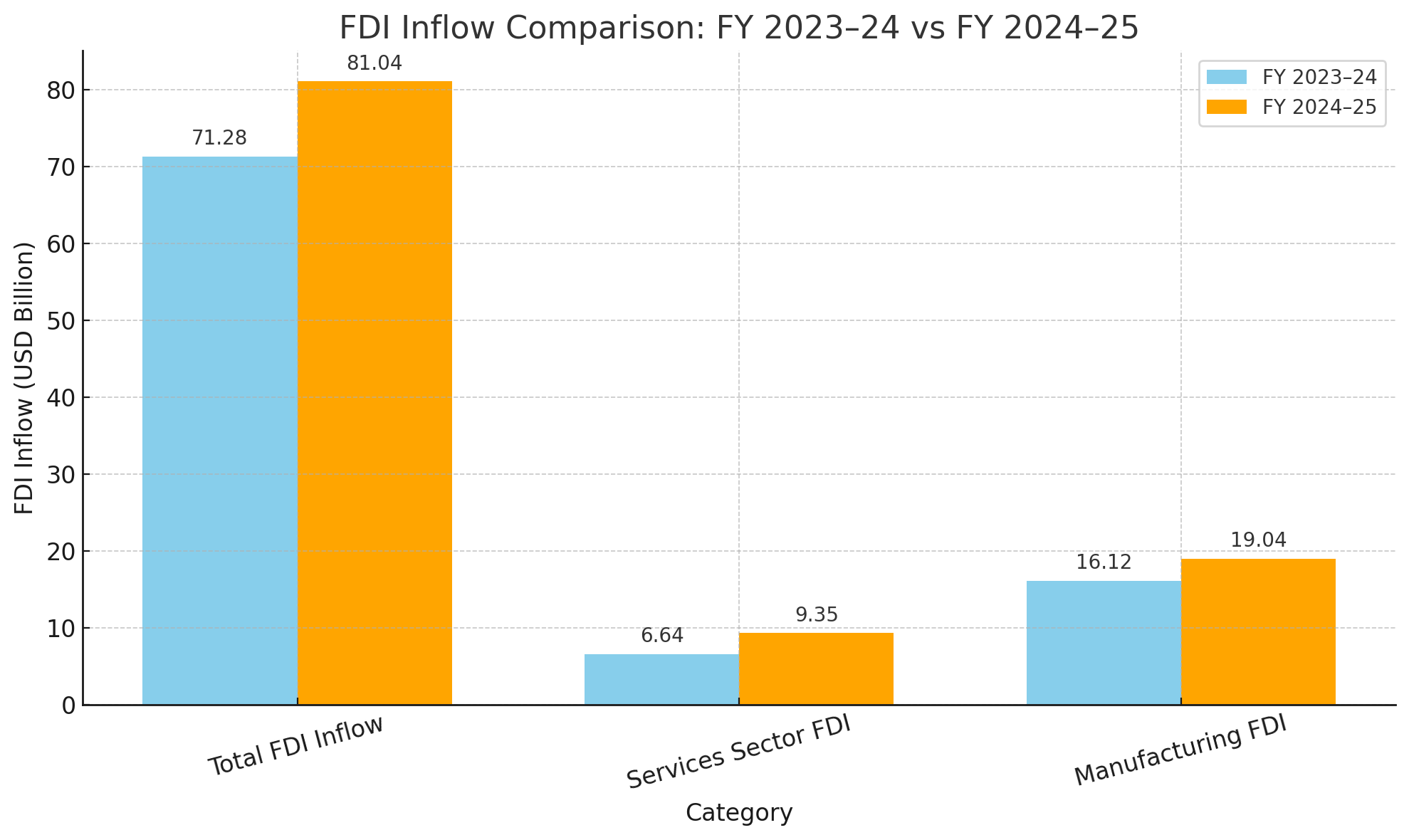

India has once again proven its mettle as a top global investment destination. With FDI inflows touching a record USD 81.04 billion in FY 2024–25, the country has registered a 14% YoY growth, backed by a liberal FDI policy, robust reforms, and rising investor confidence.

This surge presents strategic investment insights for market participants, especially in high-growth sectors like services, IT, trading, and manufacturing.

📊 Key Highlights:

💸 Total FDI (FY25): $81.04 Billion (vs $71.28 Billion in FY24)

⬆️ Growth: 14% YoY

🏆 Top Sector: Services (19% share, $9.35B, up 40.77%)

💻 Next Sectors: Computer Software & Hardware (16%), Trading (8%)

🏭 Manufacturing FDI: $19.04B, up 18% YoY

🗺️ Top FDI Recipient States: Maharashtra (39%), Karnataka (13%), Delhi (12%)

🌍 Top Source Countries: Singapore (30%), Mauritius (17%), USA (11%)

🌐 Source Countries Expanded: 112 in FY25 vs 89 in FY14

📈 Sectoral Impact on Indian Stock Market:

🏦 1. Financial & Insurance Sector

FDI reforms in insurance and pension are fueling growth in listed insurers.

🔍 Watchlist Stocks:

HDFC Life, ICICI Prudential, SBI Life, Max Financial Services

💻 2. IT & Software

16% share in FDI equity inflows signals continued momentum.

🔍 Watchlist Stocks:

Infosys, TCS, Wipro, LTIMindtree, Tech Mahindra

🛒 3. Retail & E-commerce

FDI liberalization in single-brand retail has strengthened investor interest.

🔍 Watchlist Stocks:

Titan, Trent, Avenue Supermarts (DMart)

🛠️ 4. Manufacturing & Industrial Growth

Contract manufacturing and Make-in-India policies boosted FDI.

🔍 Watchlist Stocks:

Bharat Forge, Polycab, APL Apollo, L&T, Bosch

⚙️ 5. Defence & Infrastructure

FDI limit raised in defence and civil aviation aids capital flows into PSUs.

🔍 Watchlist Stocks:

BEL, HAL, Cochin Shipyard, BEML, Adani Ports

💼 Long-Term Investment Outlook:

🔹 The FDI rise signals confidence in India’s long-term economic growth.

🔹 India’s structural reforms across sectors are attracting long-term foreign capital, which usually flows into stable and growing listed companies.

🔹 Expect higher valuations and better growth visibility in top beneficiary sectors over the next 5–10 years.

📌 Strategic Investor Insights:

Prefer sector leaders and companies with strong FPI/FII holding.

Track policy changes in Budget and Ministry updates for early signals.

Look for capacity expansion plans and capex-led growth in listed companies post-FDI inflow announcements.

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)